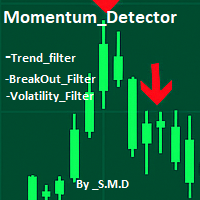

Momentum Detector

- Göstergeler

- Sibusiso Michael Duma

- Sürüm: 1.0

- Etkinleştirmeler: 5

Momentum_Detector is a powerful technical indicator designed to identify real-time momentum bursts in the market by combining volume pressure, bar expansion, and smart filter validation.

It detects when strong buyers or sellers enter the market and confirms those moves through multiple conditions such as trend direction, volatility expansion, and breakout structure.

This indicator helps traders spot true momentum shifts early — making it suitable for scalping, intraday trading, and swing trading.

The indicator evaluates each bar using two core momentum components:

-

Volume Surge Detection

-

Calculates the average tick volume over a defined period ( LengthVolume ).

-

Detects momentum when the current bar’s volume exceeds a multiple of this average ( VolumeMultiplier ).

-

-

Bar Expansion Analysis

-

Measures the average bar range (High–Low) over a given period ( LengthBarSize ).

-

Detects momentum when the current bar’s size exceeds the defined multiple ( BarSizeMultiplier ).

-

A momentum signal is confirmed when both the volume and bar size conditions are met.

-

Bullish Momentum → Up Arrow (green)

-

Bearish Momentum → Down Arrow (red)

-

Neutral Momentum → Yellow Dot

Before a signal is confirmed, the system optionally applies a series of filters to ensure market context alignment:

-

Trend Filter: Confirms signals only when aligned with the moving average direction.

-

Breakout Filter: Detects signals during price breaks of recent highs/lows.

-

Volatility Filter: Confirms that the current ATR value exceeds its recent average.

-

Level Concept Filter: Validates if signals occur around significant structural or support/resistance zones.

An information panel displays the latest detected signal, trend status, and relevant statistics for quick reference.

Features

-

Real-time detection of true market momentum

-

Combines volume and volatility to confirm strength

-

Multi-layer filters to reduce false signals

-

Works on all timeframes and symbols

-

Customizable visualization and parameters

-

Lightweight and optimized for minimal CPU load

Input Parameters

Momentum Settings

-

LengthVolume — Number of bars used to calculate average tick volume.

-

VolumeMultiplier — Multiplier threshold for confirming a volume surge (e.g., 1.5 = 150% above average).

-

LengthBarSize — Number of bars used to calculate average bar range (High–Low).

-

BarSizeMultiplier — Threshold multiplier for confirming bar expansion.

-

ShowUnfilteredMomentum — If true, displays all momentum bars even if filters fail (for study/analysis).

Filter Settings

-

UseTrendFilter — Enables or disables the trend filter.

-

UseBreakoutFilter — Enables or disables breakout confirmation.

-

UseVolatilityFilter — Enables or disables volatility-based confirmation.

-

UseLevelConceptFilter — Enables or disables structural or S/R validation.

-

LevelConcept — Mode selector: 0 = Market Structure, 1 = Support/Resistance.

Trend Filter

-

TrendMALength — Period for the moving average used in trend validation.

-

MAType — 0 = EMA, 1 = SMA.

-

RequireTrendAlignment — If true, accepts signals only in the direction of the trend.

-

MAColor — Color of the moving average line displayed on the chart.

Breakout Filter

-

BreakoutLookback — Number of bars to check for recent highs/lows.

-

BreakoutThreshold — Sensitivity for confirming breakouts (percentage of range).

Volatility Filter

-

ATRLength — Period used to calculate the Average True Range.

-

ATRMultiplier — Defines how much ATR must expand to confirm a volatility-based momentum.

Display Settings

-

ShowSignalTable — Displays the on-chart information panel.

-

TableTextSize — Font size of text in the info panel.

-

PanelBackground — Background color of the information panel.

-

PanelBorder — Border color of the panel.

-

TextColor — Text color for all display elements.

Visualization

-

Up Arrow — Bullish momentum bar (confirmed by filters)

-

Down Arrow — Bearish momentum bar (confirmed by filters)

-

Dot — Neutral momentum (indecisive but active candle)

-

Gray Line — Moving Average trend line

-

Panel — Displays signal data and trend status

Recommended Usage

-

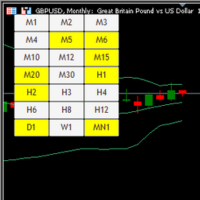

Works best on 15-minute to 4-hour charts for momentum detection.

-

Combine with Smart Money Concepts (SMC) or liquidity sweep strategies.

-

Use with Trend + Breakout filters for strong continuation signals.

-

Disable filters to view raw market impulses for scalping setups.

Notes

-

Compatible with any symbol and timeframe.

-

Does not repaint — all signals are confirmed on bar close.

-

Can be integrated into Expert Advisors for automated trading confirmation.

Summary

The Momentum_Detector is a comprehensive momentum recognition tool that merges price action, volume, and volatility into one clean visual framework.

It helps traders identify the true directional force behind each move and filter out market noise.

Whether used as a standalone confirmation tool or integrated into automated systems, it provides a reliable foundation for momentum-based trading.