Dynamic Volatility Corridor

- 지표

- AL MOOSAWI ABDULLAH JAFFER BAQER

- 버전: 1.0

- 활성화: 5

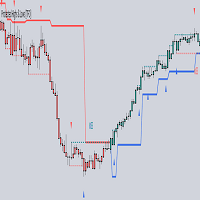

Dynamic Volatility Corridor: Your Ultimate Breakout and Trend Companion

Unlock the power of market volatility with the Dynamic Volatility Corridor, a sophisticated indicator designed to identify high-probability breakout opportunities with exceptional clarity. For just $30, this tool provides a powerful and intuitive way to visualize price action and capture significant market moves.

The Core Logic: How It Works

The Dynamic Volatility Corridor is not just another channel indicator. Its strength lies in its unique and adaptive logic that intelligently tracks price momentum.

The indicator constructs a three-line corridor around the price: an upper band, a lower band, and a central middle line. The magic happens in how the middle line is calculated on each new bar:

-

Bullish Breakout Detection: If the market shows strong upward momentum and the current bar's low price is completely above the previous bar's upper corridor line, the entire corridor immediately shifts upwards to follow the price. This signals a strong potential uptrend.

-

Bearish Breakout Detection: Conversely, if the market demonstrates strong downward pressure and the current bar's high is completely below the previous bar's lower corridor line, the corridor instantly adjusts downwards, indicating a potential new downtrend.

-

Consolidation Tracking: If the price remains within the previously established corridor, the corridor holds its position, clearly defining periods of market consolidation or ranging behavior.

This adaptive mechanism ensures the indicator is always in sync with the market's true volatility and momentum, filtering out minor fluctuations and focusing only on significant price shifts.

Clear and Unambiguous Trading Signals

The primary goal of the Dynamic Volatility Corridor is to provide clean, easy-to-interpret trading signals.

-

Buy Signal: A green "Buy" arrow appears when the price closes decisively above the upper corridor line, confirming a bullish breakout. This tells you that momentum is strong and a potential uptrend is beginning.

-

Sell Signal: A red "Sell" arrow is generated when the price closes firmly below the lower corridor line, signaling a bearish breakout and the start of a potential downtrend.

These signals are designed to be precise, appearing only when a genuine breakout condition is met, helping you enter trades with greater confidence.

Key Features

-

Adaptive Volatility Channel: The core engine of the indicator, providing a real-time view of market momentum.

-

High-Probability Breakout Signals: Clear buy and sell arrows pinpoint exact entry opportunities.

-

Signal Frequency Control: A built-in delay mechanism allows you to filter out noise by setting the minimum number of bars that must pass before a new signal can appear.

-

Full Customization: Easily adjust the corridor's width (sensitivity), the visual offset of signal arrows, and toggle additional trend lines to suit your trading style and chart preferences.

-

Clean Visual Interface: The indicator is designed to be visually clean and non-intrusive, making your charts easy to read.

Who is this for?

The Dynamic Volatility Corridor is a versatile tool suitable for:

-

Scalpers and Day Traders: Capitalize on short-term breakouts on lower timeframes.

-

Swing Traders: Identify major trend shifts and ride larger market waves on higher timeframes.

-

Beginners: The clear visual signals make it easy for new traders to identify potential trade setups.

-

Manual Traders: Use it as a standalone system or as a powerful confirmation tool for your existing strategy.

Input Parameters Explained

-

Corridor Range Step Ticks: Controls the width of the corridor. A smaller value makes the corridor tighter and more sensitive to price, while a larger value makes it wider and generates fewer signals.

-

Lot Size: A convenient input for manual traders to set their desired lot size.

-

Show Trend Lines: Toggles the visibility of two additional outer trend lines for enhanced visual analysis.

-

Enable Bars Between Signals: Activates or deactivates the signal filtering mechanism.

-

Bars to Wait Between Signals: Sets the minimum number of bars to wait before a new signal can be generated.

-

Arrow Offset from Price: Adjusts the distance of the buy/sell arrows from the price bar for better visibility.

-

Logging Settings: Advanced options for traders who wish to keep detailed logs of indicator activity for backtesting or analysis.

Elevate your trading and gain a competitive edge with the Dynamic Volatility Corridor. Add this powerful tool to your collection today!