Market Condition Evaluation based on standard indicators in Metatrader 5 - page 101

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.12 11:37

Trading News Events: U.S. Retail Sales (based on dailyfx article)

Another contraction in U.S. Retail Sales may drag on the greenback and generate a near-term rebound in EUR/USD as it dampens the Fed’s scope to raise the benchmark interest rate in mid-2015.

What’s Expected:

Why Is This Event Important:

The Fed may have little choice but to further delay its normalization cycle as lower energy costs show little evidence of boosting private-sector consumption, and we may see the central bank implement a more dovish twist to the forward-guidance for monetary policy as it struggles to achieve the 2% target for inflation.

Nevertheless, the pickup in job/wage growth may pave the way for a better-than-expected print, and a positive development may spark a bearish reaction in EUR/USD as market participants ramp up bets for higher borrowing-costs.

How To Trade This Event Risk

Bearish USD Trade: U.S. Retail Sales Falls Another 0.4% or Greater

- Need green, five-minute candle following the release to consider a long trade on EUR/USD.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Private Consumption Exceeds Market Forecast- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bearish dollar trade, just in reverse.

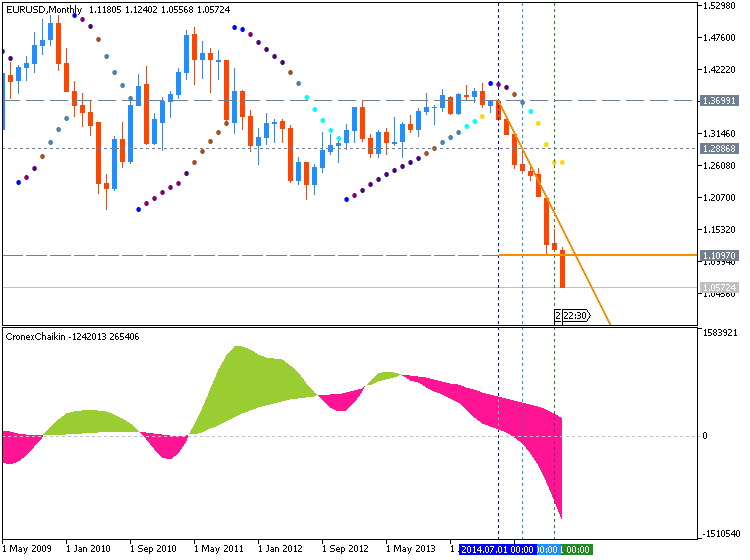

Potential Price Targets For The ReleaseEUR/USD Daily

- Long-term outlook for EUR/USD remains bearish as the RSI retains the downward trend carried over from back in October 2013.

- Interim Resistance: 1.1600 pivot to 1.6110 (61.8% expansion)

- Interim Support: 1.1096 (2015 low) to 1.1100 pivot

Impact that the U.S. Retail Sales report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

2014

U.S. Retail Sales contracted 0.9% in December, largely driven by lower gas receipts, after climbing a revised 0.4% the month prior. Despite the worse-than-expected print, it seems as though the Fed remains confident in raising the benchmark interest rate in mid-2015 as the central bank anticipates falling oil prices to have a positive impact on the economy as it boosts disposable incomes. Nevertheless, the dollar struggled to hold its ground following the print, with EUR/USD climbing above the 1.1825 region, but the market reaction was short-lived as the pair consolidated throughout the North America trade to end the day at 1.1773.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.02.12

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 44 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.17 06:04

2015-02-17 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes][AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========Economists say February RBA Minutes leave a March rate cut live

Some economists, like Annette Beacher – TD Securities Head of Asia Pacific Research – believe May is the best bet for the next RBA cut. But other economists seem to be cautiously optimistic that another cut at the March meeting is “live.”

The context of “live”, or not, is shaped by the Minutes, which revealed the RBA had the same debate in private that the market and pundits had in public about the timing of the February cut.

Felicity Emmett, ANZ’s co-Head of Australian Economics is relying on history for the March cut and expects, “another 25bp cut at the March meeting given the Bank’s historical tendency towards consecutive moves in the early part of a new cycle and its own research which suggests that the impact of one 25bp rate cut on the economy is negligible.”

