Investigation: The number everything depends upon in China's IPO market

23 - is apparently one of the most powerful

forces in China’s $6.4 trillion equity market today.

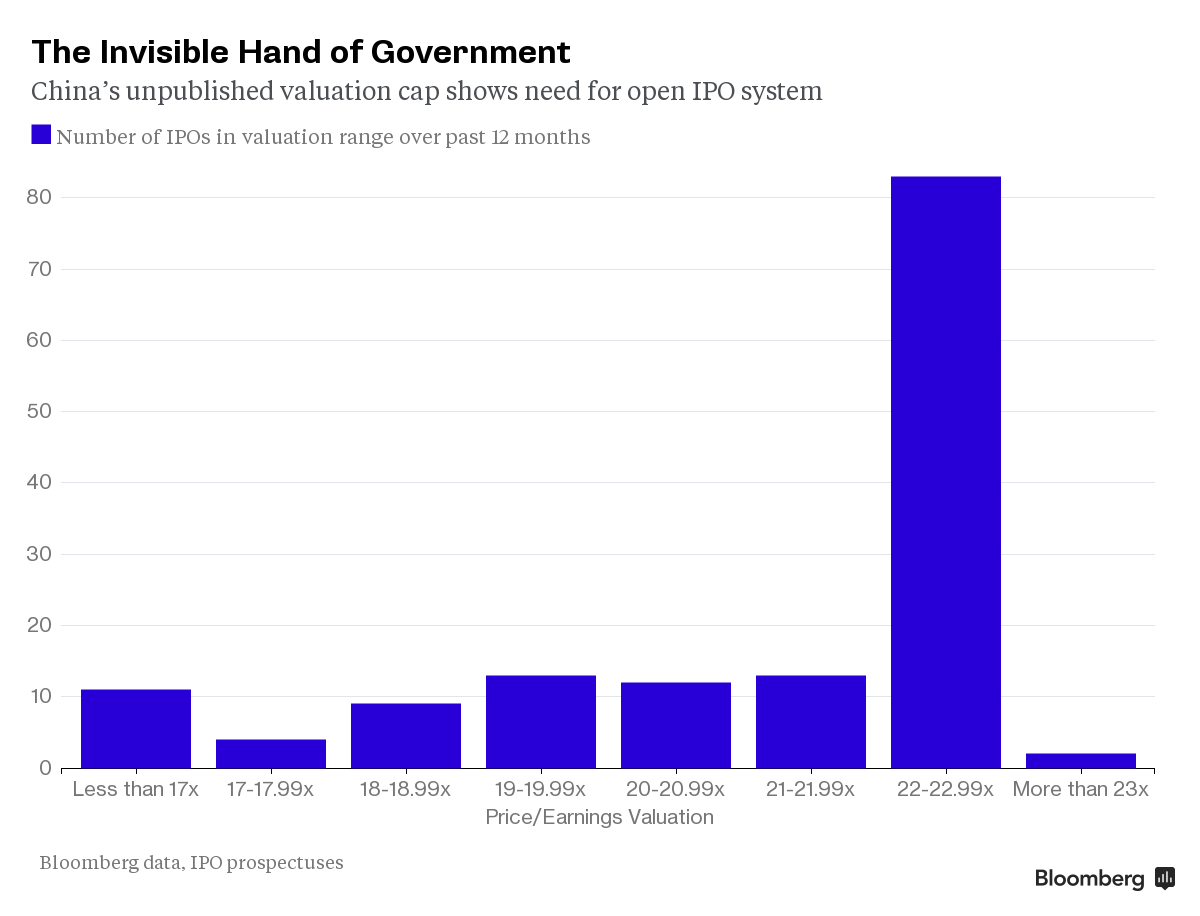

It has become a ceiling for firms trying to tap into the Shanghai benchmark index. Although market valuations have risen, virtually no firms have gone public at prices of more than 23 times their earnings per share.

According to bankers, there is no coincidence. Chinese authorities

have quietly restrained attempts to take businesses public at

richer prices. Sticking to the multiple 23, regulators are

handing investors an almost guaranteed profit when new shares

start trading.

On the other hand, companies get shortchanged with smaller cash infusions than investors are ready to pour.

The number itself however is less important than what it says about the Chinese authorities and its hold on the nation’s financial markets. Although they have made no official announcement about the ceiling, it first emerged after they tightened oversight of the IPO process in January 2014 to prevent companies and certain investors from colluding to drive up prices - a practice that had saddled individual investors with losses.

As Bloomberg reports, the 68 companies that started trading in China since the very beginning of 2015

have surged an average 199 percent, compared with a 15 percent

gain for the Shanghai Composite Index this year. The benchmark gauge rose 2 percent

at 1:14 p.m. local time. Granted, companies everywhere leave money on the table in

IPOs.

Bankers often underprice offerings to ensure stocks rise from day one. The strategy can hand a favored few instant profits and produce fuss around the shares.

In China, however, the power of 23 is supernatural. Only two of the 147 companies that went public during the past 12 months sold shares above that valuation, as it is seen below.

The two that broke through didn’t get far: circuit-board

maker Guangdong Ellington Electronics Technology Co. fetched

23.2 times profit in its June offering, while fertilizer

producer Hubei Forbon Technology Co. priced at 23.01 times later

that month.

In general, more than half of the 147 IPOs were valued at levels between 22 and 23 times reported earnings.

“It demonstrates how the system is rigged,” said Hao Hong, the chief China strategist at Bocom International Holdings Co. in Hong Kong. Companies have learned that if they try to price shares above 23, their IPOs won’t get approved, he said.

Underwriters are reluctant to talk on the record as they are afraid of the authorities, who, unlike their European and American colleagues control the timing and pricing of deals. One

banker said he only found out what pricing level they would

accept through trial and error. So 23 keeps working its strange magic.

In 2015, three Chinese firms with nothing in common went public at the exact same multiple: 22.96. The first was a budget airline, Spring Airlines Co.; the second was a cinema chain, Wanda Cinema Line Co.; the third was a producer of chicken wings, Shandong Xiantan Co. Shares of all three jumped once they started trading, with gains of as much as 376 percent.

On March 5 Premier Li Keqiang pledged to introduce a

registration system for first-time share sales, indicating a

change to a listing model where markets indicate most aspects

of an IPO. However, experts consider it will take at least one or two years for the reforms to take effect. To date, the number 23 is what counts.