und werden Sie Mitglied unserer Fangruppe

Veröffentliche einen Link auf das Skript, damit die anderen ihn auch nutzen können

Bewerten Sie es im Terminal MetaTrader 5

- Ansichten:

- 32344

- Rating:

- Veröffentlicht:

- Aktualisiert:

-

Benötigen Sie einen Roboter oder Indikator, der auf diesem Code basiert? Bestellen Sie ihn im Freelance-Bereich Zum Freelance

note ........ when you set risk to 0 it trades the lots size for every trade

reverse ...... set to true to take the opposite trade to when its set to false

Symbol GBPUSD (Great Britain Pound vs US Dollar) Period 4 Hours (H4) 2012.01.02 00:00 - 2012.06.01 20:00 (2012.01.01 - 2012.06.03) Model Every tick (the most precise method based on all available least timeframes) Parameters Risk=0; Lots=1; Stop=50; TakeProfit=100; Reverse=false; MondayStartTime="00:00"; MondayEndTime="23:59"; TuesdayStartTime="00:00"; TuesdayEndTime="23:59"; WednesdayStartTime="00:00"; WednesdayEndTime="23:59"; ThursdayStartTime="00:00"; ThursdayEndTime="23:59"; FridayStartTime="00:00"; FridayEndTime="23:59"; MondayNoBreakStartTime="00:00"; FridayNoBreakEndTime="23:00"; MonFriNoBreak=true; IntraBar=false; MagicNumber=0; WriteScreenshots=true; TrailStart=50; TrailAmount=10; periodAMA=9; nfast=7; nslow=30; G=1; dK=3; FasterLWMA=7; SlowerLWMA=30; soundAlert=true; soundFile="lwma_crossover.wav"; textAlert=true; FastEMA=30; SlowEMA=40; SignalEMA=9; SlippageExit=6; SlippageEnter=2; Bars in test 1661 Ticks modelled 7089055 Modelling quality n/a Mismatched charts errors 511 Initial deposit 10000.00 Total net profit 3180.60 Gross profit 7721.20 Gross loss -4540.60 Profit factor 1.70 Expected payoff 113.59 Absolute drawdown 345.00 Maximal drawdown 3104.30 (20.72%) Relative drawdown 20.72% (3104.30) Total trades 28 Short positions (won %) 18 (44.44%) Long positions (won %) 10 (60.00%) Profit trades (% of total) 14 (50.00%) Loss trades (% of total) 14 (50.00%) Largest profit trade 1000.00 loss trade -503.70 Average profit trade 551.51 loss trade -324.33 Maximum consecutive wins (profit in money) 5 (1549.20) consecutive losses (loss in money) 4 (-1502.00) Maximal consecutive profit (count of wins) 1995.90 (2) consecutive loss (count of losses) -1502.00 (4) Average consecutive wins 2 consecutive losses 2

