Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.17 09:47

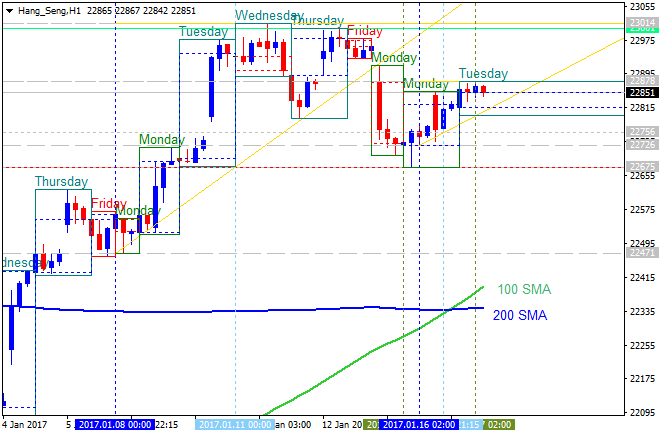

Hong Kong Stock Market Called Lower On Tuesday (based on the article)

- "The Hong Kong stock market has finished lower in two of three trading days since the end of the five-day winning streak in which it had advanced almost 800 points or 3.8 percent. The Hang Seng Index now rests just beneath the 22,720-point plateau, and the market may open under pressure again on Tuesday."

- "The Hang Seng finished sharply lower on Monday following losses from the financials, oil companies and property stocks."

- "For the day, the index tumbled 219.23 points or 0.96 percent to finish at 22,718.15 after trading between 22,657.35 and 22,908.86."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.03 08:42

Hong Kong PMI slips to contraction; Hang Seng China Enterprises Index with the daily correction to be started (based on the article)

"Business conditions in Hong Kong swung to stagnation in January, the latest survey from Nikkei revealed on Friday with a PMI score of 49.9. That's down from 50.3 in December, and it moves beneath the boom-or-bust line of 50 that separates expansion from contraction."

HSCE was bounced from 23,480 resistance level to belowfor 22,965 support level to be testing for the secondary correction to be started.

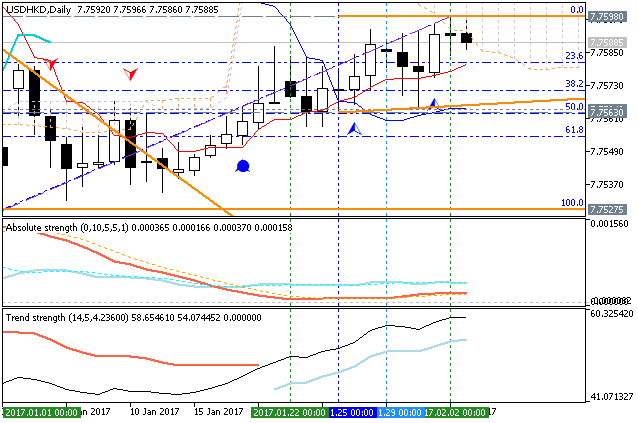

US Dollar / Hong Kong Dollar (USD/HKD): moving along bullish reversal level

Daily price is on ranging near and below 7.7598 resistance level and along Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart.

If the price breaks 7.7598 resistance level to above on daily close bar so the bullish reversal will be started on the secondary ranging way: price will be inside Ichimoku cloud.

If the price breaks 7.7563 suport level to below so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.03.29 09:57

