EMA offset band

- Indicatori

- Minh Vuong Pham

- Versione: 1.0

Description

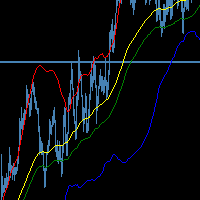

The EMA Offset Bands indicator is a custom technical analysis tool designed for MetaTrader 5 that displays a central Exponential Moving Average (EMA) line surrounded by percentage-based offset bands. This indicator creates dynamic support and resistance levels that automatically adjust based on the EMA value.

Key Features:

- Central EMA line (default: 200-period, displayed in yellow)

- Four upper offset bands at 1%, 2%, 3%, and 4% above the EMA (shown in lime green)

- Four lower offset bands at 1%, 2%, 3%, and 4% below the EMA (shown in red)

- Customizable EMA period and offset percentages

- Works on any timeframe and trading instrument

- Clean visual representation with dotted lines for bands

Trading Method Guide

Setup & Configuration

Recommended Settings:

- EMA Period: 200 (for long-term trend identification) or 50-100 for shorter-term trading

- Offset Bands: 1%, 2%, 3%, 4% (default settings work well for most markets)

- Timeframe: H1, H4, or Daily for swing trading; M15, M30 for intraday trading

Trading Strategy

1. Trend Identification

- Bullish Trend: Price consistently stays above the central EMA line

- Bearish Trend: Price consistently stays below the central EMA line

- Sideways Market: Price oscillates around the EMA with frequent crossovers

2. Entry Signals

Long (Buy) Positions:

- Wait for price to pull back to one of the lower bands (red dotted lines)

- Enter when price bounces off the -1% or -2% band in an uptrend

- Deeper pullbacks to -3% or -4% bands offer better risk/reward but occur less frequently

- Confirm entry with bullish candlestick patterns (pin bars, engulfing patterns)

Short (Sell) Positions:

- Wait for price to rally to one of the upper bands (green dotted lines)

- Enter when price rejects the +1% or +2% band in a downtrend

- Extended rallies to +3% or +4% bands provide excellent shorting opportunities

- Confirm entry with bearish candlestick patterns

3. Stop Loss Placement

- For Long Positions: Place stop loss below the next lower band or below the recent swing low

- For Short Positions: Place stop loss above the next upper band or above the recent swing high

- Alternative: Use a fixed percentage (1-2%) based on your risk management rules

4. Take Profit Targets

Conservative Approach:

- Take profit at the central EMA line (mean reversion target)

- This offers high probability but smaller gains

Aggressive Approach:

- From lower bands, target the opposite upper bands

- Example: Enter at -2% band, target +2% band

- Use trailing stops to maximize profits in trending markets

Scaled Exit Strategy:

- Close 50% of position at the EMA line

- Let remaining 50% run to the opposite band with a trailing stop

5. Band-to-Band Trading

This method works best in ranging or sideways markets:

- Buy at lower bands (-1%, -2%, -3%)

- Sell at upper bands (+1%, +2%, +3%)

- Use the central EMA as a profit-taking reference point

6. Trend Trading with Bands

In Strong Uptrends:

- Only take long positions on pullbacks to lower bands

- Avoid shorting upper bands against the trend

- The -1% and -2% bands act as dynamic support levels

In Strong Downtrends:

- Only take short positions on rallies to upper bands

- Avoid buying lower bands against the trend

- The +1% and +2% bands act as dynamic resistance levels

Risk Management Rules

- Never risk more than 1-2% of your account per trade

- Confirm band touches with price action - don't enter blindly

- Respect the overall trend - trade with the EMA direction

- Use proper position sizing based on the distance to your stop loss

- Avoid trading during low liquidity or major news events

Best Market Conditions

- High volatility markets: Use wider offset percentages (3-4%)

- Low volatility markets: Use tighter offset percentages (1-2%)

- Trending markets: Trade pullbacks to bands in the trend direction

- Ranging markets: Trade band-to-band reversals

Additional Tips

- Combine this indicator with RSI or MACD for confirmation

- The 200 EMA is widely watched, making these bands psychologically significant

- Price spending time beyond the ±3% or ±4% bands often signals exhaustion

- Adjust offset percentages based on the instrument's Average True Range (ATR)

- Backtest on your preferred instruments to optimize parameters

Common Mistakes to Avoid

- Trading against the EMA trend direction

- Entering too early before price reaches the bands

- Ignoring price action confirmation signals

- Using fixed targets without considering market conditions

- Overtrading in choppy, directionless markets

Disclaimer: This trading method should be tested on a demo account before risking real capital. Past performance does not guarantee future results. Always practice proper risk management and never invest more than you can afford to lose.