# Time Type Order Size Price S / L T / P Profit Balance 1 2012.01.02 12:00 buy 1 1.00 1.55014 0.00000 0.00000 2 2012.01.02 12:00 modify 1 1.00 1.55014 1.54514 1.56014 3 2012.01.03 06:08 modify 1 1.00 1.55014 1.55014 1.56014 4 2012.01.03 07:33 modify 1 1.00 1.55014 1.55114 1.56014 5 2012.01.03 08:20 modify 1 1.00 1.55014 1.55214 1.56014 6 2012.01.03 08:45 modify 1 1.00 1.55014 1.55314 1.56014 7 2012.01.03 11:17 t/p 1 1.00 1.56014 1.55314 1.56014 999.60 10999.60 8 2012.01.05 20:00 sell 2 1.00 1.54915 0.00000 0.00000 9 2012.01.05 20:00 modify 2 1.00 1.54915 1.55415 1.53915 10 2012.01.06 14:38 modify 2 1.00 1.54915 1.54915 1.53915 11 2012.01.06 15:40 modify 2 1.00 1.54915 1.54815 1.53915 12 2012.01.06 15:43 modify 2 1.00 1.54915 1.54715 1.53915 13 2012.01.06 16:03 modify 2 1.00 1.54915 1.54615 1.53915 14 2012.01.06 16:21 t/p 2 1.00 1.53915 1.54615 1.53915 996.30 11995.90 15 2012.01.11 00:00 buy 3 1.00 1.54842 0.00000 0.00000 16 2012.01.11 00:00 modify 3 1.00 1.54842 1.54342 1.55842 17 2012.01.11 11:28 s/l 3 1.00 1.54342 1.54342 1.55842 -500.00 11495.90 18 2012.01.11 12:00 sell 4 1.00 1.54354 0.00000 0.00000 19 2012.01.11 12:00 modify 4 1.00 1.54354 1.54854 1.53354 20 2012.01.11 12:37 modify 4 1.00 1.54354 1.54354 1.53354 21 2012.01.11 15:33 modify 4 1.00 1.54354 1.54254 1.53354 22 2012.01.11 15:36 modify 4 1.00 1.54354 1.54154 1.53354 23 2012.01.11 16:03 modify 4 1.00 1.54354 1.54054 1.53354 24 2012.01.11 17:13 t/p 4 1.00 1.53354 1.54054 1.53354 1000.00 12495.90 25 2012.01.11 17:13 sell 5 1.00 1.53329 0.00000 0.00000 26 2012.01.11 17:13 modify 5 1.00 1.53329 1.53829 1.52329 27 2012.01.12 09:03 modify 5 1.00 1.53329 1.53329 1.52329 28 2012.01.12 10:48 s/l 5 1.00 1.53329 1.53329 1.52329 -11.10 12484.80 29 2012.01.17 08:00 buy 6 1.00 1.53667 0.00000 0.00000 30 2012.01.17 08:00 modify 6 1.00 1.53667 1.53167 1.54667 31 2012.01.18 15:52 modify 6 1.00 1.53667 1.53667 1.54667 32 2012.01.18 21:11 modify 6 1.00 1.53667 1.53767 1.54667 33 2012.01.19 09:57 modify 6 1.00 1.53667 1.53867 1.54667 34 2012.01.19 11:31 modify 6 1.00 1.53667 1.53967 1.54667 35 2012.01.19 16:46 t/p 6 1.00 1.54667 1.53967 1.54667 998.40 13483.20 36 2012.02.06 08:00 sell 7 1.00 1.57781 0.00000 0.00000 37 2012.02.06 08:00 modify 7 1.00 1.57781 1.58281 1.56781 38 2012.02.06 17:13 s/l 7 1.00 1.58281 1.58281 1.56781 -500.00 12983.20 39 2012.02.09 12:00 sell 8 1.00 1.58401 0.00000 0.00000 40 2012.02.09 12:00 modify 8 1.00 1.58401 1.58901 1.57401 41 2012.02.10 06:03 modify 8 1.00 1.58401 1.58401 1.57401 42 2012.02.10 08:23 modify 8 1.00 1.58401 1.58301 1.57401 43 2012.02.10 10:32 s/l 8 1.00 1.58301 1.58301 1.57401 96.30 13079.50 44 2012.02.17 00:00 buy 9 1.00 1.58054 0.00000 0.00000 45 2012.02.17 00:00 modify 9 1.00 1.58054 1.57554 1.59054 46 2012.02.17 10:38 modify 9 1.00 1.58054 1.58054 1.59054 47 2012.02.17 16:03 s/l 9 1.00 1.58054 1.58054 1.59054 0.00 13079.50 48 2012.02.22 00:00 sell 10 1.00 1.57793 0.00000 0.00000 49 2012.02.22 00:00 modify 10 1.00 1.57793 1.58293 1.56793 50 2012.02.22 10:38 modify 10 1.00 1.57793 1.57793 1.56793 51 2012.02.22 10:42 modify 10 1.00 1.57793 1.57693 1.56793 52 2012.02.22 10:52 modify 10 1.00 1.57793 1.57593 1.56793 53 2012.02.22 13:27 modify 10 1.00 1.57793 1.57493 1.56793 54 2012.02.22 13:57 t/p 10 1.00 1.56793 1.57493 1.56793 1000.00 14079.50 55 2012.02.24 16:00 buy 11 1.00 1.58575 0.00000 0.00000 56 2012.02.24 16:00 modify 11 1.00 1.58575 1.58075 1.59575 57 2012.02.27 00:00 close 11 1.00 1.58912 1.58075 1.59575 336.60 14416.10 58 2012.03.02 20:00 sell 12 1.00 1.58473 0.00000 0.00000 59 2012.03.02 20:00 modify 12 1.00 1.58473 1.58973 1.57473 60 2012.03.05 00:00 close 12 1.00 1.58353 1.58973 1.57473 116.30 14532.40 61 2012.03.05 00:00 sell 13 1.00 1.58327 0.00000 0.00000 62 