The Minutes showed that:

"In deciding the timing of such a change, members assessed arguments for acting at this meeting or at the following meeting. On balance, they judged that moving at this meeting, which offered the opportunity of early additional communication in the forthcoming Statement on Monetary Policy, was the preferred course."

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.02.17

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 41 pips range price movement by AUD - Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.19 05:50

2015-02-18 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes][USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

FOMC Minutes - Reactions From 10 Major Banks

BofA Merrill: The recent steady stream of Fed speakers advocating for a potential June rate hike led to expectations for relatively hawkish FOMC minutes. The headlines for the minutes surprised to the dovish side, and led to a decline in Treasury yields and the US dollar. However, a closer reading suggested a more modest dovish bent with a lot of disagreement among participants. Thus, attention now shifts to Chair Yellen's Congressional testimony next week, which in our view should elaborate and update the assessment of risks while still leaving a June liftoff in play. We expect persistently below-target inflation delays the Fed until September, but the minutes confirm a fair degree of uncertainty about the timing of the first rate hike.

Credit Agricole: The minutes of the January FOMC meeting were relatively dovish and spelled more caution over the inflation outlook and timing of the rate liftoff. On balance, we continue to expect rate normalization to begin in the Q3 2015.

UBS: The minutes of this FOMC meeting are quite ambiguous. There was no definitive view on the impact of foreign developments. Also, there was no clear view on the outlook or the timing of the first rate hike. This was due, likely in part, to the fact that there was uncertainty about the right inflation measures to look at and what other measures might influence them. Even the phrase "patient" was debated: Would removing it cause markets to adjust the timing of the first rate hike too aggressively?...Unfortunately, all the cross currents give us little direction. Prior to the re-acceleration in wages and the continued strong labor market readings and the rebound in oil prices, it would appear that fading a June hike would have made sense given these minutes. Post these realities, it is not clear. The testimony next week is unlikely to prove too instructive as Yellen testifies on behalf of the committee, which last met on January 28th. For now we will keep our forecast of a June rate hike counting on the still-strong labor market and rebound in energy prices to win the day. We will have to be "patient" to see how this wind blows.

Deutsche Bank: The minutes from the January 27 - 28 FOMC meeting did not indicate any substantive changes to the growth outlook compared to the Fed's most recent projections released last December. The near-term inflation outlook was revised down slightly due to further declines in oil prices. However the staff's inflation forecast for 2016 and 2017 was "essentially unchanged." There was considerable debate over the interpretation of market-based measures of inflation compensation but there were no firm conclusions with respect to the longer-term inflation outlook, which the FOMC still sees as gradually rising toward its 2% target. Moreover, the Fed reiterated the view that low energy prices were a net positive for the economy. In short, there were no material changes with respect to the economic and financial outlook.

ANZ: The minutes from the January FOMC meeting were more dovish than expected although we do not expect there has been a wholesale change in view. The FOMC appears more concerned about risks from offshore and the higher USD and many FOMC members would prefer to keep the fed funds rate at near zero bound for a longer time. In our view, we would not read too much into the term 'longer'. In addition, given many of the offshore risks - such as the Greek and Ukraine situations - now look more likely to be resolved, this should allay a lot of the stated reasons for hesitancy. We continue to look for the first hike around mid-year although we acknowledge the risks of the Fed waiting have increased. Yellen's speeches next week will be important

NAB: The killer paragraph in the minutes of the Fed's January meeting reads as follows: "Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time". In FOMC speak, many is taken to mean a majority, and these words have had the effect of pushing implied money market yields in the fourth quarter of 2015 down by about 5bps on average, and by as much as 10bps further out along the shorter end of the yield curve. It's worth remembering here that the mood music coming from Fed officials ahead of the minutes - but since the meeting itself - had been consistent in suggesting that a June Fed 'lift-off' is still a very live risk. Janet Yellen's testimonies next week now loom large. Trading will be thinner than normal given today is the Lunar New Year holiday and so Greater China is shut.

SEB: It is our understanding that the Fed minutes did not suggest that the FOMC is paving the way for a June rate hike as "many officials were inclined to stay at zero for longer". Moreover, the drop in inflation expectations was apparently worrying since a number of participants emphasized that they would need to see either an increase in market-based measures of inflation compensation or evidence that continued low readings on these measures did not constitute grounds for concern. While we may have a different view after Chair Yellen's semi-annual testimony before congress next week, the minutes are not suggesting to us that "patience" will be dropped as early as in the March statement. Our forecast still is for liftoff a few meetings later, in September.

