MAM Forecast Indicator

- Индикаторы

- Matei-Alexandru Mihai

- Версия: 1.0

- Активации: 5

Philosophy — “Trade with probabilities, not guesses.”

Price doesn’t move in straight lines—it tests, touches, and reverts. Most traders eyeball levels and hope. MAM Forecast replaces hope with numbers: two adaptive levels (UP/DN) and their touch probabilities that always sum to 100%. You instantly see which side has the statistical edge for your chosen horizon, so you can lean into high-probability touch or stand down when odds are thin.

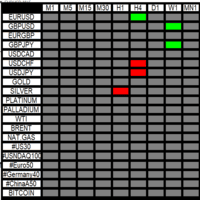

This isn’t a black box. The HUD explains, in plain sight, where the nearest adaptive UP/DN levels sit and the estimated chance price will touch them within H bars. Because levels scale with timeframe and can read Bid/Ask/Mid/Last, the tool becomes a natural companion to any strategy:

-

Scalpers can fade or follow tests with precise context.

-

Swing traders get a clean bias read and probabilistic targets.

-

Grid/mean-reversion systems can place steps where touch odds actually justify them.

It’s simple: let probabilities do the heavy lifting—so your entries, exits, and holds stop being guesses and start being informed decisions.

Technicals — What it shows and how it computes

What MAM Forecast displays

-

Two adaptive levels:

-

UP level above price and DN level below price, both scaled to your instrument and timeframe.

-

-

Touch probabilities (100% total):

-

Estimated probability price will touch UP vs touch DN within the next H bars.

-

-

Bias & live HUD:

-

Clean HUD with symbol, timeframe, chosen price source (Bid/Ask/Mid/Last), spread, BIAS (UPTREND / DOWNTREND / CONSOLIDATION), and the exact distances to each level (in pips).

-

-

Timeframe-aware rendering:

-

Each timeframe gets its own objects/prefix so multiple charts/TFs remain uncluttered and independent.

-

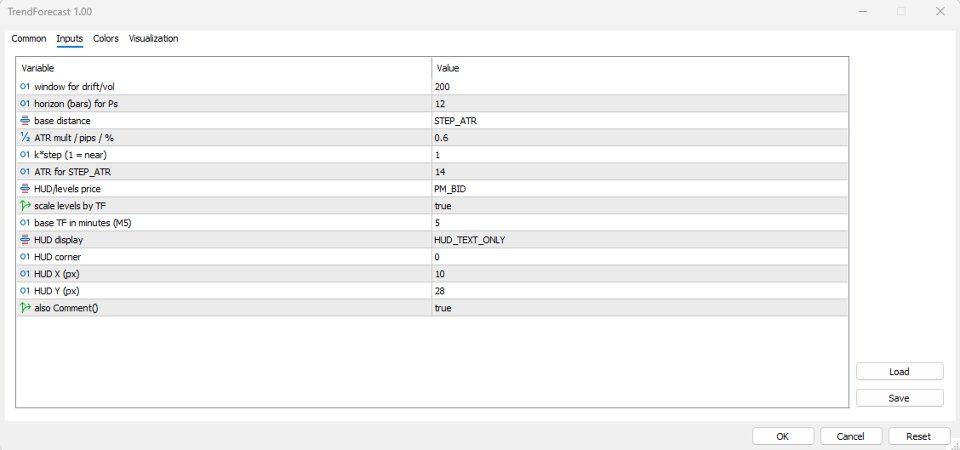

Inputs that matter

-

Distance model: STEP_MODE = ATR / PIPS / PCT with StepValue and a scale factor k (near/far).

-

Horizon: InpHorizon (bars) controls the look-ahead window used in probability calculations.

-

Price source: PM_BID / PM_ASK / PM_MID / PM_LAST / CLOSE0 makes the indicator tick-aware and robust across brokers.

-

TF scaling: Optional linear scaling vs M5 so higher TFs get appropriately wider levels.

-

HUD mode: Text-only, semi-transparent boxed panel, or terminal Comment() fallback.

How probabilities are estimated (intuition)

-

Volatility & drift: The indicator measures recent return volatility and average drift over Lookback bars.

-

Level distances: It computes the UP/DN distances using ATR/pips/% (plus spread-aware guards) and scales them by timeframe if enabled.

-

H-bar reach model: Using a normal-style approximation, it evaluates how likely price is to reach each distance within H bars.

-

Normalization: Raw UP/DN odds are normalized to 100%, giving you a clean, comparative read: if UP = 62%, then DN = 38%—period.

Bias signal (context, not a trigger)

-

A lightweight BIAS label derived from SMA(50/200) alignment or drift sign when history is short:

-

UPTREND when price > SMA50 > SMA200

-

DOWNTREND when price < SMA50 < SMA200

-

CONSOLIDATION otherwise

Use it to frame decisions (e.g., favor touches in trend direction).

-

Designed to help any strategy

-

Trend-following: Favor touches with the bias; scale in around the side with higher probability.

-

Mean-reversion: Fade stretched moves when the opposite touch becomes statistically compelling.

-

Breakout planning: When UP/DN odds tighten, expect tests; when one side dominates, plan around that path.

-

Risk placement: Set stops/TPs near adaptive levels where touch odds align with your plan.

Practical tips

-

Start with STEP_ATR and StepValue ≈ 0.5–0.8 for balanced sensitivity.

-

Tune Horizon to your rhythm (e.g., M5 scalping: 8–20; H1 swing: 8–12).

-

Keep TF scaling ON for multi-TF workflows—levels read naturally.

-

Treat probabilities as context, not certainties. Combine with your entry logic, money management, and filters.

Not financial advice. Use demo first and integrate MAM Forecast into a complete plan (risk, entries, exits). When you use probabilities in your favor, this indicator becomes a reliable ally—a steady read on where price is most likely to touch next.