Current trend

On Tuesday, the NZD/USD pair was trading flat. The demand for the USD is not high, as market participants have relatively calmed down on US rate hike speculations. The NZD, at the same time, is affected by weakness in the oil market and disappointing statistics from China, where stock markets tend to decline again.

In the morning session, the NZD is strengthening, supported by favorable data, released in New Zealand. ANZ Activity Outlook grew higher than expected, from 12.2% to 16.7%.

Support and resistance

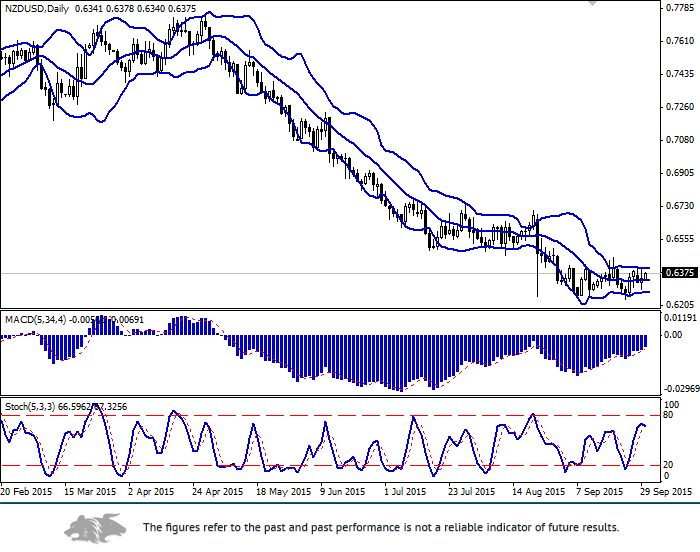

Bollinger Bands indicator on the daily chart is directed horizontally. The price range is remaining almost unchanged for several weeks already. MACD is growing and keeping a buy signal. Stochastic is trying to turn down.

The indicators recommend long positions or waiting for a clear signal.

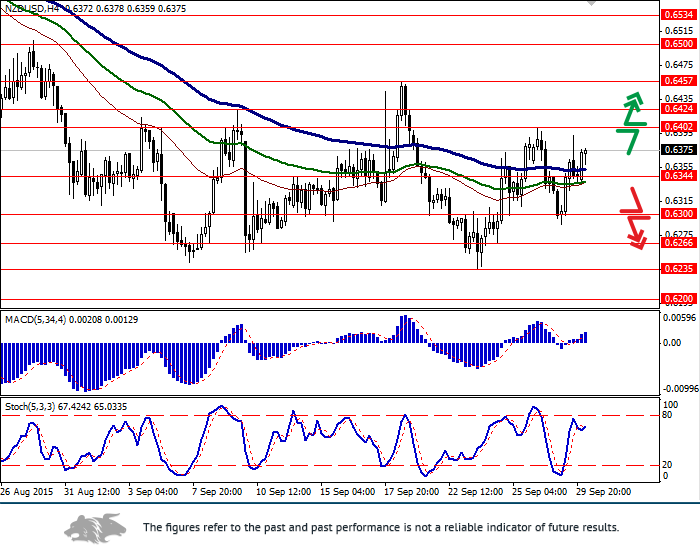

Support levels: 0.6344, 0.6300, 0.6266, 0.6235 (23 September low), 0.6200.

Resistance levels: 0.6402 (28 September local high), 0.6424, 0.6457 (18 September local high), 0.6500, 0.6534.

Trading tips

Long positions can be opened after the breakout of the level of 0.6390 with targets at 0.6430, 0.6450 and stop-loss at 0.6360. Validity – 1-2 days.

Short positions can be opened after the breakdown of the level of 0.6350 with the target at 0.6300 and stop-loss at 0.6370. Validity – 1-2 days.