Barclays: Our main takeaway from the January FOMC minutes is that concern about downside risk to inflation has risen and, consequently, the bar for raising rates by June is higher than it was in December. We maintain our baseline forecast for a June rate hike at this juncture, but the risk of a later takeoff has risen, particularly if downside surprises on core inflation continue. We look to Chair Yellen's comments in front of the US Senate and House of Representatives next week for further clarification on the committee's thinking.

Danske: The minutes from the January FOMC meeting strongly suggest that the FOMC's fed funds rate projections will be lowered at the upcoming 18 March meeting and the minutes were in general more dovish than recent Fed speeches. Data received since the FOMC meeting on 28 January includes the January employment report, which was very strong. However, we doubt that one data point is enough to turn the Committee's sentiment, in particular when inflation indicators continue to be soft. This challenges our call that the Fed will remove 'patient' from the statement in March and raise the fed funds rate this summer If February data on employment continue to show solid improvement and inflation indicators stabilise, we continue to believe the Fed would like to have the flexibility to raise rates in June. Hence, 'patient' should be dropped in March but will be combined with soft comments from Janet Yellen and lower economic projections in order to keep the market reaction moderate.

CIBC: The latest minutes show that many officials felt dropping patient could lead markets to price in too early a move to tighten policy, putting upwards pressure on rates when some sectors like housing are still showing uneven signs of recovery. Notwithstanding that, several members suggested that a "late departure" could result in monetary policy becoming excessively accommodative. Not inconsistent with that view, there was general agreement that the minutes should "acknowledge solid growth over the second half of 2014, as well as the further improvement in the labour market." The minutes overall show that opinion within the FOMC remains deeply split on when the Fed should take the next step on the road to policy normalization. Although inflation has moved down, the minutes also affirm the statement in suggesting that most members continue to see the drop as a transitory consequence of lower oil prices, and therefore not sufficient at this point to warrant a notable delay in moving interest rates up from the lower bound. Today's release does not change our view that June still remains the most likely date for policy lift off. A slight positive for bonds given further signs of the Committee's reluctance to dispense with the key word "patience". The focus now shifts to Yellen's testimony next week for further information on the policy outlook.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.02.19

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 60 pips price movement by USD - FOMC Meeting Minutes news event

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.02.19

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 65 pips price movement by USD - FOMC Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.20 09:48

Trading the News: Canada Retail Sales (based on dailyfx article)

A slowdown in Canada Retail Sales may spur a larger advance in USD/CAD as the Bank of Canada (BoC) adopts a more cautious outlook for the region.

What’s Expected:

Why Is This Event Important:

Following the surprise rate cut at the January 21 meeting, a further deterioration in the growth outlook may prompt BoC Governor Stephen Poloz to relay a more dovish tone for monetary policy and show a greater willingness to further reduce the benchmark interest rate in an effort to generate a stronger recovery.

Nevertheless, easing inflation along with the ongoing improvement in the labor market may boost household spending, and a better-than-expected print may push USD/CAD back towards the monthly low (1.2350) as it limit’s the BoC’s scope to implement offer lower borrowing-costs.

How To Trade This Event Risk

Bearish CAD Trade: Canada Retail Sales Slip 0.4% or Greater

- Need green, five-minute candle following a dismal sales report to consider long USD/CAD entry.

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position.

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish CAD Trade: Private-Sector Consumption Tops Market Forecast- Need red, five-minute candle following the release to look at a short USD/CAD trade.

- Carry out the same setup as the bearish loonie trade, just in the opposite direction.

Potential Price Targets For The ReleaseUSD/CAD Daily Chart

- Need a break of the near-term bearish momentum in RSI to favor a resumption of the long-term bullish trend.

- Interim Resistance: 1.2797 (February high) to 1.2800 (38.2% expansion)

- Interim Support: 1.2340 (38.2% retracement) to 1.2390 (161.8% expansion)

Impact that the Canada Retail Sales report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.02.20

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 69 pips price movement by CAD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.06.28 15:55

Well ... some questions and answers :

=====

Q: what is the most profitable pair to trade the news?

