Trading News Events: German Unemployment Change - Jobless Rate to Hold at Record-Low of 6.5% for Second Month

Another 10K contraction in German Unemployment may encourage a near-term

rebound in EUR/USD as it raises the prospects for a stronger recovery

in the euro-area.

What’s Expected:

Why Is This Event Important:

A further improvement in Europe’s largest economy may limit the European

Central Bank’s (ECB) scope to further embark on its easing cycle and

heighten the appeal of the single currency especially as the

member-states take unprecedented steps to mitigate the risk for

contagion.

However, waning business confidence paired with the slowdown in

production may drag on employment, and a dismal labor report may

heighten the bearish sentiment surrounding the Euro as ECB President

Mario Draghi keeps the door open to further support the monetary union.

How To Trade This Event Risk

Bullish EUR Trade: Unemployment Contracts 10K or Greater

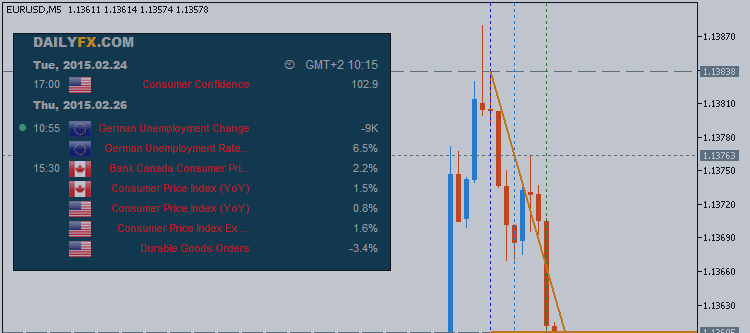

- Need green, five-minute candle following the print to consider a long EUR/USD trade

- If market reaction favors buying Euro, long EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bullish Euro trade, just in opposite direction

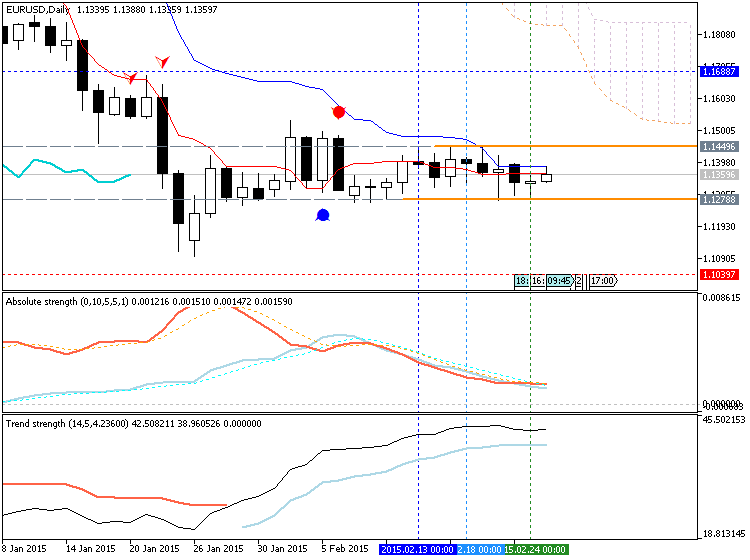

EUR/USD Daily Chart

- Long-term outlook remains bearish as the RSI retains the downward trend from 2013, but need a break/close below support to revert back to the approach to ‘sell bounces’ in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1480 (78.6% expansion)

- Interim Support: 1.1300 (161.8% expansion) to 1.1310 (100% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JAN 2015 | 01/29/2015 08:55 GMT | -10.0K | -9.0K | +20 | +33 |

The number of unemployed in Germany contracted 9.0K in January, while the jobless rate narrowed to a record-low of 6.5% from a revised 6.6% the month prior. Despite the ongoing improvement in Europe’s largest economy, the European Central Bank’s (ECB) may continue to highlight a dovish tone for monetary policy as it struggles to achieve its one and only mandate to deliver price stability. Nevertheless, EUR/USD tracked higher following the report, with the pair pushing above the 1.1300 handle to end the day at 1.1326.