3 Numbers: Upbeat EU speculator state of mind; US work markets, US yields.

10 August 2015, 12:07

0

125

3 Numbers: Upbeat EU speculator state of mind; US work markets, US yields.

Another upgrade on the standpoint for Europe's financial recuperation lands with today's discharge on speculator trust in the coin union by means of Sentix information. Later, the Federal Reserve distributes its Labor Market Conditions Index for the US. Interim, watch out for the 2-year and 10-year Treasury yields for signs that a rate trek is close ... then again not.

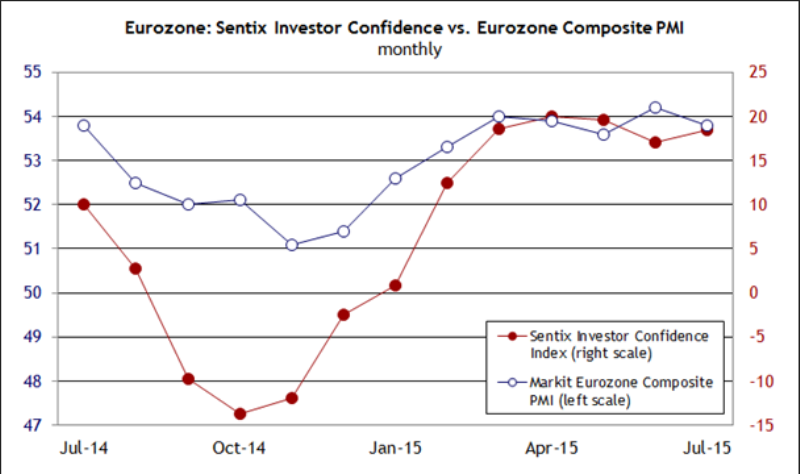

Eurozone: Sentix Investor Confidence Index (08:30 GMT) Europe's financial recuperation is in concentrate today with a report on the speculator estimation in the wake of the Greek emergency that, for the occasion, is going away. The feature getting turmoil of June and early July has blurred, however the inquiry waits on whether there's any blowback for the genuine economy. The preparatory results are gently promising, yet a complete answer is still a while away. In this way, so great.

Presently casting.com's present GDP assessment keeps on indicating an about 0.4% quarter-over-quarter pick up for the Eurozone for Q2 and Q3. That is in accordance with Eurostat's official report of 0.4% development in Q1.

Today's discharge from Sentix will give extra connection to assessing the close term standpoint. In a month ago's report, the conclusion profile was empowering with the Investor Confidence Index ascending to 18.5 for July—near the most abnormal amounts in late history. "In spite of the emergency encompassing Greece, financial specialists see the euro territory economy as more grounded than a month ago, and now really carry on as though the euro zone was in a blast!," a Sentix senior investigator wrote in ahead of schedule July.

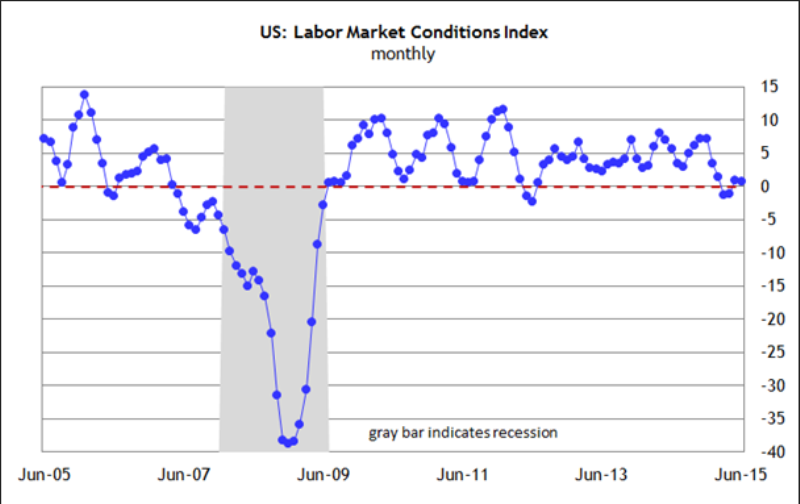

US: Labor Market Conditions Index (14:00 GMT) The US economy included 215,000 employments in July, as indicated by Friday's official discharge from Washington. The addition includes new backing for the conviction that the Federal Reserve will soon start to raise interest rates, maybe as ahead of schedule as one month from now.

"I believe it's an indication of advancement that we're seeing respectable employment increases consistently," said the Bank of the West's boss market analyst on Friday. "Exhausting is great."

Another portion of exhausting will probably touch base in today's month to month redesign of the Labor Market Conditions Index (LMCI), a comprehensively characterized metric distributed by the Fed. The national bank exhorts that this information "helpful for evaluating changes in labor economic situations."

Late values for LMCI recommend a gently positive pattern for the work market in general. In the wake of plunging into marginally negative region in March and April, the file ticked partially over zero in May and June—an indication of a positive predisposition recently, though on the edges.

Given Friday's perky numbers on payrolls, today's LMCI discharge for July will likely stay in positive domain. Assuming this is the case, the news will welcome more theory that the top notch trek subsequent to 2006 is close.

US: 2-and 10-Year Treasury Yields The energetic pace of development in the work market in July

proposes that a rate climb is close. "We see this report as effectively clearing the obstacle expected to keep the Fed on track for a September rate climb," a Barclays financial expert noted on Friday. "The bar for not moving now is much higher."

Maybe, however the Treasury business sector isn't completely persuaded. The two-year yield—considered the most delicate spot on the yield bend for rate desires—has been drifting higher as of late. For examiners reckoning a rate trek one month from now, this yield is a key wellspring of backing.