2012.03.05 00:00 modify 13 1.00 1.58327 1.58827 1.57327 63 2012.03.06 01:38 s/l 13 1.00 1.58827 1.58827 1.57327 -503.70 14028.70 64 2012.03.09 00:00 buy 14 1.00 1.58300 0.00000 0.00000 65 2012.03.09 00:00 modify 14 1.00 1.58300 1.57800 1.59300 66 2012.03.09 10:31 s/l 14 1.00 1.57800 1.57800 1.59300 -500.00 13528.70 67 2012.03.09 20:00 sell 15 1.00 1.56678 0.00000 0.00000 68 2012.03.09 20:00 modify 15 1.00 1.56678 1.57178 1.55678 69 2012.03.12 00:00 close 15 1.00 1.56687 1.57178 1.55678 -12.70 13516.00 70 2012.03.12 00:00 sell 16 1.00 1.56664 0.00000 0.00000 71 2012.03.12 00:00 modify 16 1.00 1.56664 1.57164 1.55664 72 2012.03.12 12:03 modify 16 1.00 1.56664 1.56664 1.55664 73 2012.03.13 10:16 s/l 16 1.00 1.56664 1.56664 1.55664 -3.70 13512.30 74 2012.03.15 20:00 buy 17 1.00 1.57237 0.00000 0.00000 75 2012.03.15 20:00 modify 17 1.00 1.57237 1.56737 1.58237 76 2012.03.16 13:32 modify 17 1.00 1.57237 1.57237 1.58237 77 2012.03.16 13:47 modify 17 1.00 1.57237 1.57337 1.58237 78 2012.03.16 13:53 modify 17 1.00 1.57237 1.57437 1.58237 79 2012.03.16 14:03 modify 17 1.00 1.57237 1.57537 1.58237 80 2012.03.16 14:36 t/p 17 1.00 1.58237 1.57537 1.58237 999.60 14511.90 81 2012.03.22 12:00 sell 18 1.00 1.57997 0.00000 0.00000 82 2012.03.22 12:00 modify 18 1.00 1.57997 1.58497 1.56997 83 2012.03.23 08:23 s/l 18 1.00 1.58497 1.58497 1.56997 -503.70 14008.20 84 2012.03.29 00:00 sell 19 1.00 1.58878 0.00000 0.00000 85 2012.03.29 00:00 modify 19 1.00 1.58878 1.59378 1.57878 86 2012.03.29 21:11 s/l 19 1.00 1.59378 1.59378 1.57878 -500.00 13508.20 87 2012.03.30 08:00 buy 20 1.00 1.59848 0.00000 0.00000 88 2012.03.30 08:00 modify 20 1.00 1.59848 1.59348 1.60848 89 2012.03.30 13:48 modify 20 1.00 1.59848 1.59848 1.60848 90 2012.03.30 15:57 s/l 20 1.00 1.59848 1.59848 1.60848 0.00 13508.20 91 2012.04.04 00:00 sell 21 1.00 1.59119 0.00000 0.00000 92 2012.04.04 00:00 modify 21 1.00 1.59119 1.59619 1.58119 93 2012.04.04 12:43 modify 21 1.00 1.59119 1.59119 1.58119 94 2012.04.04 15:58 modify 21 1.00 1.59119 1.59019 1.58119 95 2012.04.05 02:47 s/l 21 1.00 1.59019 1.59019 1.58119 88.90 13597.10 96 2012.04.11 00:00 sell 22 1.00 1.58622 0.00000 0.00000 97 2012.04.11 00:00 modify 22 1.00 1.58622 1.59122 1.57622 98 2012.04.11 09:56 s/l 22 1.00 1.59122 1.59122 1.57622 -500.00 13097.10 99 2012.04.11 16:00 buy 23 1.00 1.59141 0.00000 0.00000 100 2012.04.11 16:00 modify 23 1.00 1.59141 1.58641 1.60141 101 2012.04.12 13:40 modify 23 1.00 1.59141 1.59141 1.60141 102 2012.04.13 11:47 s/l 23 1.00 1.59141 1.59141 1.60141 -1.60 13095.50 103 2012.04.16 00:00 sell 24 1.00 1.58477 0.00000 0.00000 104 2012.04.16 00:00 modify 24 1.00 1.58477 1.58977 1.57477 105 2012.04.16 20:47 s/l 24 1.00 1.58977 1.58977 1.57477 -500.00 12595.50 106 2012.04.17 12:00 buy 25 1.00 1.59580 0.00000 0.00000 107 2012.04.17 12:00 modify 25 1.00 1.59580 1.59080 1.60580 108 2012.04.18 10:02 s/l 25 1.00 1.59080 1.59080 1.60580 -500.40 12095.10 109 2012.05.02 00:00 sell 26 1.00 1.62190 0.00000 0.00000 110 2012.05.02 00:00 modify 26 1.00 1.62190 1.62690 1.61190 111 2012.05.02 15:42 modify 26 1.00 1.62190 1.62190 1.61190 112 2012.05.04 17:48 modify 26 1.00 1.62190 1.62090 1.61190 113 2012.05.04 23:00 close 26 1.00 1.61524 1.62090 1.61190 651.20 12746.30 114 2012.05.08 12:00 sell 27 1.00 1.61336 0.00000 0.00000 115 2012.05.08 12:00 modify 27 1.00 1.61336 1.61836 1.60336 116 2012.05.09 15:20 modify 27 1.00 1.61336 1.61336 1.60336 117 2012.05.09 20:03 s/l 27 1.00 1.61336 1.61336 1.60336 -3.70 12742.60 118 2012.05.11 08:00 sell 28 1.00 1.61197 0.00000 0.00000 119 2012.05.11 08:00 modify 28 1.00 1.61197 1.61697 1.60197 120 2012.05.11 15:45 modify 28 1.00 1.61197 1.61197 1.60197 121 2012.05.11 23:00 close 28 1.00 1.60759 1.61197 1.60197 438.00 13180.60