A: GBPUSD

=====

Q: what is the most risky pair to trade the news?

A: GBPUSD

=====

Q: what is the most stable pair to trade the news (consistantly profitable pair for trading news events)?

A: USDCAD

=====

Q: what is less risky pair to trade the news?

A: USDCAD

=====

Thanx for your attention

That's all news

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.25 09:38

Trading the News: German Unemployment Change (based on dailyfx article)

Another 10K contraction in German Unemployment may encourage a near-term rebound in EUR/USD as it raises the prospects for a stronger recovery in the euro-area.

What’s Expected:

Why Is This Event Important:

A further improvement in Europe’s largest economy may limit the European Central Bank’s (ECB) scope to further embark on its easing cycle and heighten the appeal of the single currency especially as the member-states take unprecedented steps to mitigate the risk for contagion.

However, waning business confidence paired with the slowdown in production may drag on employment, and a dismal labor report may heighten the bearish sentiment surrounding the Euro as ECB President Mario Draghi keeps the door open to further support the monetary union.

How To Trade This Event Risk

Bullish EUR Trade: Unemployment Contracts 10K or Greater

- Need green, five-minute candle following the print to consider a long EUR/USD trade

- If market reaction favors buying Euro, long EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish EUR Trade: German Labor Report Disappoints- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bullish Euro trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Long-term outlook remains bearish as the RSI retains the downward trend from 2013, but need a break/close below support to revert back to the approach to ‘sell bounces’ in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1480 (78.6% expansion)

- Interim Support: 1.1300 (161.8% expansion) to 1.1310 (100% expansion)

Impact that the GermanyUnemployment Change has had on EUR during the last release(1 Hour post event )

(End of Day post event)

The number of unemployed in Germany contracted 9.0K in January, while the jobless rate narrowed to a record-low of 6.5% from a revised 6.6% the month prior. Despite the ongoing improvement in Europe’s largest economy, the European Central Bank’s (ECB) may continue to highlight a dovish tone for monetary policy as it struggles to achieve its one and only mandate to deliver price stability. Nevertheless, EUR/USD tracked higher following the report, with the pair pushing above the 1.1300 handle to end the day at 1.1326.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.26 05:23

2015-02-25 21:45 GMT (or 23:45 MQ MT5 time) | [NZD - Trade Balance]if actual > forecast (or previous data) = good for currency (for NZD in our case)

[NZD - Trade Balance] =Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers

==========

New Zealand Has NZ$56 Million Trade Surplus

New Zealand had a merchandise trade surplus of NZ$56 million in January, Statistics New Zealand said on Thursday.

That topped expectations for a deficit of NZ$158 million following the downwardly revised NZ$195 million shortfall in December (originally -NZ$159 million).

Exports were worth NZ$3.70 billion - shy of expectations for NZ$3.73 billion and down from the downwardly revised NZ$4.40 billion in the previous month (originally NZ$4.42 billion).

Imports were at NZ$3.64 billion versus forecasts for NZ$3.94 billion following the upwardly revised NZ$4.60 billion a month earlier (originally NZ$4.58 billion).

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2015.02.26

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 19 pips price movement by NZD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.02.27 12:05

Trading the News: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

A marked downward revision in the U.S. growth rate may generate a short-term rebound in EUR/USD should the preliminary 4Q Gross Domestic Product (GDP) report dampen bets for a mid-2015 Fed rate hike.

What’s Expected:

Why Is This Event Important:

Despite bets for higher borrowing-costs, further weakness in the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, may push Chair Janet Yellen to endorse a wait-and-see approach and further delay the normalization cycle as the central bank struggles to achieve the 2% target for price growth.

Nevertheless, the uptick in private wages paired with the ongoing improvement in the labor market may foster a better-than-expected GDP report, and bets for a stronger recovery may heighten the bullish sentiment surrounding the U.S. dollar as the Fed remains on course to remove the zero-interest rate policy (ZIRP) over the near to medium-term.

