SessionsRangeZone

- 지표

- Vladimir Utkin

- 버전: 1.0

- 활성화: 5

🌍 General Overview: Global Exchange Trading from East to West

World financial markets operate on the principle of continuous trading sessions, where activity moves with the sun from one financial center to another. Understanding this dynamic is key to successful trading!

How Trading Moves Around the World:

Asian Session (Sydney, Tokyo):

-

Opens first, sets the tone for daily volatility

-

Japanese yen, Australian dollar, Asian indices

-

Often forms key support/resistance levels

European Session (London):

-

European financial center - high liquidity

-

Euro, British pound, European stocks

-

Overlap with Asian session creates increased activity

American Session (New York):

-

World's largest financial market

-

USD, Canadian dollar, American stocks

-

Overlap with European session - peak trading day

Why This Matters:

-

📈 Volatility: Session opening times are periods of increased activity

-

💰 Liquidity: Session overlaps increase trading volumes

-

🎯 Key Levels: First hours of sessions form important price levels

-

⚡ Trading Opportunities: Each session has characteristic patterns

⚙️ Installation and Indicator Settings

Simple Installation:

-

Download Market_Sessions_RZ.mq5 file

-

Move to MQL5/Indicators folder of your terminal

-

Restart MetaTrader 5

-

Find in navigator and drag to chart

Arsenal of Settings - Complete Control:

Session Settings:

InpStartSidney = 0 // Sydney session start (hour) InpEndSidney = 9 // Sydney session end InpColorSidney = clrOrange // Session color

Similarly for Tokyo, London and New York

Visual Settings:

-

InpWidth = 60 - Displayed session height

-

InpShowLabels = INPUT_YES - Show session names

-

InpShowRange = INPUT_YES - Show session ranges

-

InpShowVLines = INPUT_YES - Session start vertical lines

Range Zones Settings:

-

InpRZ_StartHour = 9 - Zone start hour

-

InpRZ_StartMinute = 0 - Zone start minute

-

InpRZ_EndHour = 10 - Zone end hour

-

InpRZ_ZoneColor = clrBlue - Zone fill color

-

InpRZ_FillZone = true - Zone filling

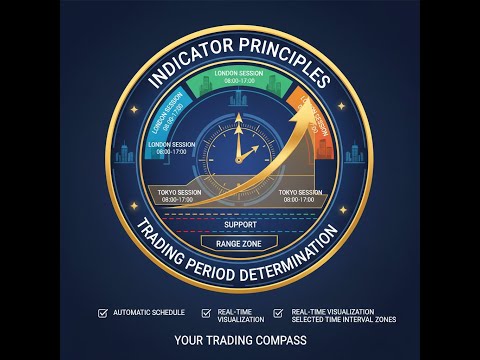

📊 Principles of Trading Period Determination

How the Indicator Defines Sessions:

Automatic Schedule:

-

Accounts for time zones of each financial center

-

Correctly handles sessions crossing midnight

-

Automatically adapts to weekends and holidays

Real-time Visualization:

-

Colored zones of active sessions

-

Labels with names and operating hours

-

Dynamic updates as market moves

Selected Time Interval Zones:

Range Zones - Your Trading Compass:

-

Show price range for selected period

-

Visualize key support/resistance levels

-

Help determine trend direction

Usage Advantages:

