Junk bonds are yielding what?!

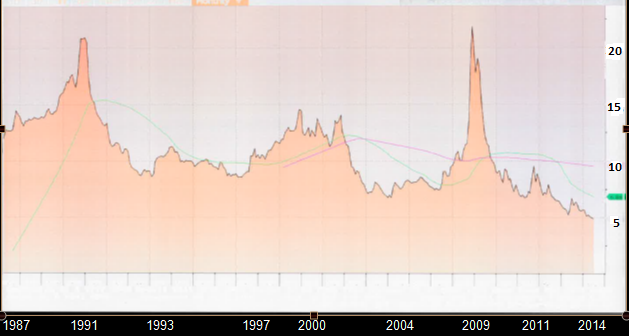

The zero interest rate environment has created complacency and a reckless desire by investors of chasing yield into the riskiest spectrum of the financial markets. The chart below is the history of junk bond yields dating back to their beginning as an asset class, illustrates this.

The above chart illustrates yield chasing at any cost unconscious of risk. Investors now perceive the only risk is that of owning assets with lower yields; principal risk is all but an illusion of being under invested.

Junk bonds, or those corporate debt instruments representing a class of stocks having the least attractive balance sheets, are the first debt class to succumb to financial headwinds. With deteriorating fundamentals, a flat economy, earnings deceleration, enormous consumer debt, all-time high NYSE margin debt and the quality of corporate debt approaching record lows, junk bond yields should not be getting cheaper and more expensive in price. It is similar to an option writer having to sell closer to in-the-money in order book any premium.

The Fed has introduced a benign complacency fostering misguided optimism in equity markets with absolutely no fear. In fact the CBOE Volatility Index (VIX), aka the fear gauge, is at multi-year lows and just north of all-time lows. Investors are convinced that any down draft, however minor in degree or percentage, is a buying opportunity worthy of risking capital. This is whimsy and is investing capital that would otherwise be designated cautiously towards risk adverse assets.

Investors have become comfortable with the perception that the Fed is providing their backing to ignore risk and to own assets at any pricing. The Fed and other central banker’s bailouts of fundamental government inefficiencies through the mindless printing of money and other monetary stimuli are casting dangerous illusions. These illusions are allowing investors to become numb to numerous economic and geo-political red flags that in ordinary times would find themselves nervously headed for the sidelines.

The market action of nearly the past two years is deceiving investors into a false sense of normalcy; as unprecedented as these times are and the chant of “this time is different” largely due to the actions of global central bankers will unquestionably result in woeful investors staring in disbelief at a sea of red on the nightly stock ticker. It is time for caution as investors are now throwing caution to the wind. All that is wrong with global economies will not be made right with the concept of borrowing to beget prosperity.