Koryu Delta Indicator

- Göstergeler

- David Kitonga Mutua

- Sürüm: 1.0

Koryu Delta Koryu Delta is a MetaTrader 5 indicator. It identifies trend reversal points using pivot point analysis and delta volume data. It detects Market Shift patterns and shows signals based on market dynamics. This tool can be used by traders who scalp, swing trade, or invest long-term. It analyzes up to 500 historical bars to find past patterns. It uses closed-bar logic for signals.

Features of Koryu Delta

- Pattern Detection: It identifies bullish and bearish Market Shift patterns using pivot analysis.

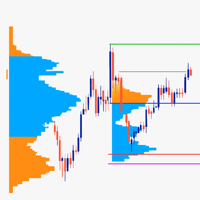

- Delta Volume Analysis: It uses tick volume and candle structure to show buying and selling pressure. The delta display can be adjusted. It calculates delta by examining body size, wick ratios, and tick volume for each candle in the pattern range.

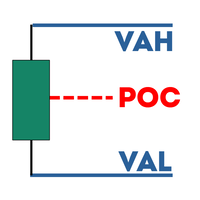

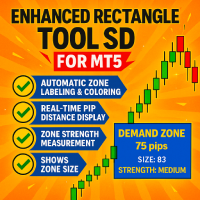

- Support Level Plotting: It draws support levels for detected patterns, including entry, stop-loss (SL), and three take-profit (TP) levels. Risk-reward ratios can be set for each. Offsets for entry and stop-loss can be adjusted in points.

- Visual Elements: It marks patterns with triangles, support levels, and labels. It uses circles and lines to highlight pivot points and pattern boundaries.

- Signal Options: Users can choose to show bullish signals, bearish signals, or both.

- Alerts: It sends push notifications and pop-up alerts for new patterns, with details on entry, stop-loss, take-profit levels, and delta volume. Notifications include symbol, timeframe, direction, and trade levels.

- Dashboard: A dashboard shows updates on patterns, signal types, and support levels. It displays the number of patterns, latest signal type, entry, stop-loss, take-profit levels, and delta volume.

- Non-Repainting Signals: Signals are based on closed bars.

Other Options

- Customization: Users can change pattern length, pattern count, delta volume visibility, and font sizes. Delta font size options include tiny, small, normal, large, or huge.

- Trade Management: It extends support levels and removes invalid patterns. It checks if patterns are invalidated by price crossing the support level.

- Visual Customization: Colors for patterns, delta volume, and support levels can be changed. Default colors include lime for bullish, red for bearish, white for delta, red for stop-loss, and aqua for entry.

- Historical Review: It checks up to 500 past bars for Market Shift patterns.

- Validation: It removes invalid zones.

How Koryu Delta Works Koryu Delta finds Market Shift patterns by identifying pivot points and checking them with delta volume. For bullish patterns, it looks for a new high above a prior pivot high, then a pullback to a low, to set a support level. For bearish patterns, it looks for a new low below a prior pivot low, then a pullback to a high, to set a support level. Patterns are marked with triangles and support indicators. Delta volume can be shown. Trade levels use user-set offsets and risk-reward ratios. Notifications are sent in real time. It scans historical data on initialization. It updates visuals and checks for invalidations on each new bar. It limits the number of patterns to the user-set amount.

Users of Koryu Delta This indicator is for traders who:

- Want trend reversal signals with entry and exit points.

- Want volume insights.

- Want a customizable chart.

- Want real-time alerts.

Differences from Other Indicators Koryu Delta combines price action, pivot points, and delta volume. It has non-repainting signals, support level management, and an interface. It works on forex, stocks, commodities, and indices.

Created by YASUKEEY