It's impossible to invest without risk. There is always a possibility to lose some - or all - of your money. You might watch inflation erode your funds. You might not earn a return that's large enough to meet your financial goals. Moreover, no strategy is entirely safe.

That suggests the biggest investment risk might not be a specific catastrophe, but rather ignorance about the types of risks you've taken and how big they are, a mistake that can lead to larger losses and heavier disappointments.

Instead of trying to eliminate risk, your awareness of risk can empower you to manage and mitigate the downsides, if and when they occur. Here are six ways risk can interfere into your investing.

Too much investment risk

As elderly generation claims, youngsters are typically more aggressive in their investments than older people, taking more risk to achieve higher returns.

But it's possible for even the very young to push this wisdom too far by investing in assets or opportunities that can be too aggressive for most people of any age, says Ben Wacek, founder of Wacek Financial Planning in Minneapolis.

Examples include penny stocks, venture capital funds and investments in friends' or relatives' startup businesses.

"Even if you're young, you have to recognize that with certain types of investments, there's no floor at the bottom. You could lose everything you have," Wacek says.

Too little investment risk

Investors who are too conservative are exposed to inflation, which erodes purchasing power over time, says Alfred McIntosh, principal at McIntosh Capital Advisors Inc. in Los Angeles.

"People who are afraid their assets will lose money will be comfortable in a savings account because they never see the value drop. But if you're earning 0.01 percent and inflation is 2.5 percent, you're losing substantially," he says.

Most investors focus more on loss of principal than inflation, even though both investment risks are real and constantly present. The goal is to find the appropriate balance.

Still, there are situations in which inflation is less material.

Examples include:

- Emergency savings.

- Short-term savings to buy a home or pay for a vacation, wedding, college expenses or other major expense.

- Savings in a health savings account, up to the amount of the associated plan's annual deductible.

- Money needed to pay current expenses during retirement.

"With a short-term goal, you have different standards. You shouldn't subject that money to the dominant risk of volatility and decline," McIntosh says.

Wacek says older investors who plan to leave substantial assets to their children or grandchildren should consider the next generations' time horizons. Otherwise, they might be too conservative in their investments.

Too much diversification

McIntosh is one of many experts who say that one of the best ways to manage risk is through diversification.

But it is possible to over-diversify.

One way is to add on investments to a target-date mutual fund, perhaps in a 401(k) retirement account, says PJ Wallin, principal owner of W Financial LLC in Richmond, Virginia.

Target-date funds are adjusted periodically to change the mix of assets from more aggressive to more conservative as the target date approaches. The date might be the year when the investor plans to retire.

These funds "aren't ideal," Wallin says, but they can make sense for investors who don't want to work with a pro or assemble their own well-diversified portfolio.

The risk is heightened when the investor muddles the strategy by adding more investments in the mistaken belief that more diversification will be less of an investment risk.

"What that does is change the allocation," Wallin says. "Target-date funds are meant to be 100 percent."

Too little diversification

The more common risk is under-diversification.

"There's a tendency for people to buy individual stocks, thinking they know and understand the company, but that's not normally the case. So, they're assuming more risk than a fund that's diversified," McIntosh says.

Employees who receive company stock or purchase shares at a discount through an employee stock ownership plan are especially prone to under-diversification, since much of their income and wealth is tied to the fortunes of one company.

"The longer you stay with the company, the more tied in you are," Wallin says. "To a certain extent, the company becomes a risk to you."

The antidote is disloyalty.

"They give you incentives to hold the company stock, but there are certain times when you can divest. The more you diversify as you go, the better off you'll be in the long run," Wallin says.

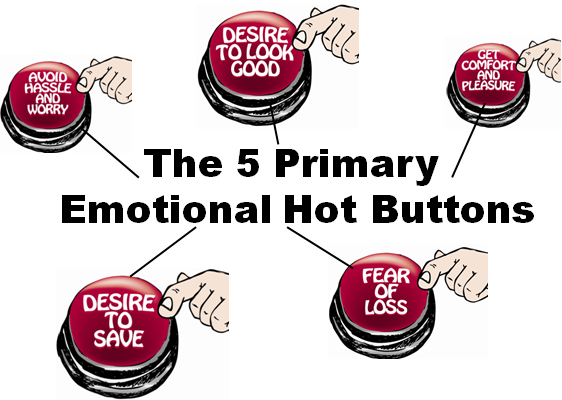

Hot buttons

Emotions can run hot when it comes to investing. For some investors, that can lead to overconfidence, says Rebecca Schreiber, a Certified Financial Planner, formerly with Solid Ground Financial Planning in Silver Spring, Maryland, and now with Integrated Systems Solutions Inc.

"People who are very certain of themselves and their future successes may feel that since their choice of investment is automatically correct because it comes from them, that they don't need to research what they're investing in. They have obviously made the correct choice," Schreiber says.

That hubris can lead to mistakes and losses.

Other investors are too frightened to invest wisely.

"No one would deliberately pass up hundreds of thousands of dollars of gains just because they're feeling nervous, but the payoff isn't real to them," Schreiber says. "The anxiety is real. The payoff isn't."

These and other extreme emotions can be risk factors in and of themselves if they trump rational facts and smart investment strategies that aim to consider, manage and mitigate risk.

Using past performance as a guide

The past is not a synonym for good experience and isn't a reliable indicator of the future. Yet, many investors look to their own past or recent market history as a guide for their investment decisions, exposing themselves to loss of principal, inflation erosion or inadequate returns.

"During the stock market crash of 2008 and 2009, millions of investors sold their investments because they'd taken on more risk than was sensible and couldn't stomach the losses in their portfolios," says Wacek of Wacek Financial Planning. "Most of these investors didn't reinvest until after the stock market was already higher than the value at which they sold."

Equally unwise is the decision to stick with inauspicious losers in the forlorn hope that they'll recover their former glory.

As McIntosh of McIntosh Capital Advisors warns, the presumption that an investment will recover "is not necessarily true."

"A lot of people invested in technology companies, and they never came back," he says. "They waited for their investment to give them back what they'd lost. They didn't do that. Now, we're years into the future, and they still have to start over."