+115,367 USD – Wins Both Short and Long ── Fully Aligned with the Gold Market

+115,367 USD – Wins Both Short and Long ── Fully Aligned with the Gold Market

🏆 Wins Both Short and Long ── Fully Aligned with the Gold Market

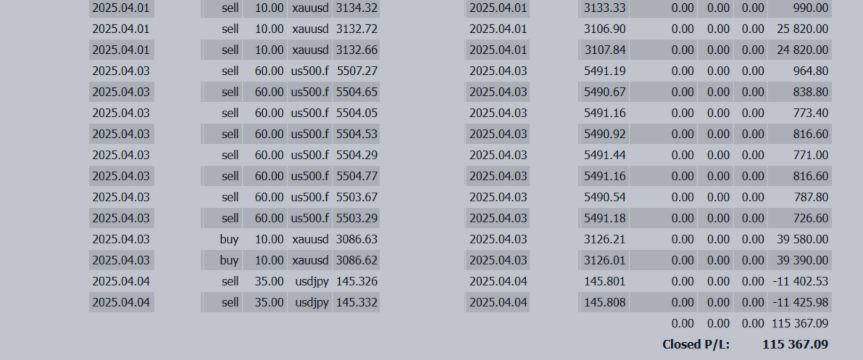

Weekly Trading Results (March 31 – April 4, 2025)

✅ Weekly Profit: +115,367 USD

📈 Strategy: “Flexible Trading” aligned with U.S. tariff risks and inflation themes led to wins across all currency pairs

💡 Gold surged sharply after a dip, making the long strategy a perfect hit. For USD/JPY, a dual approach of selling the highs and buying the dips proved successful.

🔮 Outlook & Key Events for the Week of April 7

This week, the focus is on U.S. CPI and tariff effects, with distinct themes emerging for each currency.

🇺🇸 USD/JPY

Outlook: Wide fluctuations expected due to inflation concerns and stagflation fears

📌 Key Events:

- Apr 9: FOMC Minutes – Focus on Trump tariffs' impact

- Apr 10: U.S. CPI – Forecast: +3.0% YoY (prev. +3.1%)

- Apr 11: U. of Michigan Inflation Expectations

- U.S. fiscal deficit vs. BoJ Governor’s remarks (Yen strength vs. Dollar strength tug-of-war)

📍 Strategic Point: - CPI upside surprise: Renewed USD buying

- CPI downside: Accelerated JPY buying

- Ideal to adopt both rebound selling and dip buying

🇪🇺 EUR/USD

Outlook: Upside limited due to retaliation tariff risks and ECB rate cut expectations

📌 Key Events:

- Eurozone Feb Retail Sales / German Industrial Production

- Apr 17: ECB Meeting – 6th consecutive rate cut possible

📍 Strategic Point: - Primarily a “sell on rebound” stance

- Caution on dovish ECB comments (could push EUR/USD below 1.07 again)

🇬🇧 GBP/JPY

Outlook: Prone to swings due to policy uncertainty and seasonal trends

📌 Key Events:

- UK Feb GDP / Industrial Production (impact on BoE stance)

- Tariff negotiations & UK's own avoidance strategies

- April seasonality (top avg. gain over past 15 years)

📍 Strategic Point: - Look to buy on sharp dips from weak data

- Prepare for strong rebounds based on BoE stance

🇨🇦 CAD/JPY

Outlook: Tariff spillover from U.S. pressures upside; concerns over domestic economy

📌 Key Events:

- Tariff pressure on steel & auto sectors

- PM Carney’s retaliatory policy tone

- “Buy Canadian” campaign heightening trade friction risk

📍 Strategic Point: - Favor selling on rebounds

- Watch WTI trends and Canadian employment data

🇦🇺 AUD/JPY

Outlook: Continued dovish RBA stance; U.S. tariffs act as headwinds

📌 Key Events:

- RBA statement (possible rate cut signal)

- CPI outlook (due late April)

- Rising concerns as Australia enters 10%+ tariff bracket

📍 Strategic Point: - Sell during rebounds

- Closely follow post–Qingming Festival data from China

🇿🇦 ZAR/JPY

Outlook: Continued downside expected from political turmoil and U.S. tariffs

📌 Key Events:

- U.S. reciprocal tariffs (30% on South African products)

- Coalition breakdown fears over VAT bill

- Weakened correlation with resource prices (platinum, gold)

📍 Strategic Point: - Stick with a “sell on rebound” strategy

- Clearly define exit points for yield-seeking long positions

✍️ Gold Outlook

Demand driven by both "safe haven" and "inflation hedge" factors continues. Use dips to strategically build long positions.

🧊 Afterword: Cold Showers Brought Me Clarity and Focus

The market was highly volatile this week. Amid such turbulence, I’ve adopted a special new routine: cold showers.

You might think, “No way I could handle a cold shower!” But this habit can be surprisingly powerful—especially for traders.

❄ How Cold Showers Benefit Mental & Physical State:

- Mental Reset & Enhanced Focus

→ The cold stimulates the brain, releasing endorphins, and enhances mental clarity. Your decision-making sharpens right from the start of the day. - Boosts Metabolism

→ The body tries to generate heat, activating “brown fat” which aids in metabolic processes and overall health. - Improves Circulation & Recovery

→ Especially helpful for those with muscle or joint fatigue—cold water promotes blood flow and faster recovery. - Supports Immunity

→ Cold showers stimulate white blood cell activity, potentially increasing resistance to colds and flu.

⚠ A Few Precautions

Cold showers aren’t for everyone. Please be cautious if you:

- Have compromised immunity

- Suffer from heart issues or blood pressure problems

- Are experiencing severe depression (always follow medical advice)

Rather than diving in all at once, try lowering the water temperature gradually at the end of your usual shower.

🚿 Sharper Focus in Trading Thanks to Cold Showers?

Personally, showering with cold water for 2–3 minutes in the morning makes me feel physically awake while keeping my mind calm.

This state has helped me stay composed during emotionally charged trading moments, such as right before big data releases or entries. It’s become a true weapon in my trading toolkit.

✨ In Closing

Last week’s market was filled with uncertainties—like the U.S. jobs report and growing geopolitical risks. In such times, I believe small routines that align your body and mind can create a performance edge in trading.

Why not start your mornings this week with a deep breath and a cold shower?