Author:

I designed the EA but I had help in writing the code by onestep they were excellent.

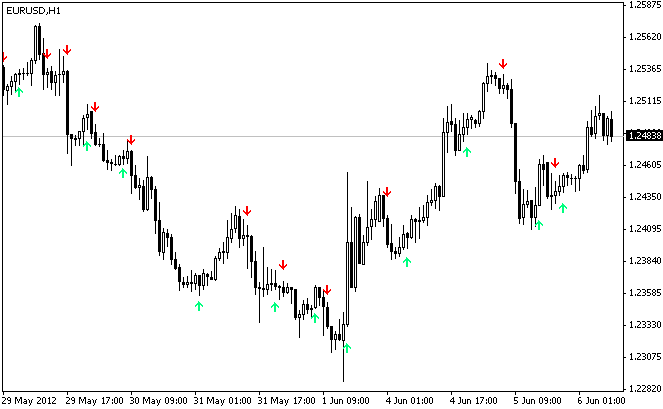

The first indicator to use is called LWMA CROSSOVER SIGNAL

It basically plots 2 points on the chart were there,s a cross over of the faster and slower LW-moving averages. The first is an ARROW pointing downwards and is coloured red, which obviously shows a downward trend and is the first signal of three I would like to pick up to indicate a possible SHORT TRADE .

The second point is an arrow pointing upwards and is coloured springreen and is the first signal of three I would like to pick up to indicate the possible LONG TRADE.

LWMA VARIABLES

The variables inputs to be able to change from the LWMA indicator when Im running my EA are:

- Faster lwma;

- Slower lwma.

Image:

LWMA CROSSOVER SIGNAL indicator

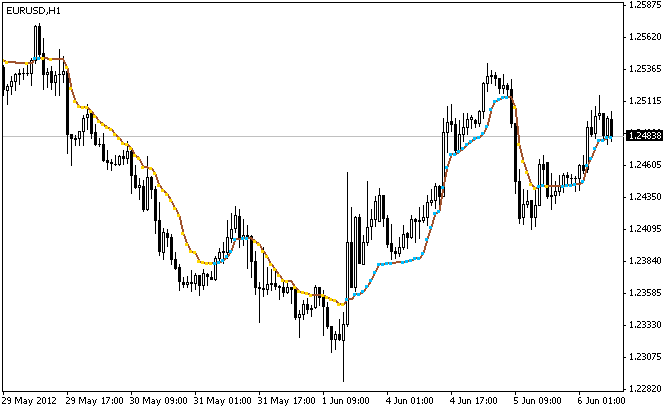

SECOND indicator is the AMA

This indicator draws a moving average line and when the line is trending upwards it plots BLUE DOTS directly on the line and when the line is trending downwards it plots GOLDDOTS on the line . It is these dots I to use for my second signals to go long or short .

