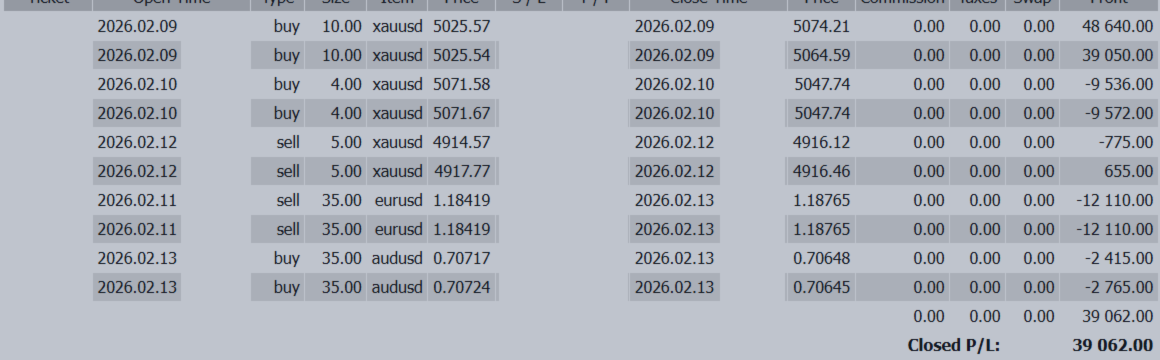

💰 +39,062 USD

🇯🇵 Japan CPI × 🇺🇸 U.S. PCE — Will USD/JPY Return to the 150s?

✅ Weekly Trade Review (Feb 9 – Feb 13)

📊 Weekly P/L: +39,062 USD

📉 Weekly Summary — GOLD Led, FX Played Support

This week had a very clear structure.

-

GOLD delivered both range and directional clarity.

-

The U.S. dollar faced mixed macro signals, failing to establish a clean trend.

As a result, performance was supported by focusing only on instruments that offered clean, tradable movement.

🟢 What Worked

✔ Concentrating on GOLD as the primary battlefield

✔ Avoiding overtrading in a volatile environment

✔ “Take only what the market gives” discipline worked effectively

⚠ Challenges

-

Dollar pairs lacked directional clarity

-

Even when analysis was correct, follow-through was limited

-

Forcing participation would have reduced expectancy

🎯 Core Strategy Remains

“GOLD + High-Precision FX” Focus Strategy

Going forward, selective use of yen-related pairs with clearer momentum is under consideration.

The base philosophy remains unchanged.

📌 Market Structure Breakdown (Feb 9–13)

① Yen Short Covering Was the Core Theme

After the Lower House election passed smoothly,

the market shifted from “uncertainty” to “stability.”

Previously accumulated yen short positions were unwound,

creating an environment where yen strength dominated through position adjustment, not fresh macro catalysts.

This was positioning-driven, not fundamentally driven yen strength.

② USD/JPY — Post-Spike Reversal Phase

The week began with upward movement,

but intervention warnings and rate-check speculation weighed on price.

However:

-

Support remains firm near recent lows

-

The structure is not a clean one-way breakdown

This is not a pure “sell dominance” market —

it is a market where oversold caution coexists with bearish bias.

③ Dollar Environment — Rate Cut Expectations Resurface

-

Retail sales softened

-

Employment data remained solid

-

CPI suggested moderating inflation

Mixed signals have revived rate cut expectations,

making it difficult for the dollar to sustain upside momentum.

Dollar rallies are increasingly capped.

④ EUR/USD — Rises Lack Sustainability

Occasional upside driven by China-related headlines,

but selling pressure tends to re-emerge.

This is currently a range-with-volatility environment rather than a stable trend.

🔮 Outlook for Next Week (Feb 16 Week)

A three-layer structure defines the coming week:

-

U.S.–Japan growth and inflation data

-

Possible official action (rate checks / intervention risk)

-

Political headlines (tariff rulings, key officials, policy signals)

Expect:

-

Data-driven moves

-

Headline-driven reversals

A classic “shakeout market.”

🎯 USD/JPY Focus

Key drivers:

-

Japan growth & CPI

-

U.S. GDP & PCE

-

Official tone and positioning

Conflicting catalysts on both sides mean

clean directional follow-through is unlikely.

The biggest risk:

Policy action abruptly reshaping technical structure.

🎯 EUR/USD Focus

Flash PMI will be key.

Euro factors and dollar factors may collide,

leading to expanded volatility.

🗓 Key Events

-

Japan GDP

-

UK CPI

-

Australia Employment

-

Japan CPI

-

Eurozone PMI

-

U.S. GDP & PCE

-

U.S. Supreme Court tariff ruling

-

FOMC Minutes

🧭 Bottom Line

Next week is not about picking direction in advance.

Volatility will likely lead.

Position imbalances may trigger sharp reversals.

Strategy:

✔ Narrow your battlefield

✔ Focus on instruments that actually extend

✔ Avoid forcing dollar pairs

This environment rewards precision of selection, not trend prediction.

📜 Afterword — Change Your “Posture,” Change the Market

Thank you for reading this week’s report.

Recent sleep science suggests that not only how long you sleep,

but how you position your body affects performance.

-

Side sleeping stabilizes breathing

-

Back sleeping may worsen apnea

-

Stomach sleeping strains the neck and spine

In other words:

Posture changes performance.

📊 In Trading, Posture > Position

We often focus on:

-

Which currency to trade

-

Where to enter

But the real edge lies in how we approach the market.

Bad posture (excess leverage) leads to pain.

Shallow breathing (emotional entries) clouds judgment.

🛌 Sideways Posture = Risk Release

Just as side sleeping helps breathing,

a “sideways posture” in trading means:

-

Don’t lean too heavily in one direction

-

Always leave an exit path

-

Maintain capital flexibility

That balance keeps you alive long-term.

⚖ Posture Doesn’t Change Overnight

Experts say changing sleep posture takes weeks.

Trading habits are the same.

You won’t transform in one session.

But you can decide:

“Tonight, I start with better posture.”

Small structural shifts create long-term change.

🌙 Final Thought

Good posture doesn’t create instant profits.

It reduces pain.

It stabilizes breathing.

It builds endurance.

Next week:

Before entering — pause.

Before reading the chart — check your posture.

Good positions, and good posture. 📈