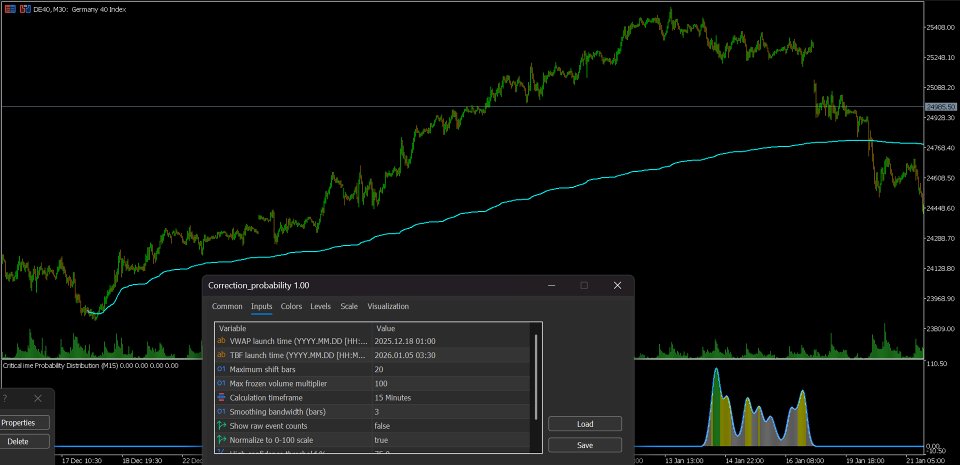

Statistical Correction Probability

- Indicatori

- Nurken Buralkiyev

- Versione: 1.4

- Attivazioni: 5

Statistical Correction Probability (KDE Reversal Timer)

Overview

Most reversal indicators fail because they attempt to predict a single, exact "turning point" in a noisy market. The Statistical Correction Probability indicator takes a different approach. Based on the legendary Paul Levine Top Bottom Finder (TBF) methodology, this tool utilizes a multi-parameter grid search and Gaussian Kernel Density Estimation (KDE) to identify high-probability zones for price corrections.

Instead of one discrete signal, it generates hundreds of potential exhaustion points and merges them into a continuous probability distribution. This allows you to see exactly where different market scenarios converge—providing a "heat map" for market exhaustion.

Core Innovation: From Discrete Events to Probability

Traditional TBF indicators are sensitive to "launching points" and intraday noise. This indicator solves that by:

-

Multi-Parameter Grid Search: Running hundreds of simulations across various shifts and volume multipliers.

-

KDE Smoothing: Applying a Gaussian Kernel (3σ radius) to transform raw data into a smooth, readable bell curve.

-

Statistical Confluence: The higher the peak, the more "agreement" there is between different mathematical scenarios that a correction is imminent.

Key Technical Features

-

5-Buffer Visual Architecture: Clearly see the probability curve and three distinct confidence zones (High, Medium, and Low).

-

Institutional-Grade Statistics: The indicator outputs the Mean Bar Position (central tendency) and Standard Deviation (timing certainty) directly to your terminal.

-

Dual Normalization Modes: * Percentage Mode: Scaled 0–100% for intuitive trend exhaustion reading.

-

Pure Probability: Mathematically pure distribution (sums to 1.0) for advanced quantitative analysis.

-

-

Noise Reduction: The Gaussian smoothing filters out "spurious" events, ensuring you only focus on significant clusters of exhaustion.

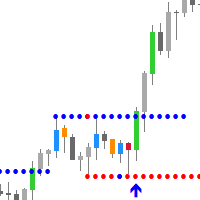

How to Trade with This Indicator

-

Peak Probability: When the blue line enters the Lime Green (High Confidence) zone, the market is at a critical statistical exhaustion point.

-

Timing Precision: A narrow, tall distribution indicates high timing precision. A wide, flat distribution suggests a broader "reversal zone" rather than a specific entry.

-

Risk Stratification: Use the confidence zones to scale your position sizes. High-confidence zones justify higher conviction.

Input Parameters

-

VWAP/TBF Launch Times: Set your anchor points for the calculation.

-

Max Shift & Volume Multiplier: Control the depth of the grid search.

-

Kernel Bandwidth: Adjust the smoothness of the probability curve.

-

Calculation Timeframe: Perform high-resolution analysis (e.g., M1) while viewing on a higher chart timeframe.

Why Choose This Tool?

Unlike standard oscillators (RSI, Stochastic) that simply measure speed, the Statistical Correction Probability indicator measures confluence. It answers the question: "How many different mathematical models agree that the price should reverse here?"

Experience the power of Gaussian statistics and Levine’s TBF logic in one professional package.

User Guide:

-

Set Launch Points: Configure the VWAP and Top/Bottom Finder (TBF) launch points according to Paul Levine's methodology.

-

Adjust for Timeframe & Data: Tune the Maximum Shift Bars and Multiplier parameters based on the level of noise and data irregularities on your lower timeframe. As a starting point, use:

-

Maximum Shift Bars: 15

-

Multiplier: 60

-

-

Set Calculation Granularity: Configure the Confidence Timeframe. A shorter (lesser) timeframe will result in a more granular, detailed calculation.

-

View Raw Data: To analyze unprocessed data, disable normalization and enable the "raw events" setting.

-

Set Confidence Levels: Adjust the High Confidence and Medium Confidence thresholds according to your individual risk tolerance.

Important Note: This process requires the Anchored VWAP tool. If you do not have it, please send me a direct message after your purchase. I will provide it to you free of charge, along with detailed instructions on Paul Levine's methodology.