TRADING LESSON: How to Trade the Gross Domestic Product (GDP)

28 September 2014, 03:11

0

1 199

There are many components of the

US Economy which can affect overall economic growth and inflation

expectations. Some of the major examples here are how many people are

employed in the economy vs. unemployed, how much the housing market is

growing in different parts of the country, and at what rate the prices

for different products in the economy are seeing increases.

As all of these things are so important to the economy and therefore to the markets, there are no shortage of economic reports which are released to try and help people gauge how things are going with different pieces of the economy. It is important for us as traders to understand the major reports here as even if we are trading off of technicals, understanding what is happening in the market from a fundamental standpoint can help establish a longer term bias for trading. In the short term an understanding of these numbers will also help to assess the erratic and sometimes extreme movements which can occur after economic releases.

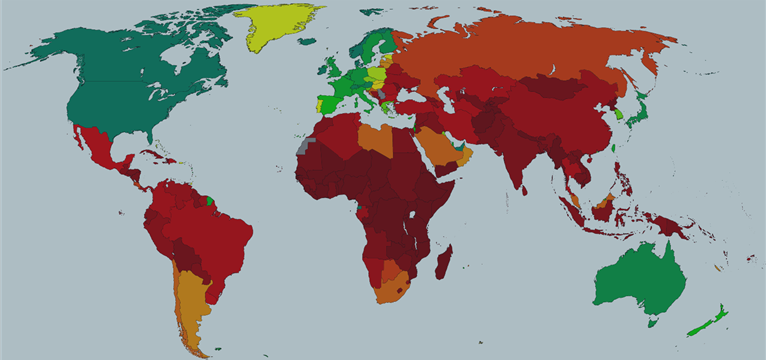

As a side note here, GDP also allows a comparison to be made of the sizes of different economies from around the world, as well as their growth rates. To give you an idea of just how large the US Economy is, 2007 GDP for the United States was estimated at 13.7 Trillion dollars. This is in comparison to the next largest economy in the world, Japan which has a GDP of under 5 Trillion Dollars.

Quarterly estimates of GDP are released each month with Advance Estimates which are incomplete and subject to further revision being released near the end of the first month after the end of the quarter being reported. In the second month after the end of the quarter being reported preliminary numbers (which basically means more accurate than advanced) normally are released and then finally the final GDP number is released at the end of the 3rd month after the end of the quarter being reported on.

Traders are going to focus heavily on the growth rate released in the Advanced number and markets will also move on any significant revisions made in the preliminary and final GDP numbers.

As all of these things are so important to the economy and therefore to the markets, there are no shortage of economic reports which are released to try and help people gauge how things are going with different pieces of the economy. It is important for us as traders to understand the major reports here as even if we are trading off of technicals, understanding what is happening in the market from a fundamental standpoint can help establish a longer term bias for trading. In the short term an understanding of these numbers will also help to assess the erratic and sometimes extreme movements which can occur after economic releases.

As a side note here, GDP also allows a comparison to be made of the sizes of different economies from around the world, as well as their growth rates. To give you an idea of just how large the US Economy is, 2007 GDP for the United States was estimated at 13.7 Trillion dollars. This is in comparison to the next largest economy in the world, Japan which has a GDP of under 5 Trillion Dollars.

Quarterly estimates of GDP are released each month with Advance Estimates which are incomplete and subject to further revision being released near the end of the first month after the end of the quarter being reported. In the second month after the end of the quarter being reported preliminary numbers (which basically means more accurate than advanced) normally are released and then finally the final GDP number is released at the end of the 3rd month after the end of the quarter being reported on.

Traders are going to focus heavily on the growth rate released in the Advanced number and markets will also move on any significant revisions made in the preliminary and final GDP numbers.