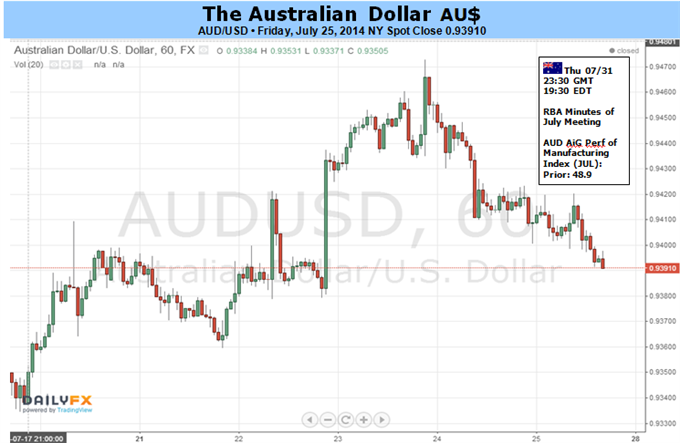

Fundamental Forecast for Australian Dollar: Neutral

- AUD Set For Another Flat Finish Despite Plenty Of Intraday Volatilite

- Light Economic Docket May Do Little To Shift RBA Policy Bets

- Low Vol. Environment Could Continue To Support Carry Demand

The Australian Dollar is set for a relatively flat finish after a turbulent week that yielded plenty of intraday volatility. An upside surprise to the Australian second quarter core CPI reading, and rise in headline inflation to the top of the RBA’s 2 to 3 percent target band, sent the currency soaring above the 94 US cent handle. Additional strength for the Aussie was found on the back of a bumper China PMI print, as well as an absence of ‘jawboning’ in a speech from RBA Governor Glenn Stevens. Ultimately, most of the gains proved short-lived, which may have reflected some hesitation from traders to push the currency into a region of noteworthy technical resistance.

Looking to the week ahead; Building Approvals and the Performance of

Manufacturing Index figures represent the only medium-tier domestic

economic data on the calendar. However, the leading indicators for the

health of the local economy may do little to materially shift the rate

outlook, meaning any reaction from the AUD may fail to find

follow-through. Similarly, the Chinese manufacturing figures (also on

tap) could generate another round of knee-jerk volatility on a surprise

reading, yet likely hold do not hold the requisite power to leave a

lasting impact on the currency.

Indeed, Stevens’ recent address reinforced the prospect of a ‘period

of stability’ for the cash rate over the near-term. At this stage it

appears unlikely the RBA will change its stance while it attempts to

foster a rebalancing of the domestic economy.

Implied volatility remains near multi-year lows, suggesting traders

continue to price in a relatively small probability of a major economic

crisis occurring in the near-term. Traders are seemingly looking past

the latest flare-up in geopolitical tensions and have returned to the

hunt for yield.