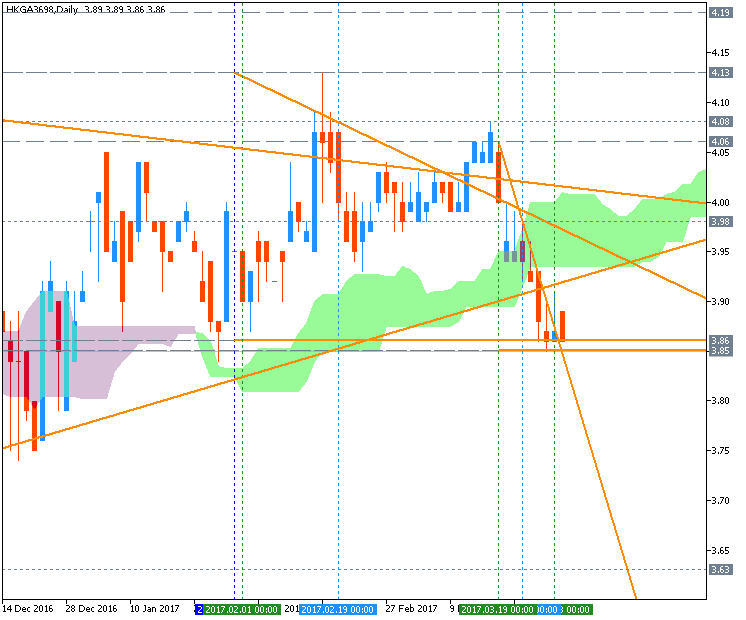

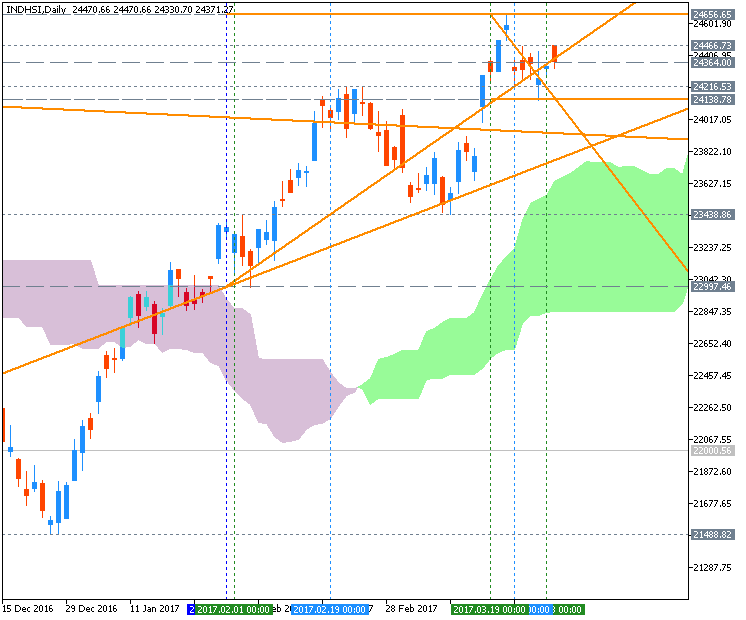

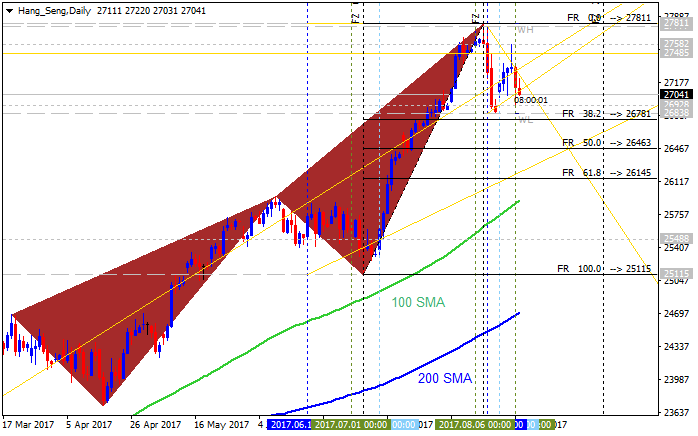

Hang Seng Index (HSI) - 85% fall for Huishan shares is nothing; daily HSI is still on bullish (based on the article)

Huishan shares on daily chart was dropped to 3.85/3.86 support level: the price broke Ichimoku cloud to below to be reversed from the bullish trend to the bearish market condition. Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be continuing.

HSI is still on the bullish area of the daily chart: price is located above Ichimoku cloud by the breaking symmetric triangle pattern to above for the 24,656 resistance level as the nearest bullish target.

- "One of the most striking things about the 85 percent plunge in Huishan Dairy Holdings Co.’s stock on Friday was how little it surprised market observers in Hong Kong."

- "There are regulatory discounts to the price-earnings multiple,” said Niklas Hageback, a Hong Kong-based money manager who helps oversee about $180 million at Valkyria Kapital Ltd. “Valuation is lagging and this has become a market-wide problem."

- "The Hang Seng index trades for about 13 times reported earnings, versus 22 for the MSCI World Index, according to data compiled by Bloomberg."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.11 07:22

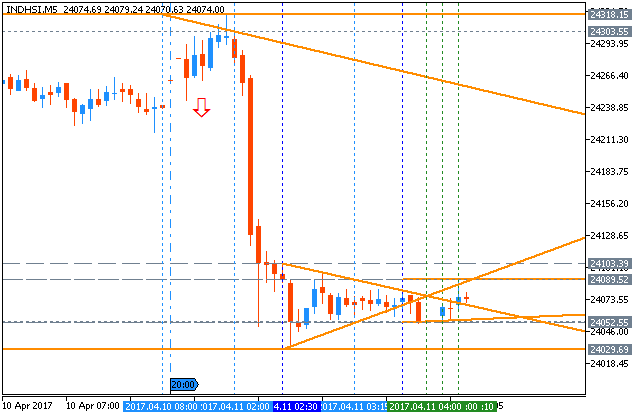

Intra-Day Fundamentals - EUR/USD, NZD/USD and Hang Seng Index (HSI): Fed Chair Yellen Speaks

2017-04-10 21:10 GMT | [USD - Fed Chair Yellen Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - Fed Chair Yellen Speaks] = The speech at the University of Michigan.

==========

From wsj article - "Federal Reserve Chairwoman Janet Yellen Sees Monetary Policy Shifting":

- "Federal Reserve Chairwoman Janet Yellen indicated Monday that the era of extremely stimulative monetary policy was coming to an end."