Once the first signal of an RED arrow from the LWMA indicator appears in line with a candle indicating a downward trend the EA needs to look for the second indication of a GOLD DOT ONLY. Which appears on the AMA line on the SAME OR VERY NEXT CANDLE along from the first LWMA SIGNAL on the chart . Then we can move onto the last signal from the third indicator once these to signals have appeared indicating a possible SHORT TRADE

Again it will be the opposite if there is a SPRINGGREEN arrow appears from the LWMA indicator in line with a candle indicating an upward trend and if ONLY A BLUE DOT on the AMA trend line appears on the very SAME OR NEXT CANDLE ALONG from the first LWMA SIGNAL . Then we can move onto the last signal from the third indicator,indicating a possible LONG TRADE

AMA VARIABLE inputs to be able to change in my working EA are

- Periodama;

- nfast;

- Nslow;

- G;

- DK.

Image:

AMA indicator

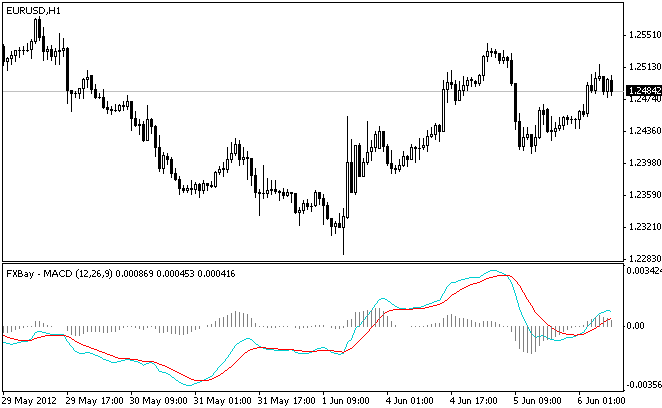

THIRD INDICATOR is the FXBAY-MACD

This indicator is a standard MACD indicator, its also got a historgram plotted for the difference of the two plotted lines

ITS the historgrams points THAT help with the third signal to take a long or short trade. And also I want to use the histogram signal to help exit a long or short trade.

Image:

- TAKING A LONG TRADE:

And the third signal to finaly open a LONG TRADE will be if I have the TWO signals from the LWMA and the AMA to go long(THE GREEN ARROW AND BLUE DOT) as they are giving me the trending upwards signals, as long as the HISSOGRAM from the MACD indicator on the candle where the AMA DOT signal is given is a POSITIVE NUMBER THEN TAKE THE TRADE

- EXITING A LONG TRADE:

to exit a LONG TRADE as soon as the HISTOGRAM on the MACD indicator hits 0.000 (zero) or LOWER THAN ZERO.(negative number)

- TAKING A SHORT TRADE:

Also if I have the TWO signals from the LWMA and the AMA to go SHORT(THE RED ARROW AND THE GOLD DOT) as they are telling me its trending downwards as long as the HISTOGRAM on the MACD INDICATOR where the AMA DOT signal is given is a NEGATIVE NUMBER, Be it on the first or second candle THEN TAKE THE SHORT TRADE

- EXITING A SHORT TRADE:

I want to exit the trade if the HISTOGRAM on the MACD indicator hits 0.00 (zero) or HIGHER THAN ZERO(positive number) .

MACD VARIABLES to change in my working EA are

- Fast EMA;

- SlowEMA;

- Signal EMA.

OTHER VARIABLES

STOP LOSS in PIPS the same for all trades,

RISK % of whats in the account.

TAKE PROFIT in pips on the EA.

ALSO WHEN TO OPEN THE TRADE on the next OPENED CANDLE or INSTANTLY AS SOON AS THE INDICATORS LINE UP

SOME GOOD VARIABLE TO TEST THE EA ON USING 15 MINUTE CHARTS:

LWMA:

- Fast lwma…………. 7

- Slow lwma………..30

AMA:

- Period ama…………9

- Nfast…………………..7

- Nslow…………………30

- G…………………..1.4

- DK………………….3.0

MACD:

- Fast ma…………..12

- Slow ma……………30

- Signal ………………9

times frames to use M5 up to H4.

Recommendations:

- any help or ideas will be greatly appriciated

- the actual ea is called snowies ea, there are also the three indicators called AMA,fx-bay_macd and lwma

HybridEA 1.0

HybridEA 1.0

Final version of my hybrid Expert Advisor.

Money Management Script

Money Management Script

Automatically does volume calculation based on percentage of desired account balance and enters instant or pending trades. Optional take profit is automatically at 1:1 with respect to SL.

VR---MARS-EN

VR---MARS-EN

Opening trades directly from charts;

Session Open H-Line

Session Open H-Line

Draws a Horizontal Line at Session Open: On the hour (09:00, 15:00 etc) or any minute past the hour (9:30, 18:47 etc).