How To Trade This Event Risk

Bearish USD Trade: Growth Rate Narrows to 2.0% or Lower

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD

- If market reaction favors a short dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: 4Q GDP Report Tops Market Expectations- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in reverse

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Break of the triangle/wedge formation favors a continuation of the bearish trend and the approach to ‘sell-bounces’ in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1470 (78.6% expansion)

- Interim Support: 1.1185 (23.6% expansion) to 1.1210 (61.8% retracement)

Impact that the U.S. GDP report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.02.27

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 19 pips price movement by USD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

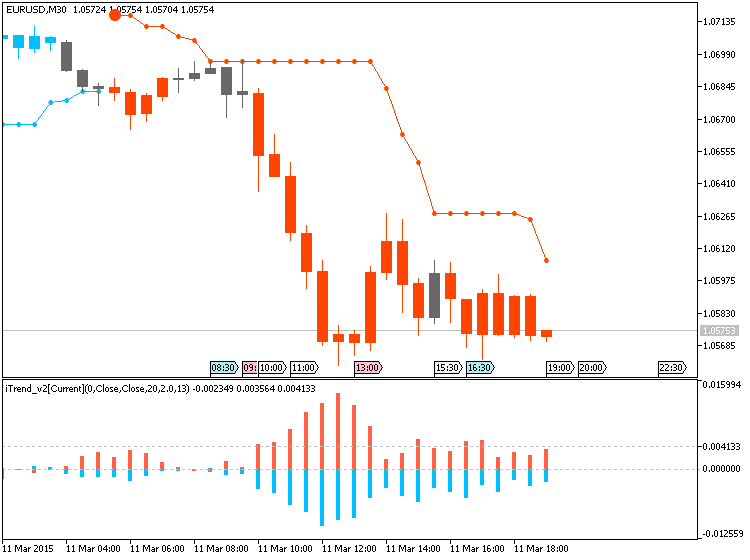

newdigital, 2015.03.11 18:01

EURUSD Moves on Lower Lows (based on dailyfx article)

The EURUSD has opened Wednesdays trading with the creation of a new weekly lower low. This decline is significant as the pair has declined as much as 347 pips week to date. However, despite its weakness the EURUSD is attempting to trade back above todays S4 Camarilla pivot at 1.0607. While this does not negate the current downtrend, traders will watch to see if price moves back into today’s trading range starting at the S3 pivot near 1.0652. In the event price breaches this point, traders may begin looking for a move back up towards range resistance at 1.0741.

In the event that price begins to again gain momentum, trend traders may elect to look for a breakout again under the S4 pivot. This would signal a potential increase in USD strength and traders would look for further declines at this point. Conversely if price trades through todays range, towards the R4 pivot at 1.0786, it would suggest price beginning a larger counter trend move with the creation of a new higher high.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.12 06:19

2015-03-11 20:00 GMT (or 22:00 MQ MT5 time) | [NZD - Official Cash Rate]if actual > forecast (or previous data) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========New Zealand's Official Cash Rate Unchanged At 3.50%

The Reserve Bank of New Zealand's monetary policy board on Thursday announced that it was holding its Official Cash Rate steady at 3.50 percent - in line with expectations.

It was the fifth straight month with no change for the RBNZ, which had hiked the OCR by 25 basis points in each of previous four meetings prior to September.

Before that, there were 23 straight meetings with no change. The OCR had been at a record low 2.50 percent since March 10, 2011 as the country dealt with the global economic slowdown.

It wasn't until last March that the central bank felt confident enough in a recovery that it lifted the OCR - although no additional action is likely in the near term.

"Global financial conditions remain very accommodative, and are reflected in high equity prices and record low interest rates. However, volatility in financial markets has increased since late-2014 following the sharp drop in oil prices, continued uncertainty about the global outlook and U.S. monetary policy, and policy easings by a number of central banks," the bank said in a statement accompanying the decision.

"The New Zealand dollar remains unjustifiably high and unsustainable in terms of New Zealand's long-term economic fundamentals. A substantial downward correction in the real exchange rate is needed to put New Zealand's external accounts on a more sustainable footing," the bank said.

The RBNZ called it prudent to take more time and further observe the effects of its moves to date.

The bank pointed to several factors for taking its time in taking any further actions, including weak global inflation, falls in international oil prices and the high exchange rate.

"Our central projection is consistent with a period of stability in the OCR. However, future interest rate adjustments, either up or down, will depend on the emerging flow of economic data," the bank said.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2015.03.12

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 115 pips price movement by NZD - Official Cash Rate news event