DSS Candles AM

- 지표

- Andrii Matviievskyi

- 버전: 30.10

- 업데이트됨: 15 4월 2025

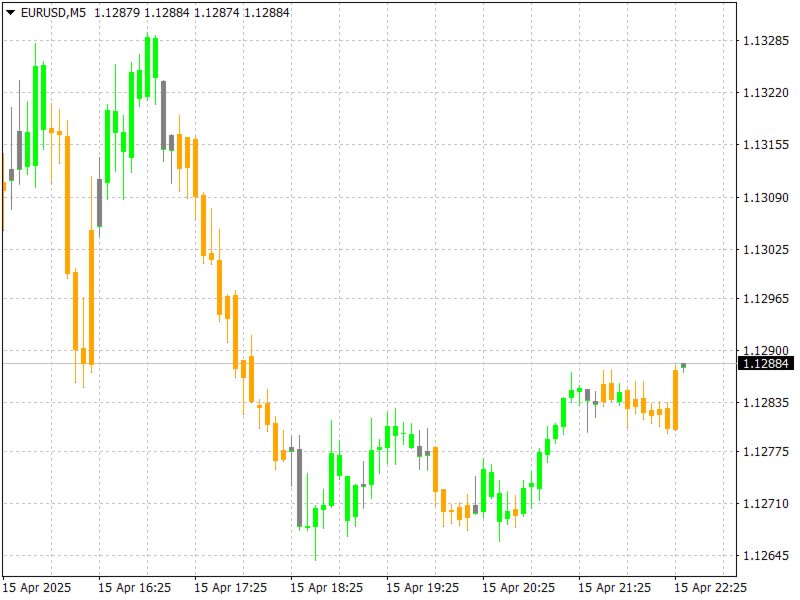

This indicator colors the price chart candles according to the data of the DSS Oscillator AM indicator.

DSS Oscillator AM is the author's implementation of the Double Smoothed Stochastic oscillator developed by William Blau and Walter Bressert.

The calculation of values is largely similar to the calculation of the classic stochastic oscillator.

The indicator takes into account the location of the current price relative to local highs/lows.

The signal about the change in the direction of price movement for the presented indicator is the change in the color of the last fully formed candle in relation to the previous candle.

The confirmation of the indicator's signal is the overcoming by the price of the high/low of the bar on which the signal was given by the indicator.

Rules for opening a position to buy an asset:

You should wait until the last candle on the price chart is complete.

If the following conditions are met, then we should talk about the appearance of a buy signal.

- The color of the last formed candle indicates an increase in the oscillator values;

- The color of the penultimate formed candle indicated a fall in the oscillator values;

- The long-term trend indicates an increase in the asset value.

Rules for opening a position to sell an asset:

You should wait until the last candle on the price chart is complete.

If the following conditions are met, then we should talk about the appearance of a sell signal.

- The color of the last formed candle indicates a fall in the oscillator values;

- The color of the penultimate formed candle indicated an increase in the oscillator values;

- The long-term trend indicates a fall in the asset value.

Settings:

- Price - the price at which the indicator is calculated;

- EMA_Period - smoothing period;

- Stochastic_Period - oscillator period;

- OB_Level - overbought level;

- OS_Level - oversold level;

Attention:

Please note that any market is constantly changing and there is no guarantee that methods that have been effective in the past will show the same results in the future.

To minimize potential losses, you should regularly optimize the product parameters, study the results of its work and withdraw part of the profit received.

It is recommended that before using the product on a real account, you test its work on a demo account in the same market and with the same broker where you plan to trade.

With respect and best wishes,

Andriy Matviyevs'kyy

P.S.

If you liked this product, I would be grateful for a fair assessment - positive user reviews motivate the author, and reasonable criticism allows us to make products better.

I suggest visiting my page where you will find many unique author's works that are the result of many years of studying exchange trading and FOREX trading.

Top