-

🎯 Accuracy: Real price levels instead of subjective lines

-

⏰ Time: Binding to specific trading periods

-

📊 Clarity: Clear chart visualization

-

🔄 Automation: Elimination of manual drawing

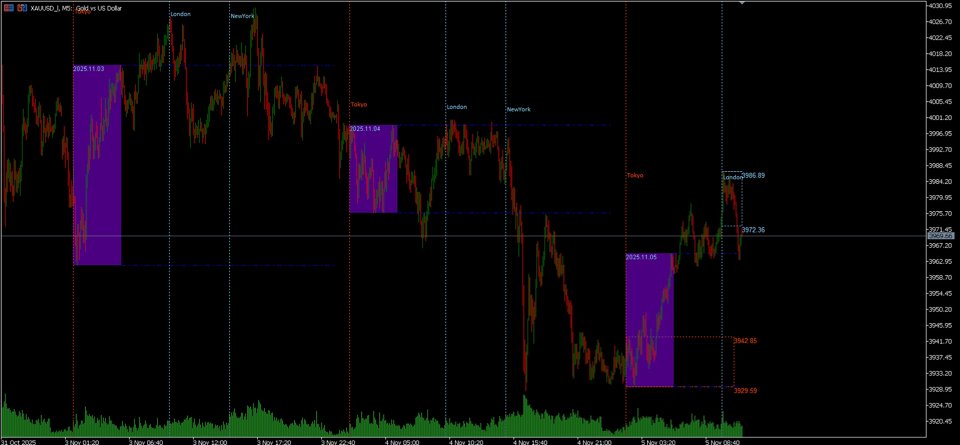

🎯 First Bar Zone: Heart of Trading Session

Drawing Rules and Timeframe Selection:

Key Setting:

InpSessionRangeTF = PERIOD_H1 // Timeframe for session's first bar

Working Principle:

The indicator identifies the first complete bar of session start on selected timeframe and builds price range from High to Low of this bar.

Why This Matters:

-

First session bar contains maximum information about market participants' intentions

-

Its range often becomes key level for entire trading day

-

Breaking this range signals bulls/bears strength

Trading Strategy Examples:

🏆 Strategy 1: "Session Breakout" (ICT Concept)

Timeframe: M15-H1

Rules:

-

Wait for London session first bar zone formation

-

On bounce from upper/lower boundary - enter in session direction

-

Stop-loss beyond opposite zone boundary

-

Take-profit at distance equal to zone width

Real Example:

EUR/USD, London session, first H1 bar with range 1.0850-1.0860. Bounce from 1.0850 and move to 1.0880 (target = 1.0850 + 30 pips).

🏆 Strategy 2: "Session Overlap" (Smart Money)

Timeframe: M5-M30

Rules:

-

Mark London and New York session overlap zones

-

Look for first bar zone breakout in general trend direction

-

Enter on volume and momentum confirmation

-

Use zone boundaries as dynamic levels

Real Example:

GBP/USD, session overlap 15:00-16:00 MSK. Upper boundary breakout of New York zone with volume increase - long entry.

🏆 Strategy 3: "Price Action Inside Zone"

Timeframe: M1-M15

Rules:

-

Define current session first bar zone

-

Trade from zone boundaries using Price Action patterns

-

Inside zone - scalping, zone breakout - trend trading

-

Combine with Fibonacci levels from zone

Real Example:

Gold, Asian session, zone 1815-1820. "Double bottom" pattern formation at lower boundary - long entry.

🏆 Strategy 4: "Multi-timeframe Analysis"

Timeframes: H1 + M15

Rules:

-

Identify key session zone on H1

-

Look for entries on M15 in breakout/bounce direction

-

Use multiple sessions for confirmation (e.g., London + New York)

-

Risk management based on zone width

🏆 Strategy 5: "Seasonal Arbitrage Opportunities"

Timeframe: H4-D1

Rules:

-

Analyze historical data for different session zones

-

Identify seasonal patterns (e.g., Asian flat + European trend)

-

Build strategy on statistical probability of movements

-

Hedge positions between correlated instruments

💎 Conclusions: Why This Indicator Will Change Your Trading

Trader Advantages:

-

✅ Time Saving: Automation of routine session analysis

-

✅ Improved Accuracy: Objective levels instead of subjective drawings

-

✅ Versatility: Suitable for any trading style and instruments

-

✅ Education: Deeper understanding of market structure and smart money behavior

Who This Indicator Is For:

-

📊 Beginner Traders: Quick understanding of market structure

-

🎯 Professionals: Precise entries and advanced strategies

-

⏰ Busy People: Saving hours of daily analysis

-

🔍 Analysts: Deep research of market patterns

Limited Offer:

The indicator is already included in the arsenal of successful traders worldwide. Join the community of professionals!

📞 For Contact and Purchase:

Telegram: @TrendHunterEA

Don't Miss the Opportunity to Turn Market Sessions into Your Source of Stable Income!

P.S. Remember: successful trading requires not only good tools but also discipline, risk management and continuous learning. Market Sessions RZ gives you the necessary advantage!