Get Ready As EUR/USD Begins To Take Center Stage Again – Citi

28 June 2015, 17:36

0

162

EUR/USD is undergoing consolidation as headlines related to Greece are becoming more confusing.

But it’s not only Greece: the pair has bigger drivers, and they could send it in a clear direction. The team at Citi weighs in:

Here is their view, courtesy of eFXnews:

The two major trends at the start of the year, EUR weakness and USD strength, are showing signs of reemerging, notes CitiFX in its weekly note to clients today.

“The recent strength of the EUR and higher yields have left Europe with tighter monetary conditions than when the ECB announced its QE program,” Citi adds.

“Going forward we struggle to see what will, at this stage, take EURUSD higher. This week’s increased optimism on Greece has not extended its gains and now that short-term pressures are fading the ECB is less likely to be quiet in the event of a stronger currency,” Citi argues.

On the other side of the equation, Citi continues to see the USD supported in sync with US yields moving higher as the Fed is set to hike in September.

If we start with the idea that the Fed could hike interest rates in September this year, which is 3 months away, how low could EUR/USD go?

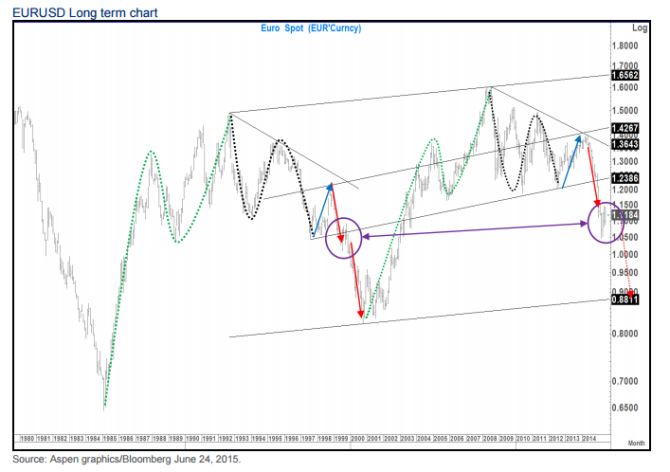

“The three months going into the Fed hike of June 1999 saw EURUSD move from 1.09 to 1.01. Anything similar from here would take us close to the trend lows. Alternatively we could look at the price action on EURUSD after the consolidation that ended in October 1999 and see that as the EURUSD downtrend resumed, we fell from 1.09 to 0.97 – a move of 12 figures which if replicated here would bring us a little closer to parity (certainly lower lows for the trend),” Citi answers.

All in all, Citi argues that the weeks and months ahead should see both trends of broad EUR weakness and broad USD strength re-established and EURUSD head towards parity as we line up for a Fed hike.