is it possible to create positive MO with trailing stops?- No, trailing stops reduce the MO, it's been tested.

PS: I'll send you later the Expert Advisor in the tester, without trailing stops it does not give any profit at all on a long history, I'd be interested in your opinion.

By popular demand: The positive mathematical expectation (PEM) over a long trading period...

- What are the ways to create it?

- //

- //

Who knows, will not tell for sure.

is it possible to create positive MO with trailing stops?- No, trailing stops reduce OD, it's been tested.

Dmitry, how to calculate the probability that on 1000 coin tosses tails will fall out 1.5 times more often than heads?

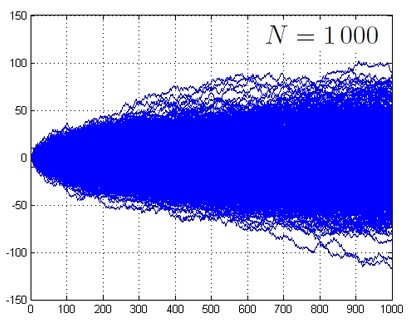

And it is also interesting, on what interval from the first flip such ratio is most probable (for on the interval of 1000 flips such ratio is practically impossible. see fig. below).

Market is not a coin. The question is off-topic.

Alexei, I'm just interested in the calculation mechanism itself...

After the externship session and the subsequent walks, I'm not thinking straight ... and I'm lazy).

Could you write the formula for the final calculation, please...

And I also wonder at what interval from the first throw such a ratio is most likely (for at 1000 throws such a ratio is practically impossible. see figure below).

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

By popular demand: Positive mathematical expectation (PEM) over a long trading period...

These and other questions...

Please do not discuss in this thread:

If possible, please back up your opinions:

Please give your opinions,,,, later I will give my ...