MAM Forecast Indicator

- 지표

- Matei-Alexandru Mihai

- 버전: 1.0

Overview

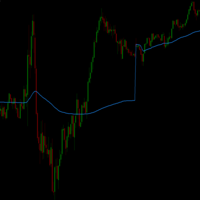

MAM Forecast is an indicator designed to replace guesswork with probabilities. It generates two adaptive levels—UP and DN—along with probabilities that always sum to 100%, giving you a clear idea of which level price is more likely to reach within the chosen horizon.

Key Features

-

Displays UP (upper) and DN (lower) adaptive levels calibrated to market volatility.

-

Shows touch probabilities (e.g., 62% vs 38%) for likelihood within the defined horizon.

-

Clean, informative HUD indicates symbol, timeframe, bias, spread, and distances to levels.

-

Bias labeling (UPTREND, DOWNTREND, CONSOLIDATION) based on simple trend logic or drift.

-

Scalable across timeframes with independent rendering so multiple charts stay uncluttered.

-

Parameter control includes distance model type, step values, horizon length, price source, and HUD style.

-

Designed to support a variety of strategies: trend following, mean reversion, breakout planning, or risk placement based on level probabilities.

Usage Applications

-

Use as context for entries/exits—e.g., favour touching side with higher probability.

-

Optimise grid or mean reversion placements where touch odds justify them.

-

Interpret trend bias and divergence as decision context, not absolute signals.

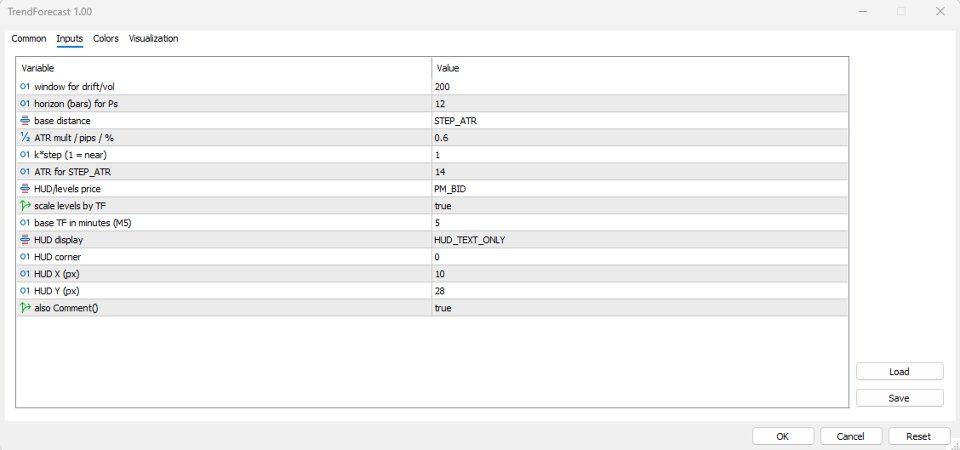

Input Parameters

-

Distance Model: Options include ATR, Pips, or Percentage with adjustable scale.

-

Horizon: bars look-ahead window to calculate probabilities.

-

Price Source & Scaling: Choose between Bid/Ask/Mid/Last; TF scaling adjusts level widths automatically.

-

HUD Display: Options for text-only, boxed panel, or fallback to terminal comments.

Practical Notes

-

Tweak StepValue (e.g., 0.5–0.8) for desired sensitivity.

-

Adjust Horizon according to timeframe—e.g., 8–20 for M5 scalping, 8–12 for H1 swings.

-

Use probabilities as guidance, not as guaranteed triggers.