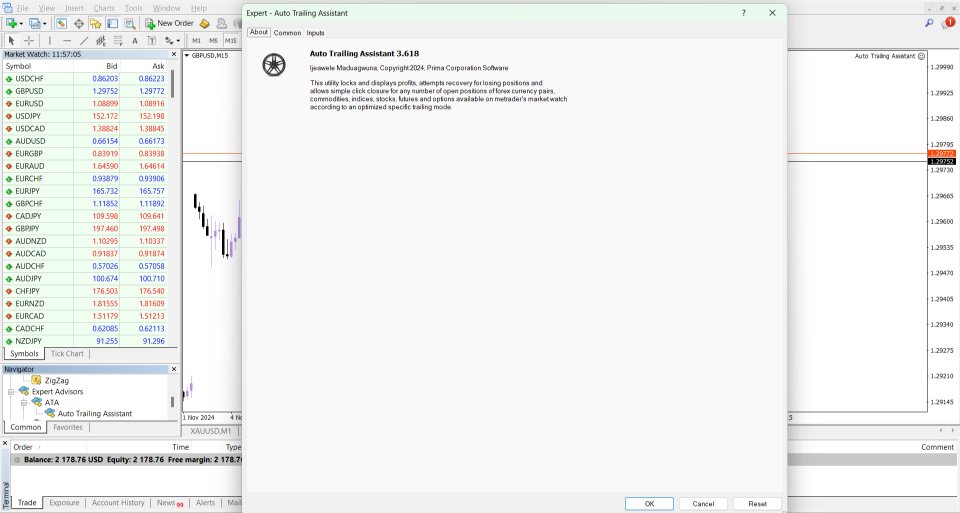

Auto Trailing Assistant

- 유틸리티

- Emmanuel Lovski Ijeawele Maduagwuna

- 버전: 3.620

- 업데이트됨: 26 1월 2026

- 활성화: 12

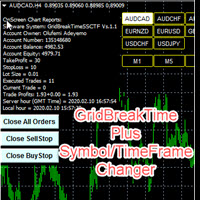

Auto Trailing Assistant (ATA) - Revolutionary Forex Trade Management Utility

?? Core Capability

Auto Trailing Assistant is a sophisticated Meta Trader utility that helps traders automatically manage and optimize trading positions with unparalleled precision and flexibility. With its comprehensive set of features, this powerful tool enables traders determine minimum guaranteed profits for each position, displayed very colorfully on the Chart of your Meta Trader.

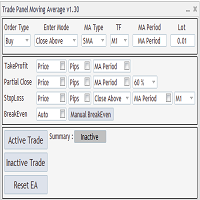

Flexible Position Targeting

- Multi-symbol support

- Filterable by magic number

- Selective position management

- Customizable order commentary tracking

- Consolidated Position Management with Weighted Averaging

Go beyond managing single orders. ATA now introduces advanced portfolio-level control, allowing you to group multiple positions on the same symbol into a single, unified position. The utility automatically calculates a Weighted Average Price based on the volume and price of each individual lot. This provides a clear, aggregate view of your market exposure and enables you to apply its powerful trailing stops and management rules to the entire consolidated position as one.?? Optimal For

- Active traders

- Portfolio managers

- Algorithmic trading enthusiasts

- Risk-conscious investors

?? Unique Technical Features

Precision Control

- Price unit selection (PIPs/POINTS)

- Granular trailing step increments

- Dynamic stop loss/take profit adjustments

?? Configuration Highlights

- Single-chart management for all trading pairs

- Advanced break-even features

- Sophisticated algorithmic trailing

Visual Management

- Interactive chart buttons for trade closure

- Customizable color-coded profit indicators

- Flexible chart information placement

Smart Recovery Mechanisms

- Trend prediction-based trailing

- Losing position management

- Maximum stop loss/take profit initialization

Advanced Trailing Modes

- **Six Intelligent Trailing Strategies**

- Percentage Locking Trailing (Recommended Default)

- Pip-Based Fixed Trailing

- Pip-Based Dynamic Trailing

- Break Even Trailing Stops

- Fibonacci Retracement Trailing

- Elliott Wave Series Trailing

? Key Benefits of the Weighted Averaging Feature:

-

Simplified Portfolio View: Manage complex accumulation or scaling strategies effortlessly. See one net position instead of multiple entries.

-

Unified Risk Management: Apply ATA's trailing stop, break-even, and recovery logic to the entire aggregated position based on its average cost. Protect your total capital at stake.

-

Strategic Flexibility: Ideal for averaging into a trend, managing grid strategies, or handling positions from different Expert Advisors (with the same Magic Number or Comment) as a single portfolio unit.