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

NZD/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

Hang Seng Index M5: range price movement by Fed Chair Yellen Speaks news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.06.05 09:06

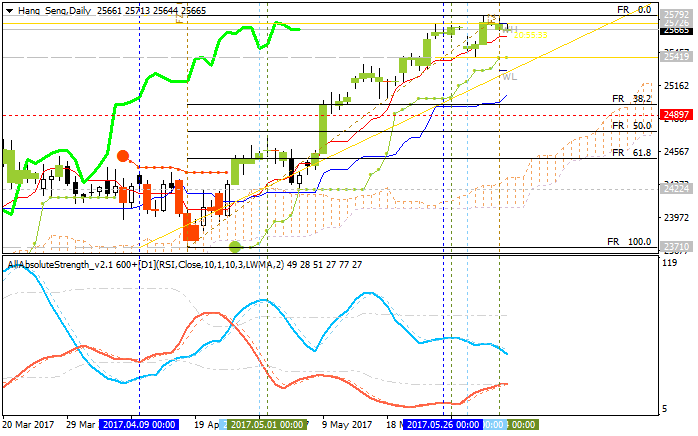

Hang Seng Index (HSI) - daily bullish; 25,792 resistance is the key (adapted from the article)

Daily price is located above Ichimoku cloud in the bullish area of the chart. The price is testing ascending triangle pattern together with 25,792 resistance to above for the bullish trend to be continuing.

- "Business conditions in Hong Kong slowed in May, the latest survey from Nikkei revealed on Monday with a PMI score of 50.5."

- "That's down from 51.1 in April, although it remains above the boom-or-bust line of 50 that separates expansion from contraction."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.08.20 06:30

Stock Market - what to watch the week of August 21-25 (based on the article)

Monday

- It's business as usual on Wall Street as a partial solar eclipse casts something of a shadow over New York City.

Tuesday

- Salesforce shares quarterly earnings after the bell.

Wednesday

- New home sales in the U.S. are out for July.

- Lowe's and American Eagle report earnings in the morning.

- Hewlett-Packard and Williams-Sonoma share results in the afternoon.

- Whole Foods investors cast their votes on the proposed $13.7 billion acquisition by Amazon.

Thursday

- The three-day annual summit in Jackson Hole, Wyoming begins.

- Existing home sales in the U.S. are released for July.

Friday

- A verdict is handed to Samsung's billionaire heir apparent Jay Y. Lee, who has been accused of bribing a government official in order to secure a merger that prosecutors say was intended to consolidate control of the nation's biggest conglomerate.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.12.07 09:32

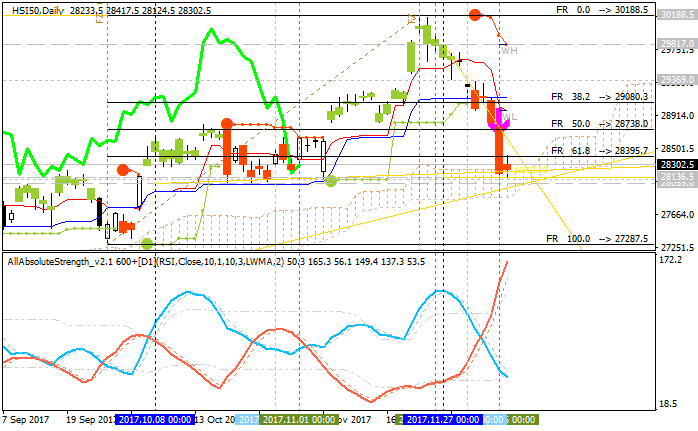

Hang Seng Index (HSI) - daily bearish reversal (based on the article)

Daily share price is on breakdown with the bearish reversal: the price is breaking 28,302 support level to below to be reversed to the primary bearish market condition.

Chinkou Span line broke historical price to below for the bearish breakdown and Absolute Strength indicator is estimating the future possible trend as a bearish as well.

- "The International Monetary Fund said the current circumstances warrant a targeted increase in capital even though the China's banking system meets the Basel requirement. In a report, released Wednesday, the Washington-based lender said buffer capital would help to absorb potential losses. More capital is justified for the largest banks because of their systemic importance and interconnectedness, the IMF said."

- "The IMF said the impact of the shocks is highly uneven across banks. Large, medium and city-commercial banks appeared vulnerable."

==========

The chart was made on MN1 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

- AllAbsoluteStrength - indicator for MetaTrader 4

- MaksiGen_Range_Move - indicator for MetaTrader 4

- iFibonacci - indicator for MetaTrader 4

- PriceChannel_Stop - indicator for MetaTrader 4

Sir,

which brokers you are using for Hang Seng Index? On MT5? I am looking for brokers who offer Hong Kong stock/index trading on MT5.

Thanks

Sir,

which brokers you are using for Hang Seng Index? On MT5? I am looking for brokers who offer Hong Kong stock/index trading on MT5.

Thanks

It was MT4 (I did not find for MT5 sorry).

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.12.25 06:50

Hang Seng Index Q1 2017 Forecast (based on the article)