Current trend

Last week, as it was expected, the EUR currency gradually declined against the USD. Several factors affected the European currency. First of all, it is the instability in Greece, where people protest against the government’s austerity measures. Secondly, weak macroeconomic statistics of key eurozone economies. Last week negative data on Consumer Price Index in France and the eurozone was released. Thirdly, the demand for the US dollar as Fed is expected to tighten the monetary policy in the coming months.

Today, Germany released weak data on Producer Price Index (-0.1% in June).

Support and resistance

This week no key statistics are released in the eurozone and the US. Only US Labor Market statistics and Purchasing Managers Index in Germany, France and the eurozone are worth noting. These data are published at the end of the trading week. The fundamental break may allow the European currency to recover some losses in the short term.

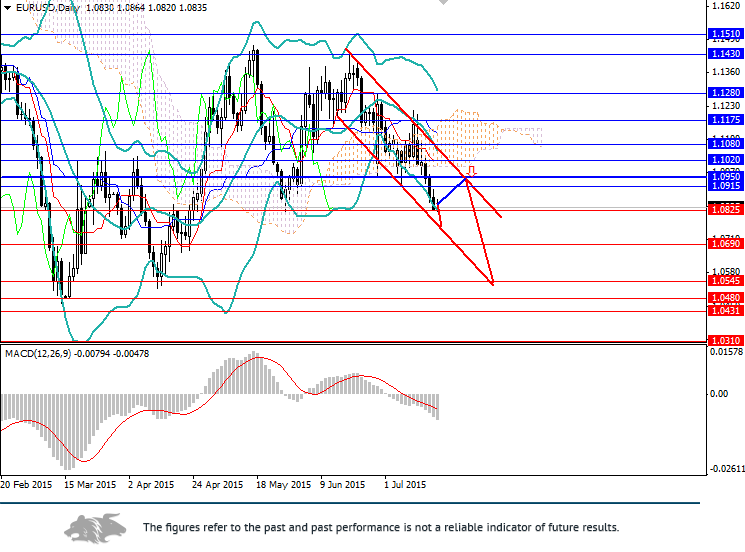

Now the pair is trading within the downward channel. When the lower line of 1.0825 is reached, a correction towards the upper border of the range 1.0915, 1.0950 is expected, followed by the further downward trend.

Main indicators confirm this scenario. MACD histogram shows the growing volumes of short positions. The pair reached the lower MA of the Bollinger Bands and, in the short term, is likely to strengthen to the middle MA, and then the European currency is expected to continue declining. In the medium-term the target levels are the recent local lows 1.0545, 1.0480.

Support levels: 1.0825, 1.0690, 1.0545, 1.0480, 1.0430, 1.0310.

Resistance levels: 1.0915, 1.0950, 1.1020, 1.1080, 1.1175, 1.1280, 1.1430, 1.1510.

Trading tips

In this situation open short positions from the key resistance levels and the upper border of the downward channel — 1.0950 with take-profit at 1.0690, 1.0545 and stop-loss at 1.1030.