-

Precision Control: The weighted average is calculated dynamically based on the open price and lot size of each trade, ensuring your management levels are mathematically accurate.

ATA represents Auto Trailing Assistant in the instructions below.

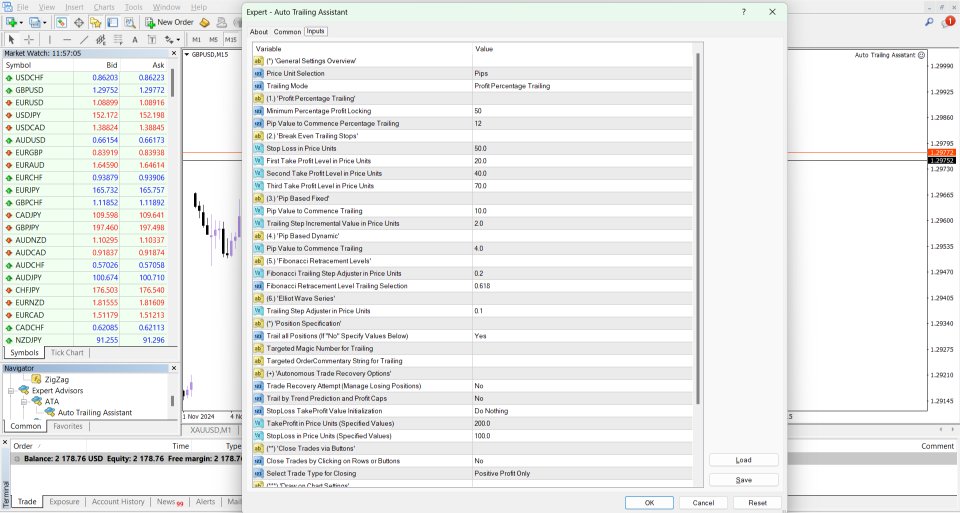

(*) General Settings Overview:

Trailing Mode: There are six trailing modes. The New Default Mode is set to Percentage Locking Trailing Mode, Mode One. This Mode is best for simple profit retention. In certain instances, the market direction reverses and a profitable trade becomes unprofitable. This Mode ensures a reasonable price gap is kept between the current market price and the locked profit price level, so that more profit can be accumulated if the trend is favorable, and so that the trade does not result in a loss, in case the trend reverses. Secondly, if the trend reverses significantly, a trader can initiate another position content with the reality that the last concluded position ended in profit.

Weighted Averaging /Single Position Selection: Select Weighted Averaging or Single Position Management.Weighted Average Position Management:

Aggregate Positions by Symbol: When enabled, ATA will automatically detect and group all open market positions for a selected symbol, calculating a single weighted average open price.

Calculation Basis: The average price is calculated as: S(Trade Open Price × Trade Volume) / Total Volume . This becomes the new baseline for all trailing stop and profit target calculations.

Compatibility: Works seamlessly with existing filters (Magic Number, Order Comment). You can choose to trail individual positions or the consolidated weighted position.

Visual Feedback: The chart display will show the combined profit/loss and the crucial weighted average price level for the aggregated position.

Single Position Management:

When enabled, ATA automatically manages all positions independently.

Auto Recommended/ Advanced Trader Selection: A User can decide to select optimal trailing settings for each mode or specific all the Pip values and Numerical constraints for each trailing mode if they have gone through the instruction video and want to control

Price Unit Selection: A User can select PIP or POINTs trailing options for handling positions (which ever you prefer). So that if you input 200 points for a EURUSD(x ...) position, it typically translates to 20 pips for the same amount of trailing distance that this Utility executes on that position.

The Pip Based Dynamic Mode is the same as the typical Meta Trader Trailing feature that is well known. Instead of right-clicking on EACH on-going trade to access the pull down menu feature, with the Trailing Stop option in points/pips, achieve this through the ATA effortlessly for all trades on your Meta Trader Terminal.

(1) Profit Percentage Trailing:

Minimum Percentage Profit Locking: This is the value a user sets for minimum retention of a profitable position.

Pip Value to Commence Percentage Trailing: This is the Pip or Point Value at which the Profit Trailing Algorithm Locks onto the Position. A very small value will ensure very tight Stop Levels.

(2) Pip Based Fixed:

Pip Value to Commence Trailing determines the pips difference that the market price must have against the initial/open price of an order, for trailing order modification to begin.

Trailing Step Incremental Value: Determines gaps in market price that must occur after trailing has begun for the ATA to incrementally improve an order's stoploss.

