Quant Apex EA

- Experts

- Shane Michael Horn

- Versione: 3.0

- Attivazioni: 5

Quant Apex EA

Disclaimer & Terms

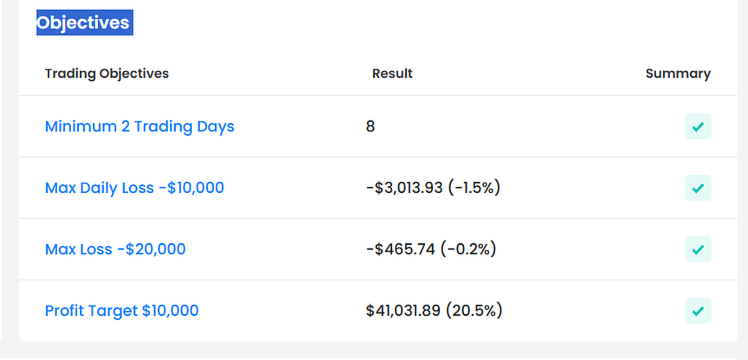

This bot is designed and optimized for prop firm challenges and evaluation accounts.

Overview

Quant Apex EA is a fully automated breakout trading system built for precision and consistency during high-probability market sessions. It identifies recent price ranges, places pending orders above and below key breakout levels, and manages open positions dynamically using multi-take-profit logic, trailing stops, and break-even mechanisms.

The EA integrates volume and volatility filters to confirm valid breakouts and avoid false entries. A dual-timeframe EMA filter ensures trading is aligned with the dominant trend, improving entry quality and trade consistency.

Key Features

-

Session-based trading control: defines exact hours for breakout sessions.

-

Smart range detection and automated breakout entries.

-

Advanced risk management: fixed or percentage-based risk with auto lot sizing.

-

Multiple take profits: up to three targets with independent lot allocation.

-

Automatic break-even move once TP1 is reached.

-

Dynamic trailing stop: supports fixed, ATR-based, and chandelier modes.

-

Daily and monthly profit or drawdown guards to protect equity.

-

EMA trend filter across multiple timeframes for higher accuracy.

-

Breakout guards combining volume, ATR, and candle-strength confirmation.

Recommended Settings

-

Pairs: Major FX pairs or indices with consistent volatility.

-

Timeframes: M15 to H1.

-

Account Type: ECN or low-spread demo/prop accounts.

-

Minimum Deposit: 1,000 USD (or equivalent prop account size).

Important Notes

Quant Apex EA is designed for prop firm evaluation and demo environments.

It does not use DLLs or any external connections.

For validation and testing, ensure the EA runs on symbols and timeframes where at least one breakout occurs during the test period.