- Indicators: JJN-Bee

- EA

- Ind-TD-Demark-3-1

The forum

----------------

Heiken_Ashi_Ma_T3 indicator for Mr.Nims, Renko Ashi Scalping System thread

----------------

Zigzag Scalping system thread

----------------

Pivot Scalper using Pivot Points - Daily (Shifted) - the thread

============

CodeBase

Waddah Attar Scalping for MetaTrader 4

Angry Bird (Scalping) - expert for MetaTrader 4 - the settings and trades - look at this post.

Renko Scalper - expert for MetaTrader 4

by Bob Volman

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

"Bob Volman (1961) is an independent trader working solely for his own account. A price action scalper for many years, he was asked to bundle all his knowledge and craftsmanship into an all-inclusive guide on intraday tactics. Forex Price Action Scalping is the long-awaited result."

Who Can Trade a Scalping Strategy? (based on dailyfx article)

- Scalpers look to trade session momentum

- Scalpers do not have to be high frequency traders

- Anyone can scalp with an appropriate trading plan

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

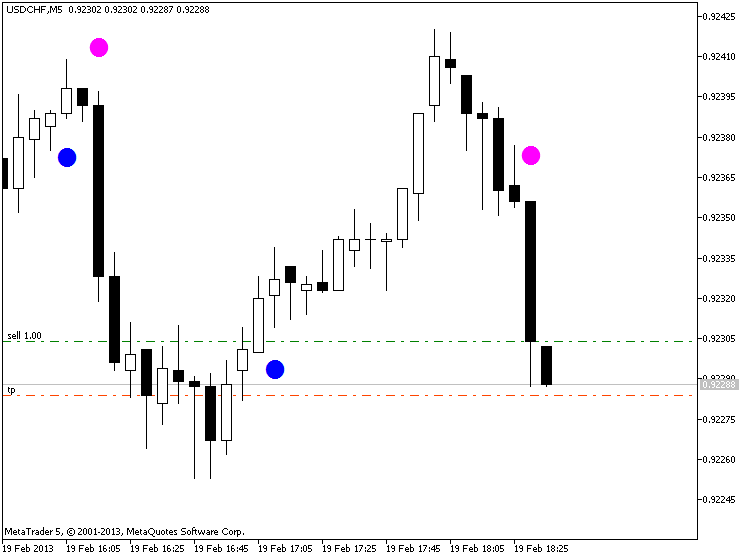

Metaquotes demo

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

GoMarkets broker, initial deposit is 1,000

- statement (77 dollars in less than 1 hour)

Alpari UK broker initial deposit is 1,000

- statement (517 dollars for one day)

RoboForex broker initial deposit is 1,000

- first statement

- updated statement (257 dollars in 2 days)

Scalping the forex market

All the ins and outs on scalping the Forex market. May Chris dives into the world of Scalping where he explains in great detail how this style of trading can be accomplished in the Forex market. This live webinar not only clarifies how a trader can scalp but also provides every Forex trader with a great guidance and extra tips.

- www.metatrader5.com

Ultra - ATR scalping tool - indicator for MetaTrader 4

Experimental indicator I wrote for myself. It's made to show some reference (it's more like a rifle scope, than a rifle). Main components are pip scale, ATR/pivot, MA level, RSI, and spread alert. Can be used on any timeframe, but since it's made for scalping it is somewhat adjusted for M1-M15.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use