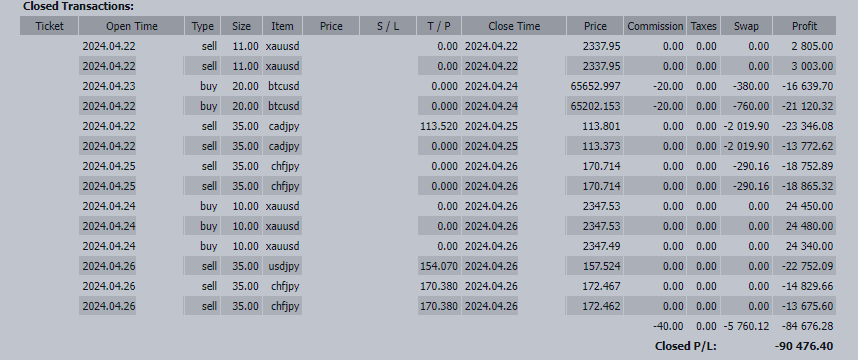

From April 22nd to April 26th, 2024, my trades resulted in a total loss of -$90,476.

Unexpectedly, USD/JPY rose to the 158 level. I persistently bought the Japanese yen, relying on potential intervention by the Bank of Japan (BoJ), but this strategy led to significant losses. There had been frequent verbal interventions from BoJ officials, so I had anticipated intervention around the 155 level, but this was a considerable miscalculation. The next threshold might be 160.

Even if the BoJ intervenes, the underlying causes of yen depreciation remain unresolved, and the yen is still targeted by speculators, suggesting that the yen weakening trend will continue. From here on, I plan to look for buying opportunities post-intervention rather than seeking selling points.

Key focuses for the future include:

- Temporary Drop to 158 Yen per Dollar, Weakest Yen in 34 Years Continues to Decline in NY Market On April 26th, in the New York foreign exchange market, the yen momentarily fell to the 158 per dollar range, marking approximately a 34-year low for the yen against the dollar. Following the BoJ's monetary policy meeting and comments from Governor Kazuo Ueda, the yen fell to the 156 range in the Tokyo market. With no currency intervention from the government and the BoJ, the yen continued to weaken significantly, dropping nearly 3 yen in a day.The BoJ maintained its current monetary policy on the 26th. Governor Ueda stated in a press conference that the yen's depreciation is "not currently having a significant impact on the underlying inflation rate." This statement, which anticipated continued easing monetary policy, furthered the yen's depreciation.

(Source: Bloomberg)

I had expected statements to curb the yen's depreciation, but instead, the remarks seemed to induce further weakening. Given the current stance in Japan, there seems to be no stopping the yen selling. Speculators might continue to target the yen.

If a dip occurs due to intervention, I plan to aggressively buy USD/JPY.

- Focus Shifts to the U.S. FOMC and Employment Data The dollar/yen is expected to remain high. With the BoJ's policy on hold, the focus has now shifted to the U.S., with upcoming events like the Federal Open Market Committee (FOMC) meeting and employment statistics. Depending on the outcomes, speculation may arise not just about delaying expected rate cuts but also about additional rate hikes.(Source: Reuters)

Pay attention to the statement. If it mentions further rate hikes, a strong buying spree for the dollar may occur again. The U.S. dollar is expected to remain strong.

P.S.

Last month, a startup called Hume AI, which develops artificial intelligence models to detect human emotions from voice, was in the news.

Given that voice input is four times faster than typing and voice carries twice as much information as text, the future of AI interfaces is expected to be voice-based. Hume AI has developed an AI model that can detect over 24 types of human emotions from voice and respond appropriately. For example, it can provide a sympathetic response to the statement, "My dog died."

Hume is using this API to help over a thousand companies and developers build applications that read emotions from human voices, launching an emotion-capturing conversational voice API, "Hume EVI."

The emergence of such companies will advance AI's ability to learn human emotions, which have always been a challenge.

In forex trading, too, big market movements are fundamentally driven by human emotions, so it's inevitable that such AIs will be increasingly utilized in trading. How well we can harness AI might become a defining factor in trading success.

I recommend keeping an eye on technological innovations in AI.

Have a great weekend!