Amid yesterday's global stock market rally, driven by strong earnings from the US semiconductor giant Nvidia, IT-related

Amid yesterday's global stock market rally, driven by strong earnings from the US semiconductor giant Nvidia, IT-related stocks led the buying spree. The Nikkei hit a record high not seen in 34 years, while Chinese and European stocks surged, with Germany's DAX and France's CAC indices hitting consecutive record highs. In the US, the Dow Jones Industrial Average soared to new heights, crossing the 39,000 mark. For 24 hours, stock markets worldwide were thriving.

Amidst this, the forex market took a backseat. The dollar market lacked direction, fluctuating without a clear trend. However, comments from Waller, a Federal Reserve Board (FRB) governor, reported during the Japanese morning session today, are likely to cause ripples. Waller remarked on the strong US consumer price index in January, stating, "January CPI could either push up inflation or serve as a warning," adding that "at least another two months are needed to confirm inflation data," and that "delaying the start of rate cuts for a few months would not have a significant impact." While still assuming rate cuts later this year, he suggested no urgent need, prompting economists to reconsider their expectations for a rate cut in May.

The dollar index has been trending downwards since February, but it rebounded upon breaching the 200-day moving average yesterday, suggesting a potential reluctance to decline further.

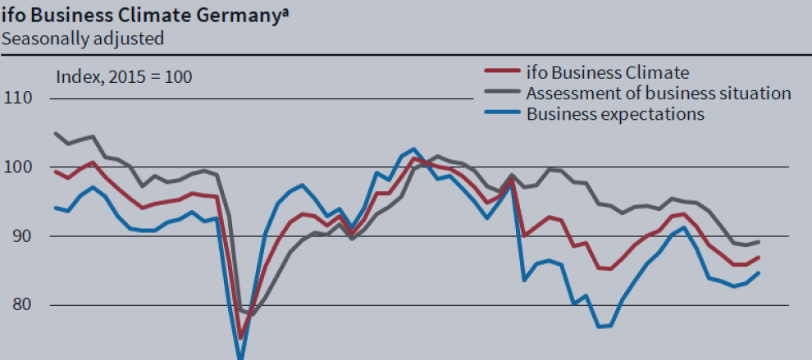

Today, economic indicators to be released in overseas markets include Germany's real GDP (final Q4 figures) and the German Ifo Business Climate Index (February), focusing on European-related data. Given the lack of major US economic indicators, the lingering effects of Waller's remarks should be considered.

In terms of speeches, several events are scheduled, including those from Green, a Bank of England Committee member, De Guindos, the Governor of the Bank of Spain, Schlegel, the Vice President of the Swiss National Bank, Schnabel, an ECB Board member, and Nagel, the President of the Bundesbank. Additionally, the ECB's consumer inflation expectations will be announced.

Firstly, it's important to monitor the euro's movement, followed by observing the extent of any potential dollar strength.

Today attention will be on the euro's movement after the release of the German Ifo Business Climate Index.