FlipToxin 5m Scalping Synthetics

- Indicatori

- Francois Alwyn Kretsman

- Versione: 1.0

- Attivazioni: 5

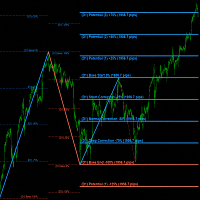

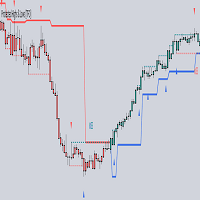

FlipToxin is a high-precision Buy/Sell flip signal indicator designed for FlipX Markets (Weltrade) and synthetic volatility indices (Deriv).

It focuses on identifying potential short-term market reversals (“flips”) and is optimized for traders who prefer fast, structured entries with disciplined risk management.

Recommended Markets & Timeframes

-

Primary timeframe:

-

M5 (5-minute chart)

-

-

Alternative timeframes (with confirmation):

-

M15 or higher

-

-

Supported markets:

-

FlipX Markets (Weltrade)

-

Boom & Crash

-

PainX

-

GainX

-

Volatility Indices (Deriv)

-

For Boom, Crash, PainX, and GainX, the M15 timeframe is recommended in trending conditions.

How FlipToxin Works

FlipToxin detects potential market flip zones where price action shows a higher probability of short-term directional change.

Signals are displayed directly on the chart and are intended for:

-

Quick entries

-

Controlled exits

-

Structured scalping strategies

This indicator is best suited for traders who follow a disciplined scalping or short-term trading approach.

Key Features

-

Clear Buy and Sell arrows on the chart

-

Non-repainting signals (signals do not disappear or move)

-

Pop-up alerts

-

Push notifications to MetaTrader 5 mobile

-

Lightweight and optimized for MT5

Best-Practice Guidelines

For best results, consider the following:

-

Trade in the direction of the higher-timeframe trend

-

Use proper risk management (stop-loss, position sizing)

-

Avoid trading during low-liquidity or erratic market conditions

-

Combine signals with price action or structure analysis

Important Notes

-

No indicator is 100% accurate

-

FlipToxin is a decision-support tool, not an automated trading system

-

Performance depends on market conditions, execution, and trader discipline

All trading decisions remain the responsibility of the trader.

Support

If you have questions or need assistance with setup or usage, support is available via the MQL Market messaging system.