SMC Liquidity

- Indicateurs

- Alex Amuyunzu Raymond

- Version: 1.0

- Activations: 5

Advanced Institutional-Grade Smart Money and Liquidity Analysis Suite for MT5

SMC LIQUIDITY is a comprehensive institutional toolkit engineered for traders who require precise liquidity mapping, market structure intelligence, smart money concepts, and order flow awareness in a single integrated interface. It is designed for professional workflow, multi-timeframe clarity, and seamless execution in fast-moving conditions. This indicator combines several institutional methodologies into one unified engine, allowing traders to interpret the market with the same information hierarchy used by advanced proprietary desks.

Core Purpose

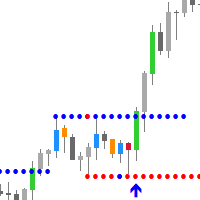

SMC LIQUIDITY identifies the underlying mechanics driving price delivery by highlighting liquidity pools, inducements, sweeps, displacement, imbalance, volatility pivots, mitigations, and structural shifts. It presents these elements in a visually coherent format that enhances decision-making without cluttering the chart.

This is not a signal generator. It is an institutional analytics system intended to strengthen analysis, validate narrative, and refine high-probability trade selection.

Key Features1. Liquidity Engine

A dedicated module that detects and maps all major liquidity zones:

-

Equal highs and equal lows

-

External and internal liquidity pools

-

Buy-side and sell-side liquidity ranges

-

Liquidity sweeps and taker events

-

Inducement levels and engineered liquidity points

This module continuously updates to reflect evolving market structure and liquidity conditions.

2. Market Structure Framework

A multi-layer structural system that reads the market using institutional logic:

-

Swing structure (HH, HL, LH, LL)

-

Break of structure (BOS)

-

Change of character (CHOCH)

-

Displacement and order flow continuation

-

Structural alignment across multiple timeframes

The structure is computed with strict definitions to eliminate ambiguity in trend direction and transition.

3. Imbalance and FVG Detection

Accurate identification and mapping of:

-

Fair value gaps

-

Displacement gaps

-

Volume voids

-

Continuous imbalance zones

Each zone adjusts dynamically with price interaction and mitigation.

4. Order Block and Institutional Footprint Module

Automatic detection and visualization of:

-

Bullish and bearish order blocks

-

Mitigated and unmitigated blocks

-

Refined OB detection with candle pattern validation

-

Reaction zones for continuation or reversal narratives

5. VWAP and Institutional Volume Levels

A dedicated institutional volume profile engine with:

-

Daily, weekly, monthly, session, and custom-session VWAP

-

Standard deviations and bands

-

Session separation for high-precision intraday analysis

VWAP aligns with market structure, liquidity, and order flow transitions.

6. Multi-Timeframe Synchronization

SMC LIQUIDITY processes higher-timeframe logic and projects critical zones and structure back into the trading timeframe. This allows:

-

Higher timeframe swing bias

-

Cross-timeframe liquidity alignment

-

Hierarchical structure overlay

The result is a top-down institutional narrative embedded directly into the chart.

7. High-Performance Rendering

The indicator is optimized for:

-

Zero lag analysis

-

Minimal CPU usage

-

Smooth redraws on volatile fast timeframes

-

Efficient processing for multi-module systems

Suitable for scalping, intraday, swing, and algorithmic workflow.

8. Clean and Professional Visualization

All elements are displayed with precision-focused formatting:

-

Crisp institutional color palette

-

Distinct visual layers

-

Clear separation of modules

-

Optional visibility toggles

The interface is designed for traders who demand a clean analytical environment.

SMC LIQUIDITY is not a simple SMC overlay or basic indicator set. It uses deep institutional logic and multi-module computation to present market data in a meaningful hierarchical structure. The system was designed to help traders understand liquidity engineering, displacement, and structure shifts rather than simply react to signals.

This makes it appropriate for:

-

Smart money concept practitioners

-

Liquidity-based traders

-

Order flow analysts

-

Proprietary-style workflow

-

Institutional price action modelling

SMC LIQUIDITY supports multiple trading methodologies, including:

-

Liquidity sweep reversals

-

Inducement and mitigation plays

-

Order block continuation setups

-

FVG based entries and exits

-

Trend and counter-trend structural trading

-

VWAP-based intraday execution

It can be used on any instrument including forex, commodities, indices, crypto, and synthetic markets.

Every module is configurable:

-

Structural sensitivity

-

Liquidity range thresholds

-

OB detection parameters

-

FVG and imbalance filters

-

VWAP mode selection

-

Session times

-

Visual styles and layout settings

This allows the indicator to adapt to any strategy or charting preference.

SMC LIQUIDITY is a professional-grade institutional toolkit that combines liquidity analysis, smart money concepts, market structure, order blocks, VWAP, imbalance mapping, and multi-timeframe intelligence into a single cohesive package. Built for traders who require accuracy, clarity, and institutional-level market interpretation, it stands as a complete analytical suite for MT5.