Futures traders may abandon gold in favor of diamonds - View

Diamonds may become futures' traders new best friend, in case Martin Rapaport from the Rapaport Group succeeds.

The chairman of the

Group, which is a source of market information in the diamond

world, first wrote a diamond-derivatives proposal for the New York

Commodities Exchange back in 1982 and was rejected. He did not give up, however, and has been working on it since that time. It is not far away from being implemented, he believes. In fact,

he’s aiming for a late 2016 to early 2017 launch.

Rapaport noted that it can only become real with a spot-cash market. “You can’t have a derivatives market without a legitimate, transparent, competitive and efficient spot-cash market,” he said.

A spot-cash market is a market in which goods are sold for money and delivered immediately, or shortly after purchasing, while a futures market is a market in which participants can purchase and sell a commodity or futures contract for delivery on a specified date in the future.

Martin Rapaport

“A diamond futures market will help the industry,” Rapaport said. “Right now, the diamond trade is forced to be in a long position. If there’s a downward movement in prices, the whole trade is at risk.”

With a derivatives market or a futures market, however, the trade will be able to reduce and even eliminate risk, he said. “Risk reduction is a win-win situation for the entire industry.”

However, there are challenges a diamond-futures market has faced:

1) Lack of fungibility:

There are thousands of different

categories of diamonds and wholesale diamond transactions tend

to be private, therefore, diamonds lack fungibility, said Paul Zimnisky, an independent analyst and consultant

to the diamond, mining and investment industries.

Diamonds come in all shapes, colors, sizes, quality types and clarity

levels, making it a challenge to come up with a standard price.

2) Apathetic investor interest:

In November 2012, the PureFunds ISE Diamond/Gemstone ETF was created. After just a year of trading, it was shutdown, because of "apathetic investor interest," Zimnisky said who was CEO of PureFunds at that time.

The ETF, which tracked the price-and-yield performance of the ISE Diamond/Gemstone Index, “had the liquidity and price transparency of equities, but was sensitive to implied diamond prices because miners’ revenues, profit and diamond inventory in the ground tend to be sensitive to diamond prices,” said Zimnisky.

Zimnisky created the Zimnisky Global Rough Diamond Price Index in July of this year to help create some transparency in the industry.

Paul Zimnisky

3) Lack of progress

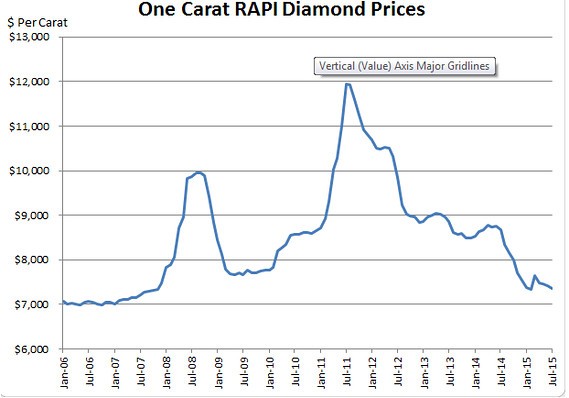

Rapaport started RapNet, part of the Rapaport Group, in 1992 and he also publishes the RapNet Diamond Index (RAPI), which indicated that one-carat laboratory-traded diamonds on July 1 fell 15.3% from a year earlier. The average price per carat, according to RAPI, stood at $7,356:

Zimnisky attributed the price declines over the past year, in part, to “reduced end-buyer demand in China, Europe and Japan.” Commodities, in general, have been hit by declines in global demand.

Diamond Exchange RAPI

As early as September, Rapaport plans to launch diamond exchange RAPX. He said it would be different from the RapNet network and offer clearinghouse services, another big step in the effort to create a futures market.

Transactions will be conducted through Rapaport Clearing House and include inspection and quality verification and anonymous trading for buyers and sellers. RAPX will also show both bid and asking prices, not just asking prices. The bid price would be the maximum price a buyer wants to pay for the diamond, while the asking price is the minimum a seller is willing to receive for the diamond.

RAPX will give the market liquidity. “We’re talking about systematic, transparent competition.”

That’s very important when it comes to creating a derivatives market for diamonds. In all, Rapaport listed 4 key things that must be established to create one - and detailed how he’s working toward achieving them: quality assurance, liquidity, low transaction cost, transparent pricing.

Are diamonds a commodity?

A key challenge on the path to a futures market included the question of whether diamonds are actually a commodity. A general definition of a commodity is quite applicable to these stones, as they are something useful or valued which are bought and sold.

Rapaport said that standardization is what makes diamonds a commodity, “where the differences in any specific quality of a diamond are insignificant when it comes to pricing.”

Besides being the most popular and common gemstones, they have quite a few

investment characteristics like gold, too.

Diamonds are also highly transportable - a “compact and secure form of wealth,” said Rapaport.

They offer “diversification” opportunities for an institutional and high-net worth investor, Rapaport said. “The world’s growing wealth will be driving demand for diversification.”

But until there’s a futures market, investors may want to look at mining companies, which can be a little "tricky", in Rapaport's view.

“What they have and what they sell aren’t as straight forward as trading specific GIA-graded polished diamonds” since there are different specifications for the diamonds they produce.