Syntetic Structure

- 지표

- Danny Giovanni Romero Lozano

- 버전: 1.0

SynteticStructure MT5

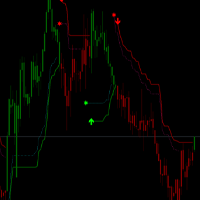

SynteticStructure is a high-performance technical indicator designed for real-time market structure identification. This advanced algorithm analyzes price action and pivot points to project dynamic Support & Resistance zones (Supply & Demand) directly onto your chart.

The indicator utilizes sophisticated swing validation logic to detect key HH/LL (Higher Highs / Lower Lows) levels. Unlike static indicators, SynteticStructure projects interest rectangles that automatically extend to the right as long as the level remains unmitigated, allowing traders to visualize the real-time validity of every price zone.

Core Features:

- Automated Structure Mapping: Instantly identifies significant pivot levels based on customizable side-bar confirmation (Left/Right bars).

- Dynamic Supply & Demand Zones: Projects colored rectangles with height automatically adjusted to market volatility using ATR (Average True Range).

- Break of Structure (BOS) Detection: The indicator visually identifies when a zone has been invalidated by price action, switching the object style to a dashed line and halting its extension.

- High-Efficiency Performance: Ultra-lightweight algorithm developed with massive data buffer management to ensure smooth performance even on extensive historical data.

- Zero Repainting: Zones are confirmed and fixed only upon candle closure, providing reliable historical data for accurate backtesting and analysis.

Input Parameters:

- InpHTF: Select the timeframe for structure analysis (e.g., M15, H1, H4).

- InpLeftBars / InpRightBars: Adjust the sensitivity for swing point confirmation.

- InpBullColor / InpBearColor: Full customization for Demand and Supply zone colors.

- InpBustedColor: Specific color assigned to zones that have already been mitigated or broken by price.

- InpDrawFill: Toggle rectangle filling for a cleaner or more highlighted visual experience.

Trading Strategy:

Perfect for Smart Money Concepts (SMC), Institutional Trading, or Trend Following strategies. For best results, it is recommended to use the indicator on a Higher Timeframe (HTF) to identify the dominant bias and seek high-precision entries on Lower Timeframes (LTF).