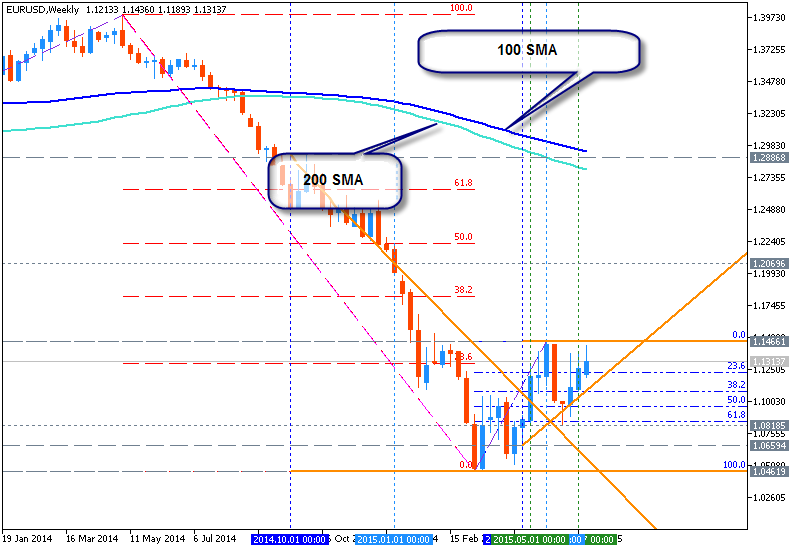

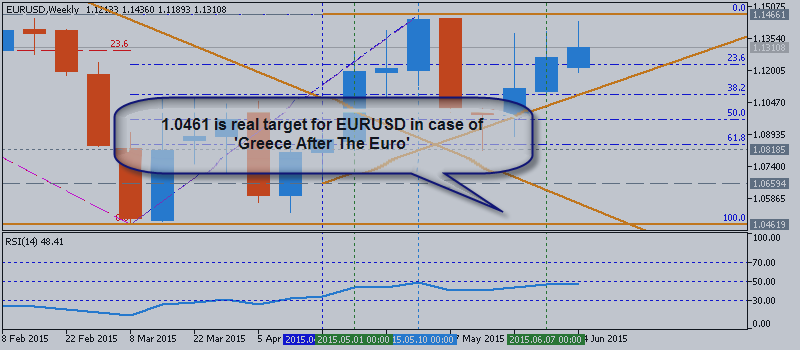

Credit Agricole about Greece After The Euro: The Greek saga continues - 1.0461 is real target in case of 'Greece After The Euro'

There won't be a grace period for Greece if it fails to repay the IMF on June 30: media reports suggested the ECB has called for an emergency meeting to discuss the Greek ELA. This could be an indication that the persistent political impasse and the intensifying deposit flight have forced the ECB to reconsider its role as lender of last resort.

'We are conscious of the fact that markets in Europe could start panicking if the deadlock persist into next week and the June 30 deadline draws near.'

'EUR seems to be holding firm for two reasons. One is the

expectations that we could squeeze higher on the back of a successful

outcome. The second reason is market positioning.'

'We suspect that EUR should come under sustained

downside pressure if we get no resolution by Monday and fears of Greek

default and capital controls escalate next week. It still remains to be

seen whether the Greek tragedy would remain a EURcentric development or

trigger global risk aversion.'

The negative scenario is that EURUSD will be moved to downside up to 1.0461 which will be the real target in case of 'Greece After The Euro':