Fundamental Forecast for Dollar: Bullish

- The Dollar advanced this past week – with remarkable progress from EURUSD and GBPUSD – despite a tepid fundamental backdrop

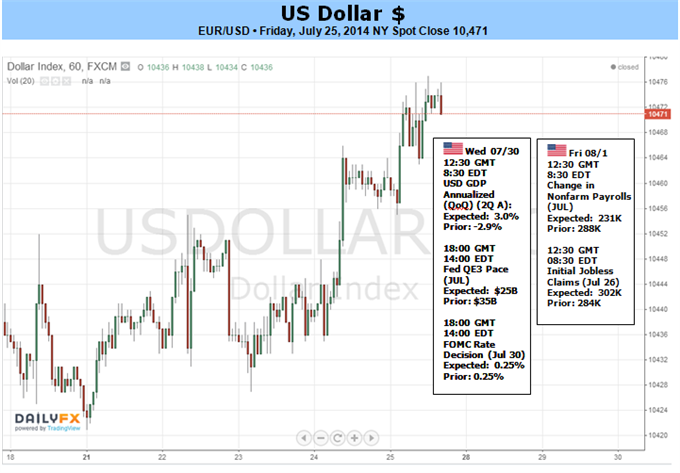

- Event risk fills out this week with high profile events like the FOMC Decision, NFPs, and 2Q GDP to spur rate forecasts and risk trends

There was little in the backdrop that should have meaningfully bolstered the US Dollar. Interest rate expectations measured through yields and Fed Fund futures were stagnant. Meanwhile, sentiment trends came nowhere near the necessary risk aversion intensity to spur a demand for the haven’s liquidity. And yet, the greenback put in for a meaningful turn. From the precipice of breaking a 17-month range support, the Dow Jones FXCM Dollar Index (ticker = USDollar) has climbed. From the majors, that has manifested in a EURUSD break to 8-month lows below 1.3500 and a tentative GBPUSD reversal back below 1.7000. However, this turn is not yet a reliable trend that can override the general lassitude in financial markets. Yet, that may change in the turbulence of this week’s packed calendar.

Though there is a flood of top-tier US event risk penciled in this coming week, three

particular releases stand out: the second quarter US growth report (US

2Q GDP), the FOMC rate decision and July nonfarm payrolls (NFPs).

These are not only high-profile events with a history of induced

volatility, but they are capable of shaping the FX market’s most

prominent fundamental themes: interest rate expectations and sentiment

trends. Between these two overriding fundamental subjects, the timing

and pace of the Fed’s monetary policy is more susceptible to change.

Yet, should one or more of these events strike a risk nerve, the

potential is far greater.

The major event risk will be split into two discrete sessions: the New

York sessions on Wednesday and Friday. And, with all of these events,

there is worth noting that there is a skew of possible impact to

certain outcomes. In the first round of event risk, we have the growth

report and policy decision. This past week, the IMF downgraded its 2014

GDP forecast sharply (2.8 to 1.7 percent) after the unexpected 1Q

contraction. This tempers expectations even though the Fed and market

have maintained optimism for a quick rebound in the 2Q. We will see if

that is the case, but a disappointment could be the greater surprise

here than a rebound that meets or outpaces expectations. Yet, a weaker

pace of recovery is unlikely to materially shift the need for policy

normalization. So GDP may prove a more capable risk driver.

Later in the same session, this FOMC rate decision will not provide

the updated forecasts (on employment, inflation and interest rates) nor

Chairwoman Janet Yellen’s press conference. That means, we are left to

an expected Taper – third to last if their pace holds – and evaluating

the monetary policy statement for tone. The central bank has remained

elusive on their timing for a policy shift and its subsequent pace – at

least that‘s how markets seem to be treating it. Policymakers cannot

pre-commit or they would risk a causing a greater surprise should

conditions change and warrant a different policy approach. That said,

the interest rate forecasts (often referred to as the ‘blue dots’) are

fairly straightforward. They project a first hike in mid-2015, a benchmark rate of 1.12 percent by end of 2015 and 2.50 percent by the close of 2016. Yet, Fed Funds futures, swaps and yields are all discounting that tempo. That is a lot of room to close the gap.