Volatility hits new highs as traders find few places to run for safe haven - Bloomberg

The Fed’s stimulus policy, which has buoyed the bull market for more than six years, has only served to confuse investors in recent days. Equities have dropped since the central bank’s decision to stand pat amid concern over global growth and financial-market rout.

On Tuesday the Chicago Board Options Exchange Volatility Index jumped the most

since August’s selloff as firms from energy to autos plunged. The ratio of puts to calls on the Standard & Poor’s 500

Index has surged 12 percent over the past week, signaling investors' search for a shelter from losses.

That’s the most pronounced five-day jump since 2009, with the biggest increase coming the day after the Fed’s rate decision last week.

On the surface, it seemed that the VW scandal and commodities plunge helped spark Tuesday’s selloff, but in fact, the shadow over the markets is the Fed’s decision last week to maintain rates near zero.

“There’s a general view of skepticism and volatility that shakes people up,” said Brent Schutte, senior investment strategist at BMO Global Asset Management in Chicago, which manages $250 billion. “Right now when there’s uncertainty, people seem to hit the sell button. Sometimes the micro can fill in for the macro.”

Giri Cherukuri, head trader and portfolio manager at Oakbrook Investments LLC in Lisle, Illinois, commented that "there is more speculation driving things. Uncertainty about what the Fed is doing is imposing volatility.”

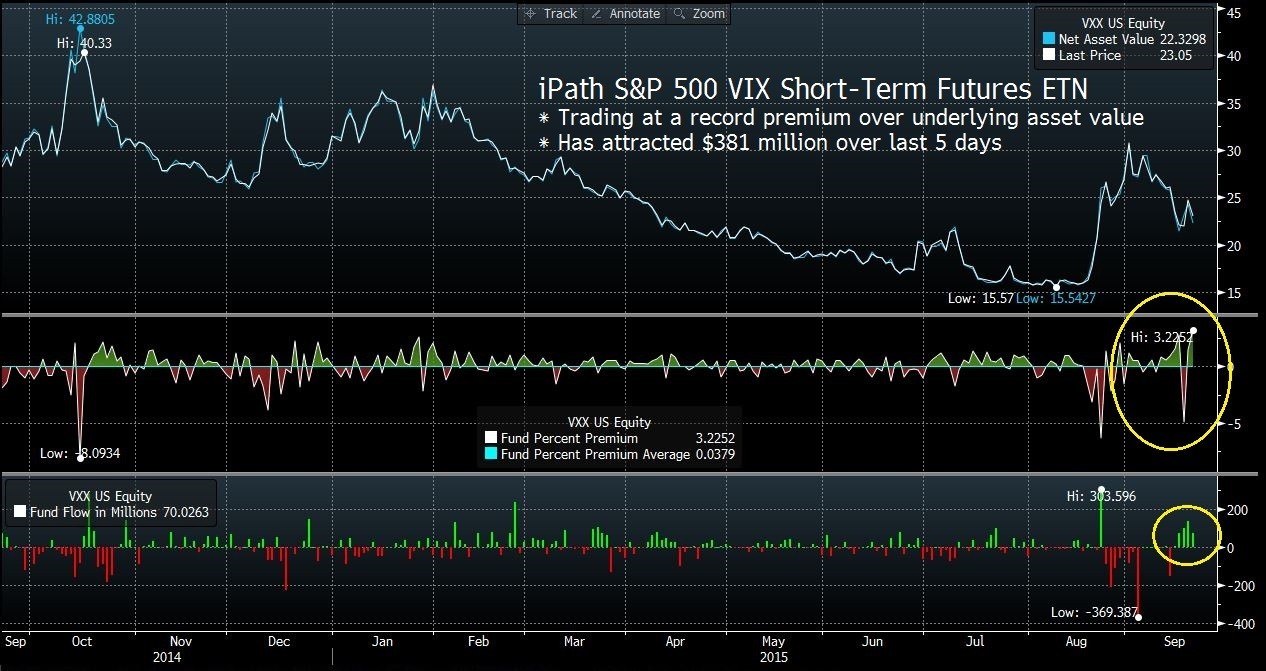

Risk aversion has led investors to pile money into an exchange-traded note that increases in value as volatility climbs. The iPath S&P 500 VIX Short-Term Futures ETN, known by its ticker VXX, has absorbed $381 million over the past week, the most since March 2013. The instrument is also trading at a record 3.2 percent premium over its underlying asset value.

Nine of ten options on the SPDR S&P 500 ETF with the highest ownership are puts. Bloomberg notes that October contracts that pay off should the fund lose 1.6 percent and Sept. 30 puts betting on a 4.1 percent dip had the highest open interest among bearish contracts.

Jim Smith, an options strategist at OTR Global Trading LLC in Purchase, New York, said that there are a lot of out-of-money put buyers in individual stocks. “It feels like it’s a defensive hedging move rather than initiating a short position.”

Meanwhile, some market players still look at the U.S. economy as a pillar of solidity, amid overall nervousness.

U.S. unemployment has fallen to the lowest level in seven years, auto sales are rising and higher retail sales indicate that consumers may be looking past recent volatility in financial markets.