Rejoignez notre page de fans

- Vues:

- 6717

- Note:

- Publié:

- Mise à jour:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

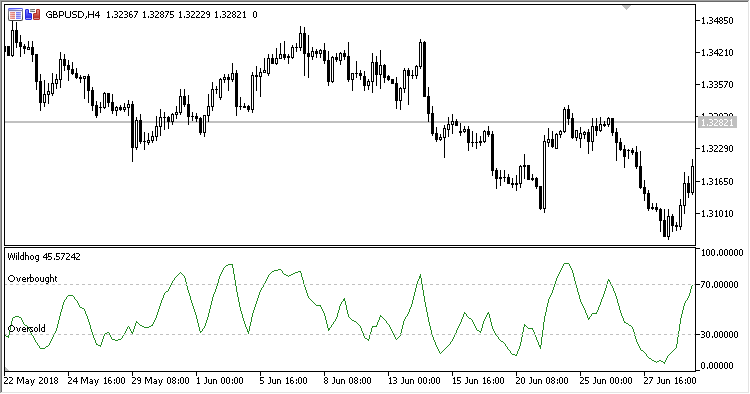

Wildhog oscillator displays asset's overbought/oversold states, as well as searches for divergences. It works on any timeframe.

The system is based on the last High, Low and Close eight bars.

The indicator has three input parameters:

- Period - calculation period

- Overbought - overbought level

- Oversold - oversold level

Calculation:

Wildhog = 100 * (Close-Min) / (3 * (Max-Min)) + PrevWildhog

where:

Max, Min are the highest and lowest prices within the Period interval

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/21393

DEMA_Range_Channel_HTF

DEMA_Range_Channel_HTF

DEMA_Range_Channel indicator with the timeframe selection option available in input parameters

DirectCandlesCounter_Candle

DirectCandlesCounter_Candle

DirectCandlesCounter indicator in the form of candles.

MostasHaR15 Pivot

MostasHaR15 Pivot

The EA uses the following indicators: iADX (Average Directional Movement Index, ADX), two iMAs (Moving Average,MA) - one indicator at CLOSE prices and another one at OPEN prices, iOsMA (Moving Average of Oscillator, OsMA).

AMA Histogram

AMA Histogram

The histogram displays the difference of a Close price and iAMA (Adaptive Moving Average, AMA) indicator value.