Current trend

On Friday, the pair XAU/USD reached its 5-years low near the level of 1077.20 but managed to correct upwards after.

Amongst other reasons, that was a result of the poor manufacturing data form China, which came out worse than already pessimistic forecasts. Furthermore, the pair remains under pressure from the expectations of not far off interest rates hikes in the US.

It should be noted that commodities markets in general remain bearish, while gold, as one of the most liquid instruments, has the strongest reaction. For example, one of the biggest gold funds (ETF) SPDR Gold Trust GLD fell for the sixth consecutive day to 684.6 tons, its lowest level since September 2008.

Support and resistance

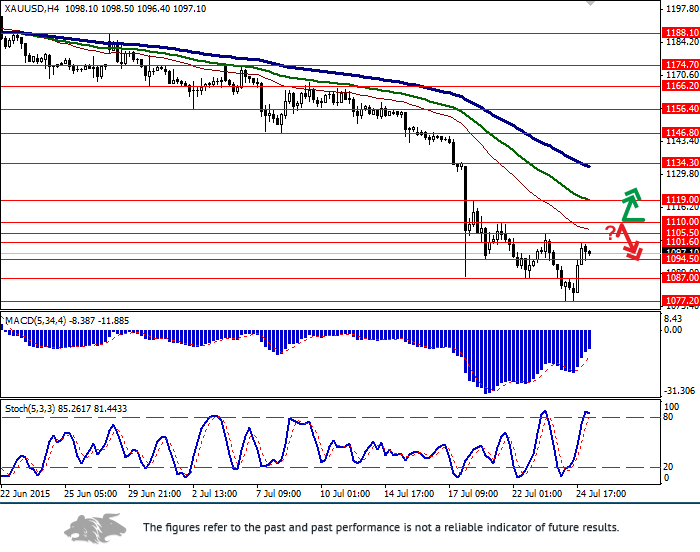

Bollinger Bands on the daily chart shows a downward trend. However, it is giving a buy signal as the price left its range few days ago. The indicator is signaling that gold is oversold and that the upward correction towards 1124.80 is possible.

MACD is trying to turn up and has formed a short-term buy signal. Stochastic is also leaving the oversold zone thus forming a buy signal.

Resistance levels: 1101.60 (24 July high), 1105.60 (23 July high), 1110.00 (psychologically important level), 1119.00 (20 July high).

Support levels: 1094.50 (20 July low), 1087.00 (22 July low), 1077.20 (24 July low).

Trading tips

Open long positions after the breakout of the level of 1110.00 (with appropriate indicators signals) with targets at 1124.80, 1134.30 and stop-loss at 1087.00.

Short positions can be opened after the price bounce off the level of 1110.00 with the target at 1077.20 and stop-loss at 1119.00.