FX Analysis

- Göstergeler

- Lee Teik Hong

- Sürüm: 1.0

- Etkinleştirmeler: 20

What is FX Analysis?

FX Analysis is a powerful MetaTrader 5 indicator that helps forex traders find the best trading opportunities. It combines four analysis tools in one easy-to-use interface:

-

Volatility Analyzer - Check single symbol’s volatility by hourly, daily

-

Currency Strength Meter - Shows which currencies are strong or weak

-

Oscillator Panel - Shows if markets are overbought or oversold

-

Top Picks – Shows if the symbol reached 60% - 80% range of volatility

Main Features

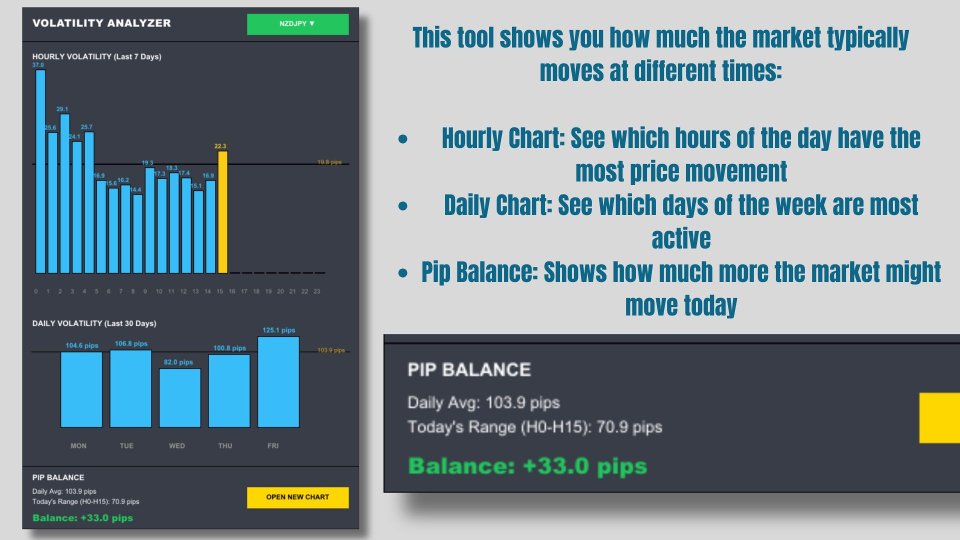

1. Volatility Analyzer

This tool shows you how much the market typically moves at different times:

-

Hourly Chart: See which hours of the day have the most price movement

-

Daily Chart: See which days of the week are most active

-

Pip Balance: Shows how much more the market might move today

For example, if the daily average is 100 pips and today it has only moved 60 pips, the balance shows +40 pips remaining. Trader can consider set TakePorfit level to 40pips.

2. Currency Strength Meter

This shows which currencies are currently strong or weak by analyzing 28 forex pairs:

-

Green bars = Strong currencies (good for buying)

-

Red bars = Weak currencies (good for selling)

-

Currencies are ranked from strongest to weakest

This helps you trade the strongest currency against the weakest one for better results.

3. Oscillator Panel

This panel monitors 5 technical indicators at once:

-

RSI (Relative Strength Index)

-

Stochastic Oscillator

-

Williams %R

-

Bollinger Bands

-

Keltner Channels

Each indicator votes whether the market is:

-

Oversold (good time to buy)

-

Neutral (wait for a better signal)

-

Overbought (good time to sell)

When 4 or 5 indicators agree, it gives you a strong trading signal.

4. Top Picks Panel

This automatically finds the best currency pairs to trade right now:

-

Shows pairs in the 60-80% volatility range (perfect trading zone)

-

Green buttons = Price is above today's opening (bullish)

-

Red buttons = Price is below today's opening (bearish)

-

Click any symbol to analyze it in detail

5. Open New Chart Feature

For symbols in Top Picks, you can click the gold "OPEN NEW CHART" button. This will:

-

Open a new chart window for that pair

-

Draw a green target line showing where price might go

-

Target is based on remaining volatility for the day

How to Use It

Trading Strategy

Step 1: Check the Top Picks panel

-

Look for symbols with 60-80% volatility percentage

Step 2: Click a symbol to see its details

-

Check if pip balance is positive (market has room to move)

-

Look at hourly chart to see if it's an active trading time

Step 3: Check Currency Strength Meter

-

For EURUSD, check if EUR is strong and USD is weak (or opposite)

-

Strong difference = better trading opportunity

Step 4: Check Oscillator Panel

-

If 4-5 indicators show OVERSOLD = consider buying

-

If 4-5 indicators show OVERBOUGHT = consider selling

-

If votes are mixed = wait for a clearer signal

Step 5: Click "OPEN NEW CHART" to see the price might go

Summary

FX Analysis makes trading easier by combining multiple analysis tools in one place. Instead of checking many indicators separately, you can see everything at once and make better trading decisions.

The indicator automatically finds good trading opportunities and shows you clear signals for when to buy or sell. It works best when you combine all three tools together - Volatility Analysis, Currency Strength, and Oscillators.