Leverage financed with credit, such as that purchased on a margin account is very common in Forex. A margined account is a leverageable account in which Forex can be purchased for a combination of cash or collateral depending what your brokers will accept.

The loan (leverage) in the margined account is collateralized by your initial margin (deposit), if the value of the trade (position) drops sufficiently, the broker will ask you to either put in more cash, or sell a portion of your position or even close your position.

Margin rules may be regulated in some countries, but margin requirements and interest vary among broker/dealers so always check with the company you are dealing with to ensure you understand their policy.

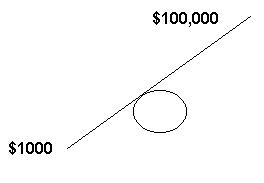

Up until this point you are probably wondering how a small investor can trade such large amounts of money (positions). The amount of leverage you use will depend on your broker and what you feel comfortable with. There was a time when it was difficult to find companies prepared to offer margined accounts but nowadays you can get leverage from a high as 1% with some brokers. This means you could control $100,000 with only $1,000.

We assume that trades which have historically reached their profit

targets quickly should continue indefinitely into the future. Therefore,

if prices aren’t hitting their targets quickly, it must obviously not

be a good trade so we exit prematurely.

This impatience is in part due to expecting the next trade to be a big

home run. As a result, we’ll place a trade size a little larger than

normal so as to squeeze a little extra juice out of the trade in case it

goes nowhere. However, during this process, the trader ends up risking a

significant portion of their account on the outcome of that one trade.

Remember, a 25% loss requires a 33% return to get back to break even. If

a 25% loss in a fast moving market is difficult enough to overcome,

imagine how challenging it would be to overcome a 25% loss in a slow

moving market. Therefore, de-emphasize each trade and think of the next

trade simply as the first of ten trades rather than the next homerun.

You can reduce the emphasis by implementing less than 10x effective

leverage. Effective leverage is simply taking the total notional trade

size and dividing it by your account size. The result will indicate how

many times you have your equity levered. According to our research, we

recommend implementing less than ten times effective leverage.

Incorporating smaller trade sizes and less leverage will alleviate the

stress of having to produce a profitable trade. As a result, you’ll be

more likely to let the trade develop and let the trade evolve in the way

the patterns indicate.