Rejoignez notre page de fans

- Vues:

- 10784

- Note:

- Publié:

- Mise à jour:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Original author:

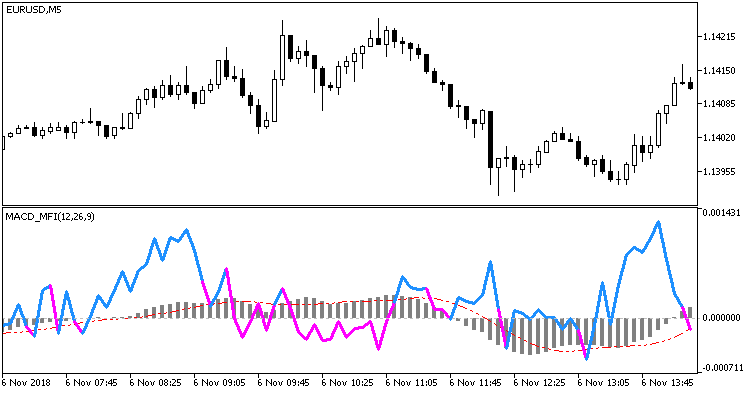

The MFI indicator (Money Flow Index) applied over MACD (Moving Average Convergence/Divergence) provides a visual presentation of the current price divergence.

In addition to divergences, MACD provides a superb display of reversals on minor periods, such as 1, 5 and 15 min. Intersection of the MACD signal line and MFI can serve as an additional signal to open a trade. MFI line color changes after such an intersection.

Input parameters contain the MACD histogram and MFI parameters, as well as caliber - the RSI scaling factor. This factor has been added due to a large variation of MACD values on different timeframes. So, "caliber" for 15 minute EURUSED is about 4, for daily TF "caliber" = 20, for M1 "caliber" =0.5.

The indicator uses the CMoving_Average class from the SmoothAlgorithms.mqh library. The class is described in detail in the article Averaging Price Series for Intermediate Calculations Without Using Additional Buffers.

Fig.1. The MACD_MFI indicator

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/23150

Exp_Slow-Stoch_Duplex

Exp_Slow-Stoch_Duplex

Two identical trading systems (for long and short positions) based on the signals of the Slow-Stoch indicator, which can be configured in different ways within one Expert Advisor

Flat Channel

Flat Channel

Brief Description

RSI EA v2

RSI EA v2

RSI EA - trading based on overbought/oversold zones determined by the iRSI (Relative Strength Index, RSI) indicator.

Yesterday Today

Yesterday Today

Trading is based on the analysis of yesterday's OHLC with the current day value.