Any great idea about HEDGING positions welcome here - page 24

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Attila Alp Oğuz: A simple question to hedgers here with two cases:

1. Let's say that you opened 2 lots long position in EURUSD when the quotation is 1,1108 - 1,1110.

And, you closed 1 lot at 1,1098 - 1,1100.

What would your loss be when the quotation is at 1,1090 - 1,1092?

2. And the same scenario implemented with the so-called hedging thing.

Let's say that you opened 2 lots long position in EURUSD when the quotation is 1,1108 - 1,1110.

And, you opened 1 lot short position at 1,1098 - 1,1100.

What would your loss be when the quotation is at 1,1090 - 1,1092?

Case #2 is clearly more “expensive”.

Commission costs were not calculated but they will be 50% higher for case #2.

Margin requirements too will be higher for case #2.

EDIT: Corrected previously posted values as the Spread costs are already contemplated in the P/L values, hence why case #2 is more "expensive".

even a professional trader needs to use another persons ideas to improve his methods.

and also help another people.

trading knowledge is like an ocean . can someone claim that know everything about a phenomena?

not at all.

Yes, I like the analogy of a vast ocean. Even to take it further, the currents, water temperature and tides. Some things we know effect the ocean, the moon on the tides etc. But other times a range of inputs will have an effect.

I've always likened trading to skills akin to the sports field. A football player may have all the skills, but he won't always have a good game and may even score an own goal! All one can do is try to continually improve and be ready for the opportunities.

I suppose hedging could be likened to a team pushing forward on attack, but still maintaining some kind of defence. In theory, 11 players hard on attack should produce a goal, but...if something goes wrong, their own goal is exposed....

I suppose hedging could be likened to a team pushing forward on attack, but still maintaining some kind of defence. In theory, 11 players hard on attack should produce a goal, but...if something goes wrong, their own goal is exposed....

Not at all, because with "hedging" there is no attack and no defence.

"Hedging" is more like a tug-off-war match played by a single team where there can never be a winner.

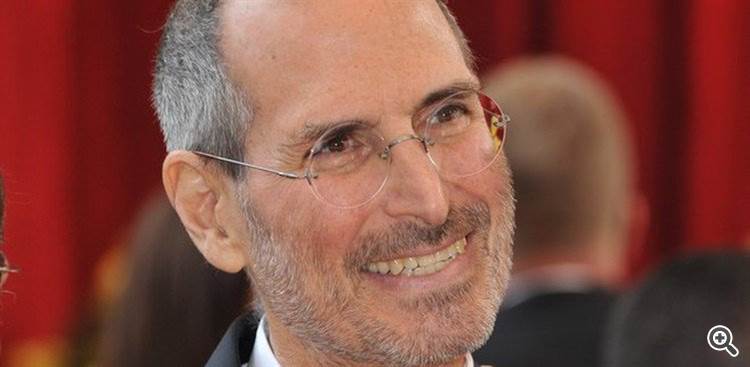

friends showed me a coca cola example. now i want to give an example from apple.

nowadays apple worth is more than $1 trillion.

Are you all believe in Steve jobs was a genius or not ?

if your answer is yes i have a famous quote for you from him.

but if you don't believe it maybe you are dumb ... or maybe don't want to see reality.

"Your time is limited, so don’t waste it living someone else’s life.

Don’t be trapped by dogma—which is living with the results of other people’s thinking.

Don’t let the noise of others’ opinions drown out your own inner voice.

And most important, have the courage to follow your heart and intuition."

Steve jobs

All of this has got nothing to do with you or your claims about hedging.

How many famous people are you planing on going to quote ?

It does not help or solve anything.

It's completely irrelevant to this thread.

Don’t be trapped by dogma—which is living with the results of other people’s thinking.

Don’t let the noise of others’ opinions drown out your own inner voice.

Luckily, I don't live with the results of your thinking.

My inner voice is firm and I will retain my own opinion. I can prove my opinion as fact. I don't see anyone with a different opinion to mine backing up anything they say.

Don’t be trapped by dogma—which is living with the results of other people’s thinking.

Don’t let the noise of others’ opinions drown out your own inner voice.

Luckily, I don't live with the results of your thinking.

My inner voice is firm and I will retain my own opinion. I can prove my opinion as fact. I don't see anyone with a different opinion to mine backing up anything they say.

So true and agree completely!

I would like to add, that since it is the the vast majority, the so called "herd", especially the newbies, that fall into the trap and defend the "hedging" method; that is the dogma.

It is we the few who go against that mentality, that are standing out from the noise.

PS! I would like emphasize once again, that "hedging" (same symbol) and true Hedging (different instruments, markets, etc.) are completely different things. I say this because some claim that we are wrong because banks and institutions use Hedging, and that would be correct because they use Hedging, not "hedging"!

Most people don't understand what Hedging really mean!

Hedging simply mean, " locking a loosing trade by opening an opposite trade with the same lot size on the same currency pair".

Any opposite trade open with a lot size which exceed the lot size of the first trade can never be considered as hedging. If its violate that rule, its then considered as " Sure-fire " martingale, because your lot size is either multiplied or divided in the opposite direction.

There is no way anyone can consider hedging as a profitable strategy, hedging is only a strategy which lock your losses so the the broker can only charge you for the open position or spread.

NB: If one person open many positions with the same lot size on one currency pair its considered as a grid strategy. If the same person one many positions on one single currency pair with various lot size greater than it predecessor its called a grid martingale.

Most people get confuse when it come to differentiate between a grid martingale strategy and a hedging strategy.

Period.

Most people don't understand what Hedging really mean!

Hedging simply mean, " locking a loosing trade by opening an opposite trade with the same lot size on the same currency pair".

Any opposite trade open with a lot size which exceed the lot size of the first trade can never be considered as hedging. If its violate that rule, its then considered as " Sure-fire " martingale, because your lot size is either multiplied or divided in the opposite direction.

There is no way anyone can consider hedging as a profitable strategy, hedging is only a strategy which lock your losses so the the broker can only charge you for the open position or spread.

NB: If one person open many positions with the same lot size on one currency pair its considered as a grid strategy. If the same person one many positions on one single currency with various lot size greater than it predecessor its called a grid martingale.

Most people get confuse when it come to differentiate between a grid martingale strategy and a hedging strategy.

Period.