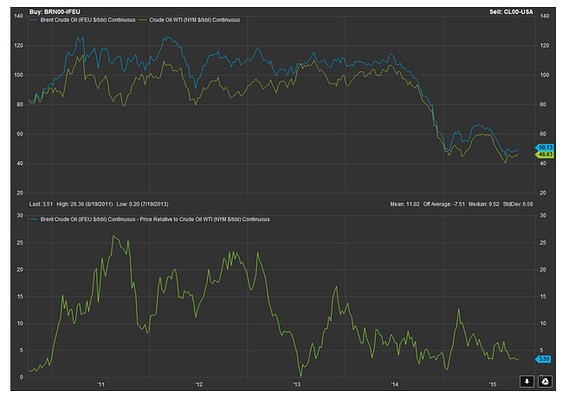

Prices for two key oil benchmarks - WTI and Brent - have been moving simultaneously for much of 2015, but soon the paths for the two benchmarks could diverge.

For the last five years, Brent crude has been the more expensive oil. Meanwhile, under the right conditions, it is possible for WTI to become the winner or at least narrow its price difference with the so-called

global crude benchmark, analysts predict.

Since about early September of this year, Brent has seen a somewhat

modest premium of $3 a barrel or less over WTI. The spread has been as wide as roughly $13 this year.

The two benchmarks briefly touched parity on an intraday basis in January of this year, with WTI briefly trading at a premium over Brent.

Traders closely monitor the price gap as they bet on whether it will narrow or widen, and the difference in prices can offer indications for trading, as well as hint at the outlook for the both benchmarks.

“If we see the Brent premium narrow to less than $2 per barrel for a prolonged period, or perhaps if we see parity, then it could be associated with tighter U.S. crude-oil production and a tighter outlook for U.S. fuel-product production,” said Richard Hastings, macro strategist at Seaport Global Securities.

Colin Cieszynski, chief market strategist at CMC Markets, suggests that the gap could decrease on the "improving supply-demand balance in the U.S., where the economy has remained robust but the lower oil price has curtailed shale-oil exploration and production.”

U.S. crude-oil production fell by 120,000 barrels a day in September compared with August, according to a report from the Energy Information Administration released Tuesday. The agency expects output to continue to decline through the middle of 2016.

In the recent days, the rally in Brent and WTI renewed supported by this report, as well as remarks from OPEC secretary-general Abdalla Salem el-Badri who said that global investments in oil and gas projects would be slashed by 22.4% this year.

Separately, the weekly number of active U.S. drilling rigs has fallen to their lowest level in more than 5 years. On Friday Baker Hughes Inc. reported a total weekly fall of 29 rigs to 809.

If the U.S. rig count declines further, that might be sufficient to get WTI and Brent “back to even,” said Cieszynski. The spread is influenced by several factors, though. If the Middle East turmoil worsens, the price gap could widen, as prices for Brent climb, while a lower risk of supply disruptions in the Middle East and higher demand for oil in Europe could send Brent prices closer to WTI, said Cieszynski.

There should be “a significant drop off in U.S. production or the removal of the [oil] export ban to bring back WTI in line with global benchmarks once more,” said Matt Smith, director of commodity research at ClipperData.

This is unlikely, however, as last month, the Obama administration said it doesn’t support a House bill to lift the ban on U.S. oil exports that is been in place since the 1970s.