📰 Risk Appetite Reignites and High Volatility Becomes the Norm — Will Stocks and a Weaker Yen Continue? USD/JPY Eyes th

📰 Risk Appetite Reignites and High Volatility Becomes the Norm — Will Stocks and a Weaker Yen Continue? USD/JPY Eyes the 156 Level

🧭 Market Overview

Risk appetite has resurfaced in the markets. The catalyst was the stronger-than-expected U.S. ISM Manufacturing PMI (January), which returned to expansion territory. U.S. equities rallied on the news, and the momentum spilled over into Tokyo and broader Asian markets.

-

The Nikkei 225 surged over +2,000 yen intraday, marking fresh session highs

-

South Korean equities jumped, led by semiconductor stocks

-

Yen weakness progressed, driven primarily by cross-yen buying

In particular, the hawkish stance from the Reserve Bank of Australia exceeded expectations, pushing AUD/JPY higher and leading gains across cross-yen pairs.

Meanwhile, USD/JPY is encountering some overhead resistance in the high-155s to just below 156. The dollar is under selling pressure against the euro and the Australian dollar, while intervention concerns linger in the background during episodes of rapid yen depreciation.

🌍 Commodities, Geopolitics, and Political Factors

Gold, silver, and crude oil — which had fallen sharply since last weekend — are beginning to stabilize.

-

Precious metals rebounded today

-

Crude oil remains capped on expectations of easing tensions involving Iran

On the Fed front:

-

Kevin Warsh has been reported as a leading candidate for the next Fed Chair

While his historically hawkish stance raises concerns, some market participants believe that two decades of time may mean a more nuanced policy approach today.

At the same time:

-

Ongoing remarks from President Donald Trump continue to symbolize market instability and heightened volatility

The U.S. continuing resolution has expired, and markets are awaiting passage of a funding bill in the House of Representatives.

🇯🇵 Japanese Politics and the Yen

Poll projections suggest the ruling coalition holds an advantage in the upcoming general election. However, the voting behavior of the social-media generation remains unpredictable and fluid.

If yen weakness accelerates too rapidly, the likelihood of verbal intervention from Japanese officials may increase.

🇬🇧 London FX Session — USD/JPY Tests the 156 Area

Dollar buying re-emerged during the London session.

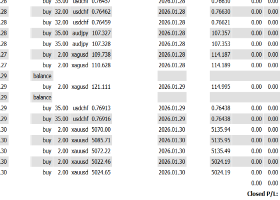

| Pair | Tokyo → Early London | After Full London Participation |

|---|---|---|

| USD/JPY | Softened from 155.60 → 155.31 | Rose to 155.99, 156 in sight |

| EUR/USD | Fell from 1.1825 → 1.1780 range | Dollar buying dominant |

| GBP/USD | Slid from 1.3706 → 1.3651 | Erased Tokyo gains |

| AUD/JPY | Mid-109s on RBA hawkish tone | |

| EUR/JPY | Climbed toward 183.90 | |

| GBP/JPY | Moved above 213 |

European equities opened firm on the back of U.S. stock gains, though the upward momentum showed signs of pausing.

🗓 Key Events Today

Economic Data

-

Turkey CPI / PPI (January)

-

France preliminary CPI, French fiscal balance

-

Hong Kong retail sales

-

Brazil industrial production

Speeches & Events

-

ECB Eurozone Bank Lending Survey

-

Richmond Fed President Barkin

-

Fed Vice Chair Bowman speech

Major U.S. Earnings

-

AMD

-

Merck

-

Pfizer

-

Take-Two Interactive

-

PepsiCo

🎯 Summary

The current market environment can be described as:

“A high-volatility market that reacts to every headline”

-

U.S. economic data → equity rally → yen weakness led by cross-yen pairs

-

The dollar tends to weaken against European currencies, yet remains resilient against the yen

-

Political developments (U.S. and Japan) and Fed leadership speculation are amplifying volatility

-

The battle around the 156 level in USD/JPY is the near-term focal point

While the trend of rising equities and a weaker yen continues, the constant presence of intervention risks, political uncertainty, and Fed leadership developments creates an environment defined less by clear trends and more by endurance and tactical positioning.