Current trend

Last week, oil prices showed the biggest weekly fall since March this year. WTI crude futures fell by 7.4%, while Brent fell by 2.6%.

The price of oil still remains under the pressure from fundamental factors, such as oversupplied markets, eurozone crisis, world (and especially Chinese) stock markets fall, investors’ funds shift into the Yen, USD and CHF, oil reserves increase in the US, nearing an end Iranian negotiations and output increase by the OPEC countries. The International Energy Agency last Friday noted that markets are going to remain oversupplied in 2016.

In the short-run, oil prices can find the support if Iranian nuclear program negotiations are delayed or failed, which would allow for a short-term price correction.

From the fundamental point of view, in the medium-term the pressure on the price will remain.

Support and resistance

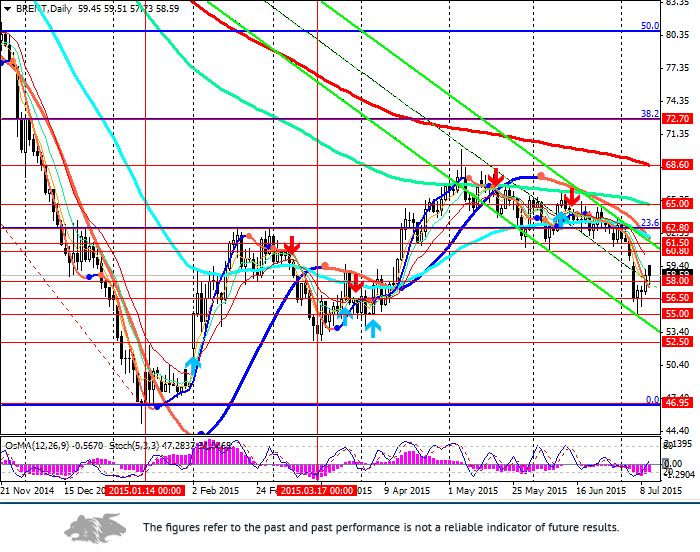

The price fall towards year lows at 46.00 is likely to continue.

The price rebound is possible up to 59.00-59.50. The farthest level of growth is 62.80 (23.6% Fibonacci).

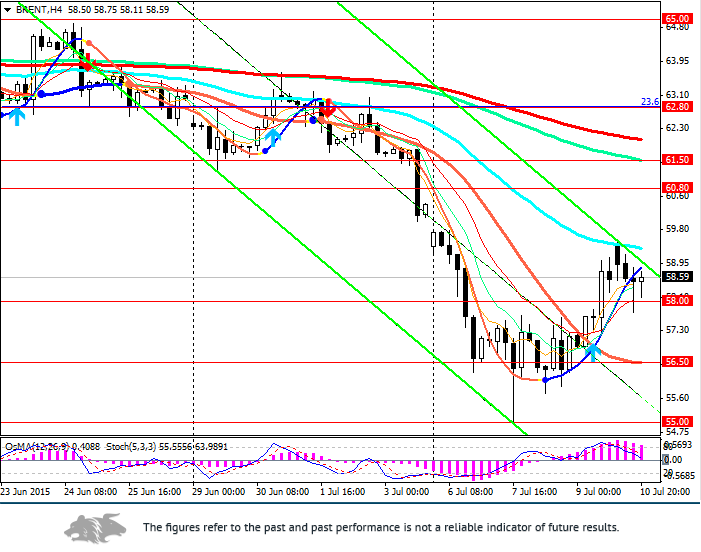

On the daily chart, the price remains in the middle of the downward channel. However, OsMA and Stochastic are turning to form a buy signal that implies an upward correction might continue. On the 4-hour chart, the indicators give sell signals.

Fundamental factors are stronger at present, thus consider any local price rebound as an opportunity to open short positions.

Support levels: 56.50, 55.00.

Resistance levels: 59.50, 60.80, 61.50.

Trading tips

Open short positions from the current levels or preferably from 59.00, 59.15, 60.00 with targets at 57.00, 56.50, 55.00, 52.50, 46.00 and stop-loss at 60.50.

Long positons can be opened after the breakout of the level of 60.80 with targets at 62.80, 63.90, 65.00, 68.60, 72.70.