In any case, the viewpoint is generally blended through the benchmark 10-year yield, which has been ticking lower. In the wake of a week ago's reassuring employments report, will we see a more brought together message in the Treasury market in the days ahead?

Based on the 10-year note, there's still a decent measure of instability on the timing of the top notch trek. This key yield slipped on Friday to 2.18%, as per Treasury.gov information. That is near the most minimal level in over two months.

In the event that the 10-year yield switches course this week and inches higher, the adjustment in heading would send a more grounded message that the swarm's valuing in a rate trek for one month from now. Accepting, obviously, that the 2-year yield clutches its late increments. By difference, if the 2-year yield slips, the change will be seen as a wager that the national bank will postpone fixing until after September's approach meeting.

For the occasion, in any case, the inclination is by all accounts inclining toward within the near future. "The Fed can feel more great about uprooting" drawing nearer to fixing, prompted an altered salary chief at Pioneer Investments in Boston. "The birds of prey have a superior case for the September fixing."

- EU financial specialist certainty ought to stay cheery in today's redesign from Sentix

- The Fed's Labor Market Conditions Index is on track to remain gently positive

- The US 10-year yield could rise this week after Friday's energetic payrolls report

Another upgrade on the standpoint for Europe's financial recuperation lands with today's discharge on speculator trust in the coin union by means of Sentix information. Later, the Federal Reserve distributes its Labor Market Conditions Index for the US. Interim, watch out for the 2-year and 10-year Treasury yields for signs that a rate trek is close ... then again not.

Eurozone: Sentix Investor Confidence Index (08:30 GMT) Europe's financial recuperation is in concentrate today with a report on the speculator estimation in the wake of the Greek emergency that, for the occasion, is going away. The feature getting turmoil of June and early July has blurred, however the inquiry waits on whether there's any blowback for the genuine economy. The preparatory results are gently promising, yet a complete answer is still a while away. In this way, so great.

Presently casting.com's present GDP assessment keeps on indicating an about 0.4% quarter-over-quarter pick up for the Eurozone for Q2 and Q3. That is in accordance with Eurostat's official report of 0.4% development in Q1.

Today's discharge from Sentix will give extra connection to assessing the close term standpoint. In a month ago's report, the conclusion profile was empowering with the Investor Confidence Index ascending to 18.5 for July—near the most abnormal amounts in late history. "In spite of the emergency encompassing Greece, financial specialists see the euro territory economy as more grounded than a month ago, and now really carry on as though the euro zone was in a blast!," a Sentix senior investigator wrote in ahead of schedule July.

On the off chance that today's redesign for August adheres near a month ago's level, the case will reinforce for expecting that Europe's recuperation will survive and maybe even flourish in the wake of late turbulence in Greece.

US: Labor Market Conditions Index (14:00 GMT) The US economy included 215,000 employments in July, as indicated by Friday's official discharge from Washington. The addition includes new backing for the conviction that the Federal Reserve will soon start to raise interest rates, maybe as ahead of schedule as one month from now.

"I believe it's an indication of advancement that we're seeing respectable employment increases consistently," said the Bank of the West's boss market analyst on Friday. "Exhausting is great."

Another portion of exhausting will probably touch base in today's month to month redesign of the Labor Market Conditions Index (LMCI), a comprehensively characterized metric distributed by the Fed. The national bank exhorts that this information "helpful for evaluating changes in labor economic situations."

Late values for LMCI recommend a gently positive pattern for the work market in general. In the wake of plunging into marginally negative region in March and April, the file ticked partially over zero in May and June—an indication of a positive predisposition recently, though on the edges.

Given Friday's perky numbers on payrolls, today's LMCI discharge for July will likely stay in positive domain. Assuming this is the case, the news will welcome more theory that the top notch trek subsequent to 2006 is close.

"On offset, we think that the employments information meets the Fed's criteria of more change before raising rates," the examination group at BBH composed a week ago. "In a perfect world, this will be affirmed in the Labor Market Conditions Index and the JOLTS report" that are booked for overhauls this week.

US: 2-and 10-Year Treasury Yields The energetic pace of development in the work market in July

proposes that a rate climb is close. "We see this report as effectively clearing the obstacle expected to keep the Fed on track for a September rate climb," a Barclays financial expert noted on Friday. "The bar for not moving now is much higher."

Maybe, however the Treasury business sector isn't completely persuaded. The two-year yield—considered the most delicate spot on the yield bend for rate desires—has been drifting higher as of late. For examiners reckoning a rate trek one month from now, this yield is a key wellspring of backing.

In any case, the viewpoint is generally blended through the benchmark 10-year yield, which has been ticking lower. In the wake of a week ago's reassuring employments report, will we see a more brought together message in the Treasury market in the days ahead?

Based on the 10-year note, there's still a decent measure of instability on the timing of the top notch trek. This key yield slipped on Friday to 2.18%, as per Treasury.gov information. That is near the most minimal level in over two months.

In the event that the 10-year yield switches course this week and inches higher, the adjustment in heading would send a more grounded message that the swarm's valuing in a rate trek for one month from now. Accepting, obviously, that the 2-year yield clutches its late increments. By difference, if the 2-year yield slips, the change will be seen as a wager that the national bank will postpone fixing until after September's approach meeting.

For the occasion, in any case, the inclination is by all accounts inclining toward within the near future. "The Fed can feel more great about uprooting" drawing nearer to fixing, prompted an altered salary chief at Pioneer Investments in Boston. "The birds of prey have a superior case for the September fixing."

In the reason for gaging what happens next, it'll be valuable to check whether the current week's 10-year yield https://www.mql5.com/en/signals/120434#!tab=history