Current trend

The GBP/USD pair keeps trading flat near the local high at 1.5700. For the GBP, the opening of the current trading week was not so favorable, but after the Bank of England released its Minutes on Wednesday, the pound managed to gain back its losses. Also yesterday, the UK Inflation Rate statistics supported the British currency.

It is worth noting that neither the Minutes, nor the Inflation Rate statistics sprang any surprises. All nine members of the Monetary Policy Committee voted to hold interest rates at the record low level of 0.5%. Also the volumes of the QE program remained unchanged at 375 billion pounds.

The steps, taken by the Bank of England, are clear and transparent. Last week, Mark Carney, Governor of the BoE, indicated that the Central Bank would tell the approximate dates of an interest rate rise only by the end of the year. By that time, the Fed may already increase its interest rate; therefore, the British regulator should not postpone its similar decision.

Until the end of the week, there are no more macroeconomic releases which can affect the pair dynamics. However, long positions still look more attractive, partly due to the positive forecast on UK inflation and retail sales statistics, released on Thursday.

Support and resistance

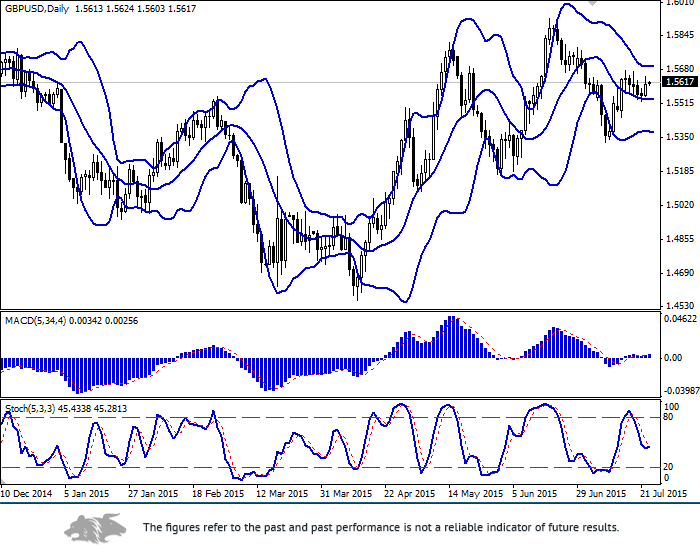

Bollinger Bands on the daily chart are almost horizontal, and the possible lower border of the sideways channel is quite far away, at 1.5380. Currently, the indicator does not give any clear signals.

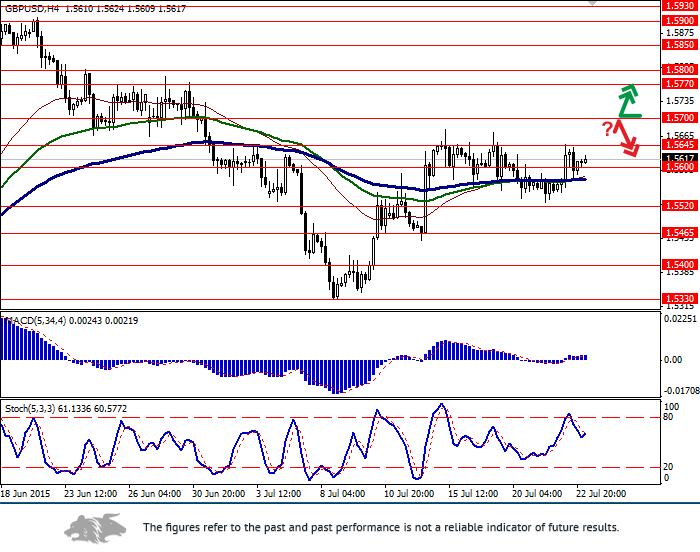

MACD also cannot give a clear picture. The histogram is above the zero and the signal lines, but its volumes are low and the lines are very close to each other, so, therefore, the signal may be canceled anytime. The indicator does not contradict the short-term long positions, but it is better to postpone the opening of new orders.

Oscillator Stochastic is in the middle zone and is trying to turn upwards again. It also indicates a possible upward dynamics in the short term.

Support levels: 1.5600 (the nearest "bearish" target), 1.5520, 1.5465, 1.5400 and 1.5330 (July 8 low).

Resistance levels: 1.5645 (the upper border of the short-term flat channel), 1.5700 (estimated range for the short-term flat extension), 1.5770, 1.5800, 1.5850, 1.5900 and 1.5930 (near June 18 high).

Trading tips

Open long positions when 1.5700 is broken through, if technical indicators do not contradict it. Set take-profit at 1.5800 and stop-loss at 1.5600 or higher.

An alternative scenario may be possible when the pound bounces off 1.5700, supported by the weak UK Retail Sales statistics. In this case, a rollback to the previous level 1.5520 may be used with stop-loss at 1.5750.