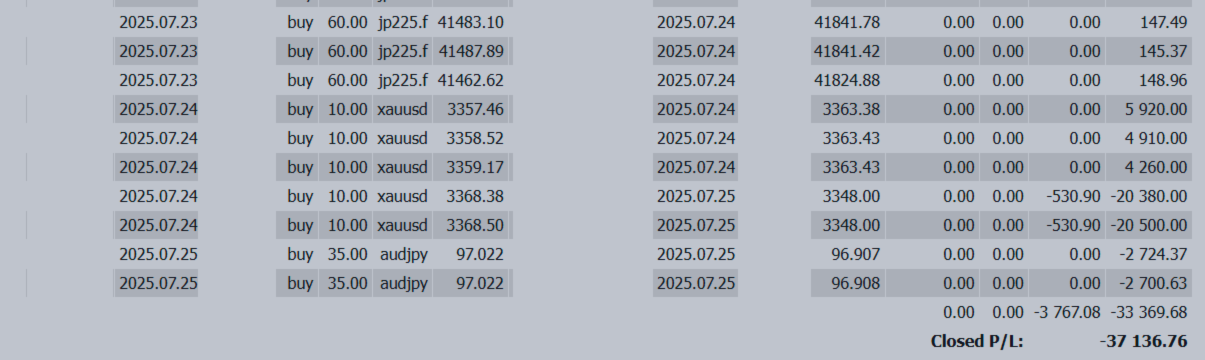

Weekly Report: -$37,136 Loss | Gold’s Turbulence Hurts, Big Events Ahead Next Week!

Weekly Report: -$37,136 Loss | Gold’s Turbulence Hurts, Big Events Ahead Next Week!

Period: July 21–25, 2025

✅ This Week’s Performance Review

- Net Result: -37,136 USD

- Main Cause:

Gains from EUR trades were wiped out by a sharp downturn in XAU/USD (Gold), which delivered heavy losses.

The “secure profit” scenario collapsed, highlighting the ever-present unpredictable volatility risk.

✅ Market Summary (July 21–26)

- USD/JPY:

Yen strengthened to 145.86 after Japan’s Upper House election, then rebounded toward 147 later in the week. - EUR/USD:

Supported by optimism around US-EU trade talks and ECB’s pause on rate cuts, the euro climbed to 1.1789 at one point. - GBP/JPY:

Dropped from mid-199 to mid-197 before recovering to 198. - CAD/JPY:

Slid from low 108s to low 107s, then edged back toward 107.80+. - AUD/JPY:

Broke through 0.66 vs USD, hitting YTD highs and holding firm in the ¥96 range. - ZAR/JPY:

Range-bound near 8.3, still firm vs USD.

✅ Key Drivers for Next Week (July 28–Aug 1)

Markets brace for high volatility as multiple top-tier events converge:

- FOMC Meeting (July 29–30) → Expected hold, but Powell’s tone could tilt sentiment.

- BOJ Meeting (July 30–31) → Hold likely, but any hawkish signal in outlook report or Ueda’s remarks could spark yen moves.

- US Data Avalanche:

JOLTS, ADP, GDP (Advance), PCE, ISM, NFP → Huge potential for sharp price swings.

USD/JPY Outlook

- Key risk from Japan political uncertainty vs Fed tone.

- Range-watch: 146.80–148.80, spikes possible post-events.

EUR/USD

- ECB paused cuts last week; Lagarde signals “wait-and-see.”

- Potential retest of 1.18 if USD softens on data.

GBP/JPY

- BOE fully priced for 25bp cut on Aug 7; Bailey remains dovish → upside capped.

CAD/JPY

- July 30: BOC meeting, statement tone critical.

- July 31: GDP, watch for surprises.

- US-Canada trade friction remains a wildcard.

AUD/JPY

- Focus on July 30 CPI (Q2).

- Weak print locks in August RBA cut → bearish AUD scenario.

✅ Strategy Summary for Next Week

- USD/JPY: Prepare for violent swings → tight stop-loss discipline.

- EUR/USD: Data-driven; upside bias if US data disappoints.

- GBP/JPY: BOE dovishness caps gains; fade rallies.

- CAD/JPY: Monitor GDP & trade rhetoric for directional cues.

- AUD/JPY: CPI + RBA bets + BOJ tone = triple risk factor.

📝 Afterword: “The Market & the Mind Both Need Darkness”

Thanks for reading this week’s report.

Recently, I came across research on hair, skin, and nail health, stressing simple fundamentals:

- Balanced diet

- Quality sleep

- Regular care

This made me think about trading. No flashy tricks or extreme leverage—foundation matters most:

- Follow your rules

- Practice strict money management

- Take breaks when needed

But there’s another insight:

A 2024 study found people with a strong “Night Sky Connectedness Index (NSCI)” score reported higher happiness and well-being. Stargazing or simply being under the night sky fosters awe, lowers stress, and improves overall health.

Trading immerses us in constant screens and artificial light. Sometimes, a moment in darkness—looking at the stars, walking under moonlight, or breathing by a campfire—can reset your mental state and sharpen decision-making.

There’s no magic shortcut to trading success, just as there’s no overnight beauty secret. Consistency builds resilience—for your portfolio and your mind.

So this weekend, try the “luxury of darkness.” Disconnect, find stillness, and let the stars remind you of perspective.

👉 Next week will be volatile—FOMC, BOJ, heavy data flow—but with calm and discipline, we’ll navigate it.

Wishing you a balanced, focused, and profitable week ahead. 🌙