Banks Dealing Range

- Indicatori

- Aurthur Musendame

- Versione: 1.0

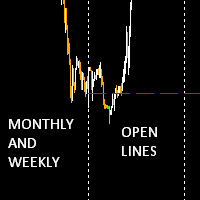

The Central Bank Dealers Range (CBDR) is a key ICT concept, used to project potential highs and lows for the day based on market conditions during a specific time window. The CBDR is utilized to forecast price movements in both bullish and bearish market conditions. By identifying this range, traders can better anticipate the price levels that may form as the day progresses.

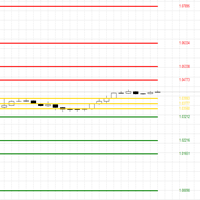

CBDR and Standard Deviation

A key feature of the CBDR is its application of standard deviation, a statistical measure used to assess the volatility or dispersion of price from its mean (central point). Here's how it works:

- The CBDR creates a central price range, represented as a rectangle.

- Standard deviations above and below the CBDR is calculated to help traders understand the possible range for price movement. This can be visualized as additional price levels above and below the central range, giving traders an insight into where price is likely to go if it expands beyond the initial range.

Ideal CBDR Range

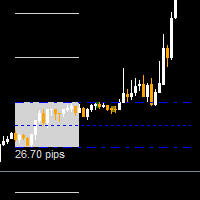

The ideal CBDR range is typically less than 40 pips, with the most fruitful ranges being around 20-30 pips. A larger range (greater than 40 pips) is generally considered unfruitful for day trading and may signal that the market has already made significant movement.

Using CBDR in Trading

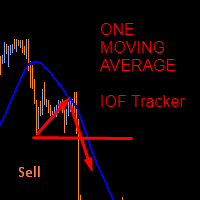

- Sell Days: The high of the day on a bearish day often forms up to 3 standard deviations above the CBDR, with the majority of price action happening between 1 and 2 standard deviations above the range.

- Buy Days: Conversely, on bullish days, the low of the day is often found 3 standard deviations below the CBDR, with the majority of price action occurring within 1 to 2 standard deviations below.

Best Time Frames for CBDR

- The 15-minute chart or lower timeframes are ideal for measuring the CBDR, as this allows for more precise entry points and alignment with intraday price movements.

Best Markets for CBDR

While CBDR was initially tested on NASDAQ (NQ Futures) and E-mini (S&P 500), it has proven effective on major forex pairs like GBP/USD, EUR/USD, and XAU/USD.

CBDR Indicator's Functionality

This CBDR Indicator:

-

Displaying the Dealing Range in Pips: The indicator shows the pips within the CBDR, helping you quickly gauge the volatility and potential for price expansion during the day.

-

Red Box for Exceeded Ranges: When the CBDR exceeds the ideal size (typically greater than 40 pips), the indicator will plot a red box around the range. This visually warns traders that further price movement might be limited for the day. In such cases, traders may choose not to trade, as larger ranges often signal price exhaustion.

-

Preference for Smaller Ranges: The indicator also highlights that smaller CBDRs are more favorable. A smaller range typically signals consolidation, and when price breaks out of this smaller range, it could lead to significant price expansion. This is a signal for traders to stay alert for potential trading opportunities.

-

Standard Deviation Lines: The indicator plots standard deviation lines both above and below the CBDR. These lines help you visualize the expected range of price movement based on historical volatility.

- Trading Strategy: You can use the 1 standard deviation (SD) level for entering a trade on the manipulation side of the CBDR based on ICT AMD.

- Expansion Targets: By targeting 5 standard deviations, you can ride the price expansion/distribution as the market moves further from the CBDR. This approach helps capture larger moves that align with the overall trend or market structure.