Current trend

Yesterday, the British currency continues strengthening against the Japanese Yen amid a series of interesting macroeconomic releases both from Japan and the UK.

The Yen was under pressure from weak Machinery Orders statistics (+2.8% in July vs. +10.5% forecast) and Domestic Corporate Goods Price Index, which came in 0.3% below expectations at 3.6%.

On the other hand, the British currency was supported by the results of the Bank of England meeting. As it had been expected, the Regulator decided to keep its approach to monetary policy unchanged and, at the same time, did not revise quite optimistic forecasts of economic growth and timing of a rate increase (the first quarter of 2016).

Support and resistance

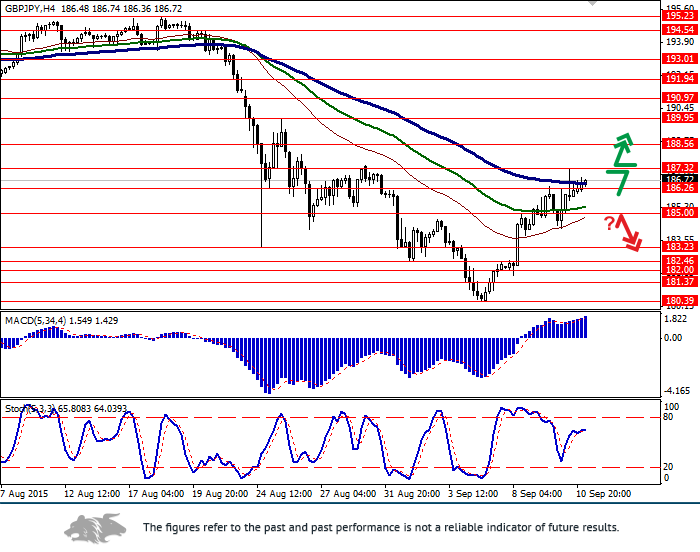

Bollinger Bands on the daily chart is turning horizontally. At present, the indicator is not giving any clear trading signals.

MACD is growing and keeping a strong buy signal. It is recommended to keep existing and open new long positions in the short run.

Stochastic is turning horizontally, indicating a possibility of a downward correction in the short run.

Support levels: 186.26, 185.00, 183.23 (24 August low), 182.46, 182.00, 181.37, 180.39 (7 September current low).

Resistance levels: 187.32, 188.56, 189.95 (25 August local high), 190.97, 191.94, 193.01, 194.54, 195.23 (18 August high).

Trading tips

Long positions can be opened after the breakout of the level of 187.32 (with appropriate indicators signals) with targets at 188.70, 189.00 and stop-loss at 186.26, 186.00.

Short positions can be opened after the breakdown of the level of 185.00 with the target at 183.00 and stop-loss at 186.00.