Specified Initial Stop Loss: this determines the pips distance from the order's initial/open price that the stop loss level must be adjusted to. This value must be greater than your Broker's Order freeze level in points. If the execution price lies within the range defined by the freeze level, the order cannot be modified, cancelled or closed.

Specified Initial Take Profit: this determines the pips distance from the order's initial/open price that the take profit level must be adjusted to. This value must be greater than your Broker's Order freeze level in points. If the execution price lies within the range defined by the freeze level, the order cannot be modified, cancelled or closed.

(3) Pip Based Dynamic:

Pip Value to Commence Trailing refers to the pips difference that the market price must have against the initial/open price of an order, for trailing order modification to begin.

Specified Dynamic Stop Loss: this determines the pips distance from the order's initial/open price that the stop loss level must be adjusted to. This value must be greater than your Broker's Order freeze level in points. If the execution price lies within the range defined by the freeze level, the order cannot be modified, cancelled or closed.

Specified Dynamic Take Profit: this determines the pips distance from the order's initial/open price that the take profit level must be adjusted to. This value must be greater than your Broker's Order freeze level in points. If the execution price lies within the range defined by the freeze level, the order cannot be modified, cancelled or closed.

(4) Break Even Trailing Stops:

Break Even: When set to true, activates the break-even trailing stop feature. Advanced Break Even Feature - achieves break even in terms of trade profit irrespective of commissions or swap charges involved.

Initial Stop Loss: This is the value at which the stop loss is set away from the initial/open price of the orders in the terminal

First Pips Level Gain, Second Pips Level Gain, Third Pips Level Gain: defines the amount of pips locked at previous price levels. For instance , when the market price moves to Take Profit One, the ATA adjusts the order's stop loss to breakeven. When the market price moves to Take Profit Two, the ATA adjusts the order's stop loss to Take Profit One. When the market price moves to Take Profit Three, the ATA adjusts the order's stop loss to Take Profit Two. And finally when the market price moves beyond Third Pips Level Gain, the ATA adjusts the order's stoploss to the final and last price level, that is Take Profit Three.

(5) Fibonacci Retracement Levels Trailing:

Fibonacci Trailing Step Adjuster: Determines gaps in market price that must occur after trailing has begun for the ATA to incrementally improve an order's stoploss.

Fibonacci Retracement Range: this determines the difference in Fibonacci price level ratios, that the order's initial/open price that the stop loss level and take profit level must be adjusted to.

(6) Elliot Wave Series Trailing:

Trailing Step Adjuster: Determines gaps in market price that must occur after trailing has begun for the ATA to incrementally improve an order's stoploss and take profit value in this mode.

The Elliot Wave Series is an intelligent price level adjusting mode that handles the well known back and forth market price movement as best as possible within its multi step complex algorithm.

(*) Position Specification :

Trail all Positions (If "No" Specify Values Below): This option enables users target positions opened by specific EAs identified by their magic numbers or

Targeted Magic Number for Trailing: Specify the magic number of the orders you wish to ONLY trail.

Targeted Order Commentary String for Trailing: Specify the order commentary attached to the orders you wish to ONLY trail.

(+) Autonomous Trade Recovery Options :

Trade Recovery Attempt (Manage Losing Positions): Determines whether trailing stops should be applied to losing positions. This mode is best used for managing losing positions and minimizing the losses incurred when a trade is taken against the market trend.

Trail by Trend Prediction and Profit Caps: Trail only when structural market movement changes for each position.

Initialize Max Stop Loss & Take Profit Values: Toggles off and on the initialization of maximum stop loss and take profit values.

(**) Close Trades via Buttons:

Close Trades by Clicking on Buttons (Column or Positions): This is a chart interactive feature that enables a user to terminate an order by clicking on the chart information specific to that order.

Select Trade Type for Closing: This determines the category of trades that a user can close via clicking on the chart interactive buttons. It includes three options, open positions, pending orders and all market active orders.

(***) Draw on Chart Settings:

Chart Corner for Displayed Trailing Statistics: Determines where the user prefers the displayed information to show on the chart.

Locked Profit Color Indicator: specify the color of the displayed order's chart statistic that depicts the value of the minimum order guaranteed profit.

Positive Profit Color Indicator: specify the color of the displayed order's chart statistic whenever the order gets profitable.

Negative Profit Color Indicator: specify the color of the displayed order's chart statistic whenever the order's profit value goes negative.

Pending Order Color Indicator: specify the color of the displayed order's chart statistic for pending orders.

Default Font Color: specify the color of the text used in the chart information display.

**Transform Your Trading Approach with Intelligent, Automated Trade Management**